Federal government outlines $83B in clean economy tax credits in bid to compete with U.S. incentives

Serious money is heading for Canadian industries looking to reduce emissions after the federal government unveiled its answer to the U.S. Inflation Reduction Act.

The spending commitments announced in Tuesday's federal budget include tax credits for investments in clean electricity, clean-tech manufacturing, and hydrogen that together are expected to cost some $55 billion through to the 2034-35 fiscal year.

- Details: Budget 2023 prioritizes pocketbook help and clean economy

- Capital Dispatch: Sign up for in-depth political coverage of Parliament Hill

Total tax incentives amount to almost $83 billion over that timeframe when the carbon capture and storage and clean-tech investments credits announced last year are factored in, both of which saw minor boosts this round.

The government says the funding is necessary to boost clean economy spending from some $15 billion a year to the $100 billion a year needed. The spending is also needed to not fall behind as other countries roll out subsidies, most notably with the US$369 billion contained in the landmark U.S. legislation passed last year.

"In what is the most significant economic transformation since the Industrial Revolution, our friends and partners around the world, chief among them the United States, are investing heavily to build clean economies," said Deputy Prime Minister Chrystia Freeland as she introduced the budget.

Tax credits are the backbone of the effort because they are stable and efficient way to roll out government support, while leaving decision-making with the expertise of the private sector, said a senior government official in the budget lockup.

Clean electricity is the biggest focus of the credits, costing $6.3 billion over the first four years starting in 2024, and $25.7 billion through to the 2034-35 year. Notably, provincial utilities and Indigenous-owned corporations will be eligible for the credits.

The spending is meant to help spur both more generation, as well as a better-connected east-west grid to meet the expected doubling of electricity demand by 2050.

The clean electricity package is where the government has likely done enough to meet its goals, said Michael Bernstein, executive director of Clean Prosperity.

Other funding areas however, including the $11.1 billion in credits for manufacturing and $12.4 billion for carbon capture through to 2034, likely aren't enough to close the gap with what the U.S. is offering, he said.

"It really is one of those situations where your competitor has stepped up and said we are going to be providing an almost unthinkable amount of money."

Canada has opted for construction-focused project support, while the U.S. IRA covers operational costs with payments based on production volumes. It's like Canada is offering a single large cup of soda, whereas the U.S. is offering endless kiddy-cup sized refills, meaning Canada needs to offer a pretty big cup to compete, said Bernstein.

Since it's not covering operations, Canada needs to move quickly on offering the carbon pricing backstop that it's promised to develop in the budget, he said.

The so-called contracts for difference would provide certainty to industry on future carbon pricing and credits, but so far they're still in consultation, as are several other key policies.

"What surprised me was how many things are still left to be determined," said Rachel Samson, vice-president of research at the Institute for Research on Public Policy.

Along with the contacts for difference, she noted that details are scarce about how the $15 billion Canada Growth Fund will be spent.

The government announced in the budget that the fund will be administered independently by the Public Sector Pension Investment Board, with money starting to flow in the first half of the year, but didn't provide guidance on priority areas.

Samson said it was good the government isn't trying to direct the money itself, but worried that pension fund managers are too cautious to put the money in the bold projects needed.

"We need projects that are more on the cutting-edge, that are riskier."

The government also pushed down the road any commitments on biofuels such as sustainable jet fuels, which surprised Samson as Canada is currently exporting the raw wood pellet feedstock and knows companies have projects ready to go.

The budget was also notable for what wasn't in it for the oil and gas industry. While it did tweak last year's carbon capture incentives, it didn't go as far as some were pushing for, while the emissions cut-off for hydrogen production will likely exclude most carbon-capture based hydrogen projects.

"Oil and gas did not get a lot of what I think it wanted in this," said Samson.

The lack of funding comes as climate advocacy groups have pushed against support for both programs as wasteful projects that don't achieve the emission cuts needed in the near term, while also pushing against support for an industry that has reported record profits.

The government has also framed the budget as one of fiscal restraint that it hopes will allow private capital to do much of the heavy lifting to keep Canada in the running.

"Canada must either meet this historic moment, this remarkable opportunity before us, or we will be left behind as the world's democracies build the clean economy of the 21st century," said Freeland.

This report by The Canadian Press was first published March 28, 2023.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

'A beautiful soul': Funeral held for baby boy killed in wrong-way crash on Highway 401

A funeral was held on Wednesday for a three-month-old boy who died after being involved in a wrong-way crash on Highway 401 in Whitby last week.

'Sophisticated' cyberattacks detected on B.C. government networks, premier says

There has been a "sophisticated" cybersecurity breach detected on B.C. government networks, Premier David Eby confirmed Wednesday evening.

Police handcuff man trying to enter Drake's Toronto mansion

Toronto police say a man was taken into custody outside Drake's Bridle Path mansion Wednesday afternoon after he tried to gain access to the residence.

