Freeland to table housing and affordability-focused fall economic statement Nov. 21

Deputy Prime Minister and Finance Minister Chrystia Freeland will be presenting an updated picture of Canada's finances on Nov. 21, when she tables the 2023 fall economic statement.

Finance Canada confirmed the date of the annual economic update on Thursday, in which Freeland is expected to present a revised assessment of the federal deficit and planned spending, from what was outlined in the last budget.

With a slowing economy and a revised spending and savings plan, Freeland is framing this statement as a check-in on Canada's financial situation and the government's "plan to help create good jobs, to build more homes and to make life more affordable."

As of the 2023 federal budget, the government had plans for continued deficit spending targeted at Canadians' pocketbooks, public health care and the clean economy. In the months since, the Liberals have put a fresh focus on the housing crisis and the cost of groceries.

As of that mega economic update in March, the federal deficit was projected to be $40.1 billion in 2023-24, nearly $10 billion more than forecast in the previous fall's economic snapshot. In a financial statement published last month, the 2022-23 deficit was $35.3 billion, $7.7 billion lower than forecasted.

With the Bank of Canada still trying to tamp down inflation—suggesting recently that fiscal and monetary policy are rowing in opposite directions—and the Conservatives grilling the government over its spending, restraint has been a word Freeland's been repeating as of late.

Anticipating the fall economic update was around the corner, Business Council of Canada CEO Goldy Hyder penned a letter to Freeland late last month, stating "new seriousness is required," given the current geopolitical uncertainty and domestic economic conditions.

"While we may have avoided a recession so far, there is considerable risk that could change in the next few quarters. At best, private sector economists’ forecasts point to no growth in 2024 and very weak growth thereafter," Hyder wrote.

"This suggests higher interest rates for longer to contain stubborn inflation. Whether or not there is a technical recession will be of little comfort to Canadians – who are already experiencing a higher cost of living."

