Here's what to expect in the 2024 federal budget

Deputy Prime Minister and Finance Minister Chrystia Freeland will be presenting the 2024 federal budget on Tuesday, revealing how the federal Liberal government intends to balance the nearly $40 billion in pre-announced new spending with her vow to remain fiscally prudent.

Amid calls for a concerted focus on boosting Canada's productivity, Freeland has said the full picture of the state of the country's finances will focus on "building more homes, faster, making life more affordable, and creating more good jobs."

Declaring that the country is at a "pivotal moment" that requires urgent investment, the federal government is planning to introduce a bevy of measures in Tuesday's budget to help put a dent in Canada's housing crisis and win back straying millennial and Generation Z voters.

However, the new spending is coming amid concerns over a sizable federal deficit and remaining uncertainty around the degree of provincial and territorial buy-in for some of the bigger-ticket loan offerings the Liberals have previewed as coming in the budget.

Among the tens of billions of dollars pre-promised for health, child care and building 3.9 million new homes, more than $17 billion is loan-based, meaning the money is expected to come back around. Meanwhile, possible further sizeable spends have yet to be announced, such as the initial pharmacare allotment.

New wealth taxes ahead?

How Freeland intends to uphold her fiscal targets outlined in the fall economic statement – maintaining a declining deficit-to-GDP ratio and keeping deficits below one per cent of GDP in 2026-27 and beyond – is going to be one of the key areas of focus for those scrutinizing the federal balance sheet.

While Prime Minister Justin Trudeau has ruled out raising taxes on Canada's middle class, Freeland has so far refused to say whether the budget could include new or higher taxes for wealthier Canadians or corporate Canada. Nor has she shed any light on where additional revenue may be found, whether in deeper cuts or otherwise.

Moreover, the finance minister vowed last week that the deficit will not increase in this budget and the Liberals remain mindful of not knocking the Bank of Canada off its track towards reducing interest rates.

With these factors in mind, economists are largely forecasting that the most likely ways Freeland will look to offset the coming new spending will be to push off earmarked spending into future years and raise taxes.

"Some part of it could also come from higher revenues, increasing taxes on corporations, things like excess profit taxes … or increasing taxes on the wealthiest Canadians," Desjardins' senior director of Canadian economics Randall Bartlett said.

"Whether that's on income from financial assets, or whether that's on personal and increasing the marginal income tax rate."

Trudeau delivered a speech to the Canadian Chamber of Commerce in Ottawa on Monday afternoon, further prepositioning his government's economic vision.

"Millennials and Gen Z now make up the majority of Canada's labour force. They are our economy. Everything that is created, built, served and sold in this country is increasingly being created, built, served and sold by millennials and Gen Z. So, their success is going to be our success, Canada's success," Trudeau said.

Speaking to a crowd that's calling on the government to work with businesses to spur economic growth and not impose new taxes that could deter investors, Trudeau made no mention of any wealth-targeting plans that may be afoot.

"Canada's competitiveness is slipping, and productivity continues to decline. This weak performance leaves Canadians poorer, with fewer opportunities to achieve their personal goals, and it forces them to pay more just to stay where they are," Canadian Chamber president and CEO Perrin Beatty said in a statement preceding the prime minister's address.

"Without much greater growth, we won't be able to maintain our standard of living or provide the services Canadians require."

'Generational fairness' focus

Traditionally, governments have held budget news — save for some pre-tabling leaks — for the day the document is tabled in the House of Commons. However, the federal Liberals deployed a new pre-budget communications strategy this year.

Since late March, Trudeau and members of his cabinet have been selectively teasing out bits and pieces of the federal budget before it is actually unveiled, through a series of near-daily announcements.

With a targeted focus on Canada's younger generations who are feeling squeezed by inflation and as if the deck is stacked against their future prosperity, the overall theme for the 2024 budget is "generational fairness."

Seeking to echo this, on Monday Freeland kept with the pre-budget political tradition of selecting her budget day shoes, a pair of black leather heels from direct-to-consumer Canadian shoe brand Maguire.

Founded by two sisters, the brand has a stated focus on "working to make high-quality fashion footwear fair and accessible."

New spending announced so far

Here is a recap of all the new spending and major loan commitments as well as announcements about budget-related policy pledges made during this weeks-long pre-budget rollout:

- March 27: Canadian Renters' Bill of Rights, $15-million Tenant Protection Fund, and renter credit changes.

- March 28: $1 billion in loans and $60 million in grants to build or renovate child-care centres, plus $48 million to extend student loan forgiveness for early childhood educators.

- March 30: Touting plan to rollout the first phase of national pharmacare related to contraceptives and diabetes medication.

- April 1: $1 billion over five years to fund a new national school food program for 400K more kids.

- April 2: $6-billion Canada Housing Infrastructure Fund, topping up the Housing Accelerator Fund by $400 million.

- April 3: $15-billion top-up to the Apartment Construction Loan Program, launching "Canada Builds."

- April 4: $1 billion in loans and $470 million in contributions for new rental protection fund to preserve rent prices.

- April 5: $600 million in for a series of new homebuilding innovation efforts aimed at scaling-up modular and prefabricated homes.

- April 6: $2.4 billion to build capacity in artificial intelligence, largely for computing capabilities and technical infrastructure.

- April 8: $8.1 billion over the next five years as part of the long-term defence policy update.

- April 9: $500 million for a new youth mental health fund to help community organizations provide more care.

- April 10: $105 million to double firefighters and search and rescue volunteer tax credits, and $166.2 million for First Nations emergency management.

- April 11: 30-year mortgage amortizations for first-time homebuyers purchasing new builds, additional RRSP extension.