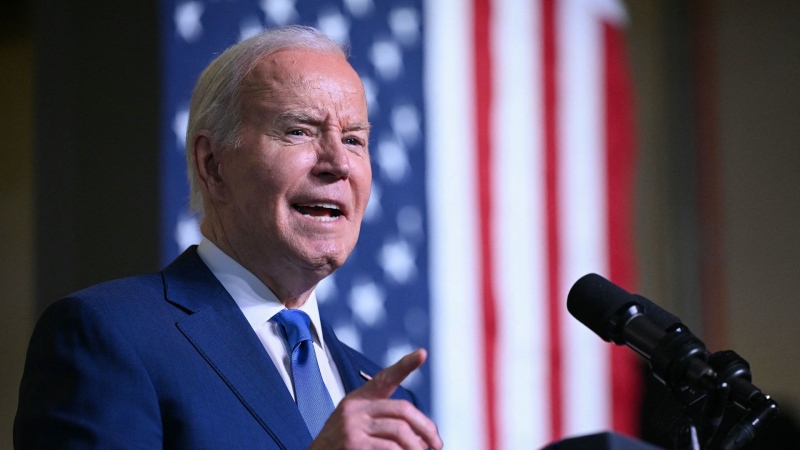

Biden says he will stop sending bombs and artillery shells to Israel if they launch major invasion of Rafah

U.S. President Joe Biden said for the first time Wednesday he would halt shipments of American weapons to Israel, which he acknowledged have been used to kill civilians in Gaza, if Prime Minister Benjamin Netanyahu orders a major invasion of the city of Rafah.

Rookie goalie Arturs Silovs to start for Canucks in Game 1 vs. Oilers

Rookie goalie Arturs Silovs will start in net for the Canucks as Vancouver kicks off a second-round series against the Edmonton Oilers Wednesday night.

Nijjar murder suspect says he had Canadian study permit in immigration firm's video

One of the Indian nationals accused of murdering British Columbia Sikh activist Hardeep Singh Nijjar says in a social media video that he received a Canadian study permit with the help of an Indian immigration consultancy.

Pfizer agrees to settle more than 10K lawsuits over Zantac cancer risk: Bloomberg News

Pfizer has agreed to settle more than 10,000 lawsuits about cancer risks related to the now discontinued heartburn drug Zantac, Bloomberg News reported on Wednesday, citing people familiar with the deal.

Quebec premier defends new museum on Quebecois nation after Indigenous criticism

Quebec Premier Francois Legault is defending his comments about a new history museum after he was accused by a prominent First Nations group of trying to erase their history.

U.S. presidential candidate RFK Jr. had a brain worm, has recovered, campaign says

Independent U.S. presidential candidate Robert F. Kennedy Jr. had a parasite in his brain more than a decade ago, but has fully recovered, his campaign said, after the New York Times reported about the ailment.

Local Spotlight

Vancouver and Edmonton's mayors bet on who will win Round 2 of the playoffs. Here's what's at stake

The stakes have been set for a bet between Vancouver and Edmonton's mayors on who will win Round 2 of the Stanley Cup playoffs.

'No other life taken': Mother leads ATV helmet drive to honour daughter's legacy

A grieving mother is hosting a helmet drive in the hopes of protecting children on Manitoba First Nations from a similar tragedy that killed her daughter.

Northern Ont. woman makes 'eggstraordinary' find

A chicken farmer near Mattawa made an 'eggstraordinary' find Friday morning when she discovered one of her hens laid an egg close to three times the size of an average large chicken egg.

P.E.I. lighthouse, N.B. river spotlighted in Canada Post series

A P.E.I. lighthouse and a New Brunswick river are being honoured in a Canada Post series.

'It looked so legit': Ontario man pays $7,700 for luxury villa found on Booking.com, but the listing was fake

An Ontario man says he paid more than $7,700 for a luxury villa he found on a popular travel website -- but the listing was fake.

Investigating the tale of Winnipeg's long-running mystery bookstore

Whether passionate about Poirot or hungry for Holmes, Winnipeg mystery obsessives have had a local haunt for over 30 years in which to search out their latest page-turners.

'Love has no boundaries': Sask. couple in their 90s and 80s get married

Eighty-two-year-old Susan Neufeldt and 90-year-old Ulrich Richter are no spring chickens, but their love blossomed over the weekend with their wedding at Pine View Manor just outside of Rosthern.

Twin Alberta Ballet dancers retire after 15 years with company

Alberta Ballet's double-bill production of 'Der Wolf' and 'The Rite of Spring' marks not only its final show of the season, but the last production for twin sisters Alexandra and Jennifer Gibson.

Video shows gaggle of geese stopping traffic on Highway 1 near Vancouver

A mother goose and her goslings caused a bit of a traffic jam on a busy stretch of the Trans-Canada Highway near Vancouver Saturday.