IN DEPTH

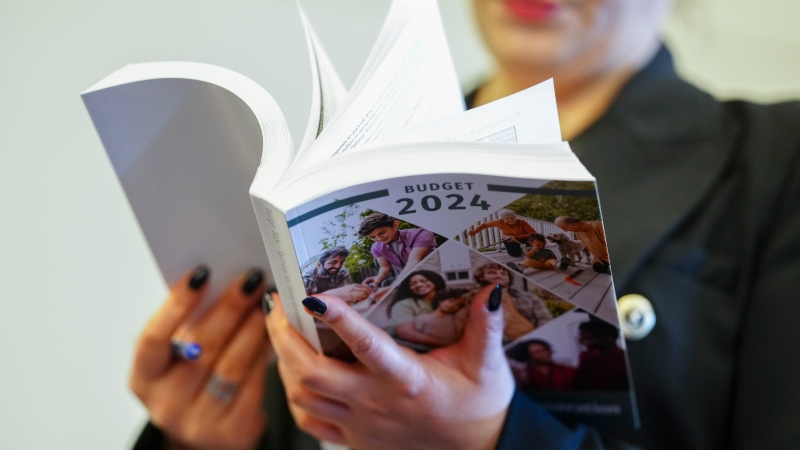

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

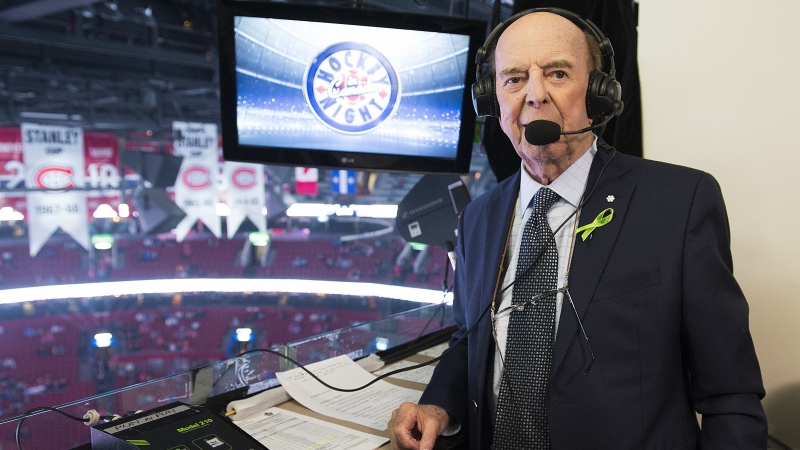

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

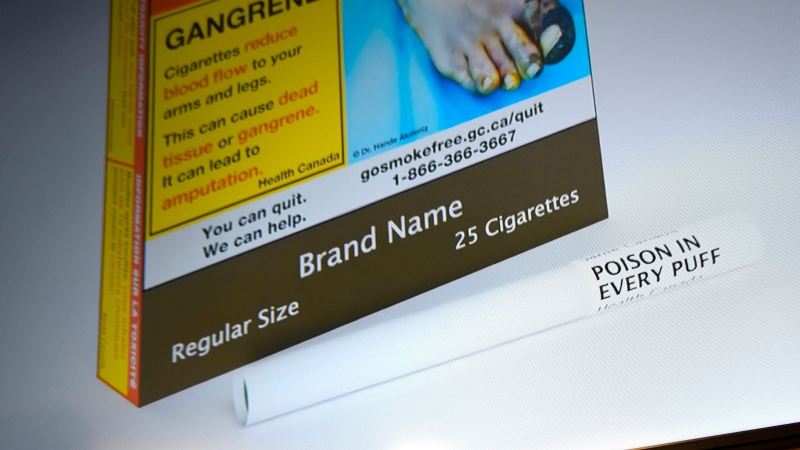

In a world first, all king-size cigarettes in Canada will feature one of these warnings starting Tuesday

Tobacco manufacturers have until Tuesday to ensure every king-size cigarette produced for sale in Canada has a health warning printed directly on it.

Norovirus spreading at 'higher frequency' than expected in Canada

Norovirus is spreading at a 'higher frequency' than expected in Canada, specifically, in Ontario and Alberta, according to the Public Health Agency of Canada.

Anne Hathaway reveals she's now five years sober

Anne Hathaway first shared she lost interest in drinking after a bad hangover in 2018. She’s now five years sober.

Wet weather to plague provinces, some areas to see up to 45 millimetres of rain

The same storm system that brought deadly tornadoes to parts of the U.S. is heading north, hammering some Canadian provinces with rain and snow, according to latest forecasts.

Gold watch worn by richest passenger aboard Titanic sells for record-breaking US$1.5 million

A gold watch worn by John Jacob Astor IV, a member of the wealthy Astor family and the richest man aboard the Titanic, sold for a record-breaking US$1.485 million at auction on Saturday.

'Deeply unhappy' grocery shoppers plan to boycott Loblaw-owned stores in May

A boycott targeting Loblaw is gaining momentum online, with what could be thousands of shoppers taking their money elsewhere in May.

French actor Gerard Depardieu in police custody, legal team says

French actor Gérard Depardieu has been taken into police custody in Paris to face questioning, his lawyer told CNN Monday.

McGill University says pro-Palestinian demonstrators 'refuse' to collaborate, encampment violates policies

McGill University says the growing encampment on its lower field in solidarity with Palestinians in Gaza violates its policies.

Trial for man accused of killing 4 Indigenous women in Winnipeg begins

The trial for the man accused of killing four Indigenous women in Winnipeg is set to begin on Monday.

Local Spotlight

Canada's oldest hat store still going strong after 90 years

Since 1932, Montreal's Henri Henri has been filled to the brim with every possible kind of hat, from newsboy caps to feathered fedoras.

Road closed in Oak Bay, B.C., so elephant seal can cross

Police in Oak Bay, B.C., had to close a stretch of road Sunday to help an elephant seal named Emerson get safely back into the water.

B.C. breweries take home awards at World Beer Cup

Out of more than 9,000 entries from over 2,000 breweries in 50 countries, a handful of B.C. brews landed on the podium at the World Beer Cup this week.

Kitchener family says their 10-year-old needs life-saving drug that cost $600,000

Raneem, 10, lives with a neurological condition and liver disease and needs Cholbam, a medication, for a longer and healthier life.

Haida Elder suing Catholic Church and priest, hopes for 'healing and reconciliation'

The lawyer for a residential school survivor leading a proposed class-action defamation lawsuit against the Catholic Church over residential schools says the court action is a last resort.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.