Canada extending repayment of COVID-19 business aid loans to 2023

The federal government is extending the deadline for small businesses to pay back their Canada Emergency Business Account (CEBA) loans to the end of 2023.

The government introduced CEBA in April 2020 as an interest-free loan program, offering initially up to $40,000 to small businesses and non-profits who have experienced a loss of revenue due to COVID-19. An expansion was then offered, seeing businesses able to apply to receive up to $60,000 loans.

Prior to Wednesday’s update, if claimants repaid the balance of their loan on or before the end of 2022, the government planned to forgive up to one-third of their loan.

Now, eligible businesses “in good standing,” will have until Dec. 31, 2023 to repay and be eligible for up to $20,000 of debt forgiveness.

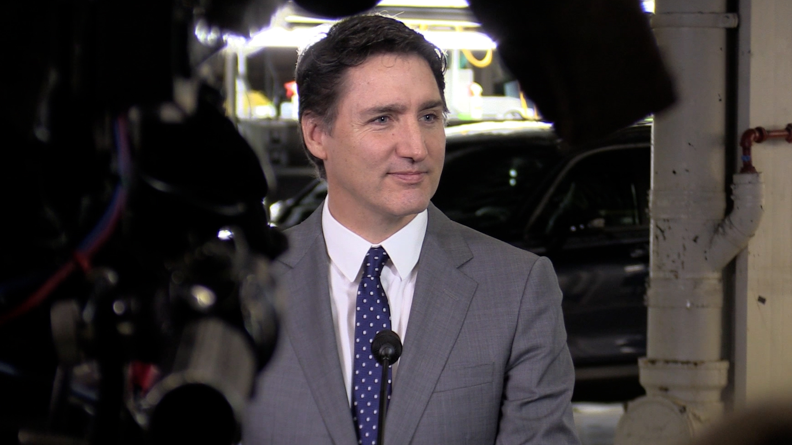

Prime Minister Justin Trudeau and Minister of International Trade, Export Promotion, Small Business and Economic Development Mary Ng made the announcement on Wednesday, noting that given new restrictions many businesses are facing due to the current Omicron surge, they may need more time to pay back their loans.

“As workers and small businesses and people across the country face renewed uncertainty and with new lockdowns, rising case counts, and the Omicron variant, we continue to know what the best thing for our economy is to support our workers and businesses through this pandemic,” said Ng.

The government is also extending the repayment deadline for the partial forgiveness for what Ng called the “CEBA-equivalent lending” provided through the Regional Relief and Recovery Fund to Dec. 21, 2023.

“We’ve heard from businesses that they're looking for this flexibility, and that's what today's announcement is about. This additional year will help businesses get that flexibility to work together through this pandemic, to the end of this pandemic."

Outstanding loans after the new deadline will be converted to two-year term loans with a five per cent interest rate, starting on Jan. 1, 2024, with the loans due in full by Dec. 31, 2025.

While applications closed for these loans in mid-2021, since its launch 898,254 businesses have been approved for these loans, totalling $49.17 billion in federal assistance.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Ex-tabloid publisher testifies he scooped up possibly damaging tales to shield his old friend Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars to keep them from the public eye.

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.

Local Spotlight

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

'I'm committed': Oilers fan won't cut hair until Stanley Cup comes to Edmonton

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

'It's not my father's body!' Wrong man sent home after death on family vacation in Cuba

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

'Once is too many times': Education assistants facing rising violence in classrooms

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”

UBC football star turning heads in lead up to NFL draft

At 6'8" and 350 pounds, there is nothing typical about UBC offensive lineman Giovanni Manu, who was born in Tonga and went to high school in Pitt Meadows.