U.S. raises trade concerns with Canada over online-streaming bill

Minister of International Trade, Export Promotion, Small Business and Economic Development Mary Ng speaks in the House of Commons on Parliament Hill in Ottawa, May 19, 2022. THE CANADIAN PRESS/Sean Kilpatrick

Minister of International Trade, Export Promotion, Small Business and Economic Development Mary Ng speaks in the House of Commons on Parliament Hill in Ottawa, May 19, 2022. THE CANADIAN PRESS/Sean Kilpatrick

Washington has raised concerns about the trade implications of Ottawa's online-streaming bill, prompting a legal expert to warn that Canada could face hundreds of millions of dollars of retaliatory tariffs if it becomes law.

U.S. Trade Representative Katherine Tai expressed disquiet about the proposed legislation, known as Bill C-11, during talks earlier this month with International Trade Minister Mary Ng at the Canada-United States-Mexico Agreement (CUSMA) Free Trade Commission ministerial meeting.

The online-streaming bill, which has passed the House of Commons and is now in the Senate, would force American-owned platforms, including YouTube, Netflix and Amazon's Prime Video, to promote Canadian TV, movies, videos or music, and help fund Canadian content.

Last month, federal Heritage Minister Pablo Rodriguez claimed the online-streaming bill, if passed, would generate at least $1 billion a year for Canada’s creative sector, including Indigenous programs.

Ottawa’s public record of the meeting on July 8 with Ng did not mention that her American counterpart raised concerns about the bill

But the U.S. government's record of the meeting says “Ambassador Tai expressed concern about … pending legislation in the Canadian Parliament that could impact digital streaming services.”

Alice Hansen, a spokeswoman for Ng, said Wednesday: "Ambassador Tai raised Bill C-11, and Minister Ng reiterated that this bill does not institute discriminatory treatment and is in line with Canada's trade obligations."

Michael Geist, the University of Ottawa’s Canada Research Chair in internet law, accused the Canadian government of ignoring the "trade risks" linked to its online-streaming bill.

"It is clear the U.S. is paying attention," Geist said.

“By raising concerns before the bill even passes, there is an unmistakable signal that Canada could face hundreds of millions of dollars of retaliatory tariffs as a consequence of legislation that already faces widespread opposition from Canadian digital-first creators,” he said.

Toronto-based trade lawyer Lawrence Herman, founder of Herman and Associates, said though Washington is raising concerns about the bill’s effect on American firms and applying pressure on Ottawa, the U.S. is “a long way from retaliation."

“As the American government generally does, they will threaten all kinds of retaliatory measures," he said. "I don’t think they would have a strong case unless they can show that the policies are discriminatory or targeted.

"In Canada’s case, they want streaming services to pay their fair share for access to the Canadian market. My assessment is (the bill) is not discriminatory."

Bill C-11 has been sharply opposed by digital-first creators and Conservative MPs who claim it would allow a future government to regulate people posting videos on YouTube — a charge the government denies.

YouTube, in its submission to the Commons heritage committee, argued the bill would impose international trade barriers to the "exchange of cultural exports" on digital platforms, including by Canadian creators, and set a "harmful" global precedent.

The government this month launched a consultation on the development of a model digital trade agreement.

It said such a model agreement would help Canada address emerging technology issues and build on existing free trade agreements, including CUSMA, the North American free trade agreement known as USMCA on the other side of the border.

Digital issues are also on the table in ongoing talks with the U.K. on a free-trade deal.

The Office of the U.S. Trade Representative had not yet responded to a request for comment on Wednesday.

This report by The Canadian Press was first published July 28, 2022.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

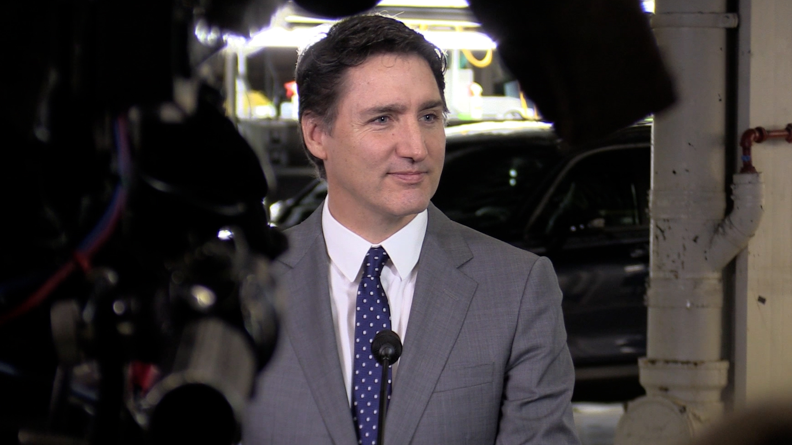

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Body of Quebec man who died in Cuba found in Russia, family confirms

A Montreal-area family confirmed to CTV News that the body of their loved one who died while on vacation in Cuba is being repatriated to Canada after it was mistakenly sent to Russia.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

Saskatchewan isn't remitting the carbon tax on home heating. Why isn't my province following suit?

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

RCMP officers had no legal authority to enter man's home, make arrest: B.C. court

A B.C. man has been found not guilty of assaulting two RCMP officers – with the court finding he was resisting an "unlawful entry and arrest" in his home before he was tasered, taken down and hauled away in handcuffs.

'Deep ignorance': Calls for Manitoba trustee to resign sparked after comments about Indigenous people and reconciliation

A rural Manitoba school trustee is facing calls to resign over comments he made about Indigenous people and residential schools earlier this week.

Local Spotlight

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

'I'm committed': Oilers fan won't cut hair until Stanley Cup comes to Edmonton

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

'It's not my father's body!' Wrong man sent home after death on family vacation in Cuba

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

'Once is too many times': Education assistants facing rising violence in classrooms

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”

UBC football star turning heads in lead up to NFL draft

At 6'8" and 350 pounds, there is nothing typical about UBC offensive lineman Giovanni Manu, who was born in Tonga and went to high school in Pitt Meadows.