- April 12: A multibillion-dollar package tying in the government's suite of plans meant to solve the housing crisis.

- April 14: A new Secondary Suite Loan Program allowing homeowners to access up to $40,000 in low-interest loans to add secondary suites.

Political expectations

The incoming budget will also be a key political document. While the federal New Democrats continue to back the Liberals on confidence matters, Conservative Leader Pierre Poilievre has maintained a double-digit lead over the Liberals with his largely economy-focused partisan attacks.

Each taking their turns setting out their expectations for Tuesday's budget tabling – slated for around 4 p.m. ET in the House of Commons – Trudeau's political opponents have a laundry list of measures they'd like to see included.

For Poilievre, his chief demand for some time has been to "fix the budget" and stop inflationary spending that he argues is driving up the average family's interest obligations. In question period on Monday he took aim at certain plans to spend more.

"They have a food program which after eight years has no food, an affordable housing program which has doubled housing costs… When will they realize that after eight years this NDP-Liberal prime minister is not worth the cost?" he asked.

NDP Leader Jagmeet Singh said he wants to see a budget that lowers costs for Canadians and makes "big corporations start paying their fair share."

"Let's take on the corporate greed, which is driving up the cost of living," Singh said, speaking to reporters ahead of question period. "We absolutely believe that the wealthy should pay their fair share. But what we've been focused on … it's large corporations that are exploiting Canadians."

Similarly, Green Party co-leader Elizabeth May called on Trudeau to take "bold steps" to increase revenue and "make wartime level investments to fund the caring society that Canadians deserve."

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

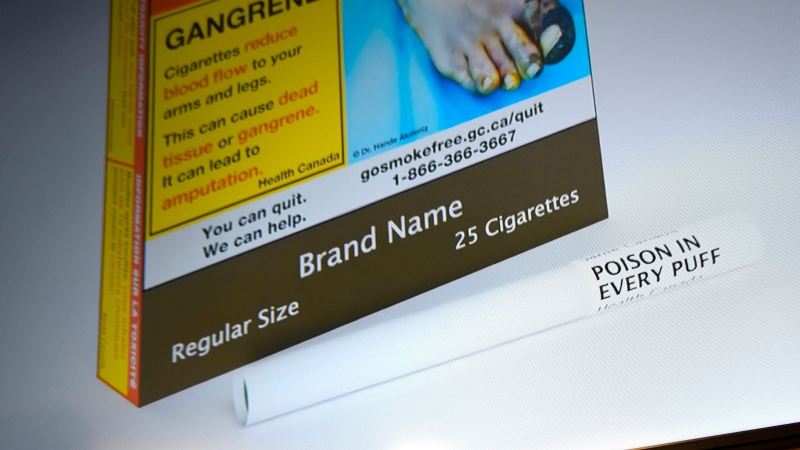

In a world first, king-size cigarettes in Canada must feature one of these warnings starting Tuesday

Tobacco manufacturers have until Tuesday to ensure every king-size cigarette produced for sale in Canada has a health warning printed directly on it.

Norovirus spreading at 'higher frequency' than expected in Canada

Norovirus is spreading at a 'higher frequency' than expected in Canada, specifically, in Ontario and Alberta, according to the Public Health Agency of Canada.

French actor Gerard Depardieu released after questioning over alleged sexual assaults

French actor Gerard Depardieu was questioned by police on Monday in connection with alleged sexual assaults against two women on separate film sets, police sources said, and was released without charge.

WATCH So you haven't filed your taxes yet…

The clock is ticking ahead of the deadline to file a 2024 income tax return. A personal finance expert explains why you should get them done -- even if you owe more than you can pay.

Wet weather to plague provinces, some areas to see up to 45 millimetres of rain

The same storm system that brought deadly tornadoes to parts of the U.S. is heading north, hammering some Canadian provinces with rain and snow, according to latest forecasts.

'I feel honoured to say I was his friend': Wayne Gretzky remembers Bob Cole

Tributes continue to pour in for Bob Cole as his family has confirmed a funeral will be held for the legendary broadcaster Friday in St. John's, N.L.

Majority of aspiring homeowners awaiting rate cuts before buying: BMO survey

The majority of Canadians aspiring to buy a home say they will push their plans to next year or later to wait for interest rates to drop, a new survey shows.

Third youth charged with second-degree murder in death of 16-year-old: Halifax police

Police have charged a third youth in connection with the death of a teenager in Halifax last week.

Anne Hathaway reveals she's now five years sober

Anne Hathaway first shared she lost interest in drinking after a bad hangover in 2018. She’s now five years sober.

Local Spotlight

Canada's oldest hat store still going strong after 90 years

Since 1932, Montreal's Henri Henri has been filled to the brim with every possible kind of hat, from newsboy caps to feathered fedoras.

Road closed in Oak Bay, B.C., so elephant seal can cross

Police in Oak Bay, B.C., had to close a stretch of road Sunday to help an elephant seal named Emerson get safely back into the water.

B.C. breweries take home awards at World Beer Cup

Out of more than 9,000 entries from over 2,000 breweries in 50 countries, a handful of B.C. brews landed on the podium at the World Beer Cup this week.

Kitchener family says their 10-year-old needs life-saving drug that cost $600,000

Raneem, 10, lives with a neurological condition and liver disease and needs Cholbam, a medication, for a longer and healthier life.

Haida Elder suing Catholic Church and priest, hopes for 'healing and reconciliation'

The lawyer for a residential school survivor leading a proposed class-action defamation lawsuit against the Catholic Church over residential schools says the court action is a last resort.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.