CRA audits of ultra-wealthy Canadians yield zero prosecutions, convictions

Data from the Canada Revenue Agency shows its recent efforts to combat tax evasion by the super-rich have resulted in zero prosecutions or convictions.

In response to a question tabled in Parliament by NDP MP Matthew Green, the CRA said it referred 44 cases on individuals whose net worth topped $50 million to its criminal investigations program since 2015.

Only two of those cases proceeded to federal prosecutors, with no charges laid afterward.

The lack of prosecutions follows more than 6,770 audits of ultra-wealthy Canadians over the past six years.

It also comes amid a roughly 3,000 per cent increase in spending on the agency's high-net-worth compliance program between 2015 and 2019 due to a beefed-up workforce, according to an October report from the parliamentary budget officer.

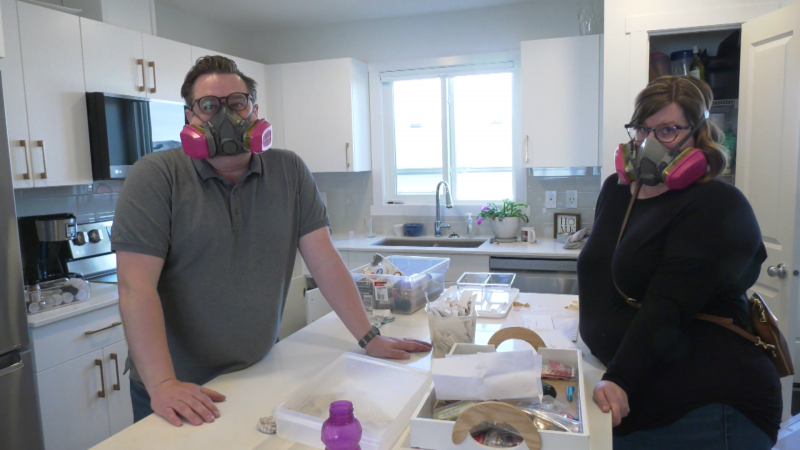

Green said federal authorities avoid pursuing Canada's biggest tax cheats but go after small business owners who don't pay their taxes under a "two-tiered system" pocked with "loopholes."

"The CRA is not pursuing Canada's largest and most egregious tax cheats. And yet for a small mom-and-pop shop, if you don't pay your taxes long enough -- two or three years -- then they will absolutely go in and garnish your wages because they know you don't have the ability to take it to court," he said.

"There's a tax code for the ultra-wealthy and then there's a tax code for the rest of us," Green said. "The rich are taking advantage of the holes in our tax system. And this Liberal government continues to allow them to do so."

The issue is top of mind for federal lawmakers this week as a parliamentary committee convened Tuesday to discuss the CRA's attempts to combat tax evasion and avoidance.

"The ultra-rich will not be treated with kid gloves. I have no respect for those who cheat the tax system. But I can tell you that if you think that we're going to resolve everything, I think you're naive," National Revenue Minister Diane Lebouthillier told the panel in French, citing the need for international co-operation.

"The super-wealthy are able to pay for super lawyers, super tax specialists. They can do everything to get out of paying their fair share."

Increasingly, those individuals are going to court when audited in order to withhold documents, with about 3,000 "complex" cases now ongoing, the minister said.

"The fact that the cumulative 44 investigations ... have not resulted in convictions within five years is a result of the complexity of the cases and the high legal threshold for securing a criminal conviction in Canada," CRA spokeswoman Pamela Tourigny said in an email.

Members of the House finance committee also passed a motion Tuesday from NDP finance critic Peter Julian calling on the government to launch a public inquiry into tax planning by KPMG in connection with shell companies -- named after ancient swords -- and allegations of investment fraud on the Isle of Man.

The requested investigation follows reports that the British Crown dependency, renowned as a tax haven, may have been linked to alleged fraud that saw millions siphoned offshore and embezzled from Canadian investors.

"KPMG Canada has been very clear that we have no connection whatsoever to the Isle of Man sword companies or the CINAR fraud," spokeswoman Tenille Kennedy said in an email, adding that the company will continue co-operating with the CRA.

Conservative national revenue critic Philip Lawrence said in a statement that "well-connected elites" enjoy exemptions "while everyday Canadians are left further behind," and that Tories stand for tax fairness.

Denis Meunier, former director general of the CRA's criminal investigations directorate, said the dearth of criminal charges is striking. But authorities often lack resources to carry out pricey, painstaking prosecutions across international borders and can opt instead for hefty non-criminal penalties.

"They may have some of the best lawyers fighting, so you may see that more in Tax Court, rather than convictions," Meunier said of proceedings against the ultra-wealthy.

Settlements are much more common than criminal prosecutions, saving investigators time and money, said Kevin Comeau, author of a 2019 C.D. Howe report on money laundering.

"The problem with that is that you don't have on the public record that these persons did not comply with the tax law. And therefore you don't have that public shaming and you don't have that warning to other tax cheats out there," he said.

Tax evasion often boils down to unreported incomes or exaggerated expenses, which can then be deducted from income declared on tax filings.

"It's not atypical to see individuals pay out invoices from foreign consulting companies. You pay a million bucks for a specialized report, and the company is a consulting firm based in a tax haven (where the real, or 'beneficial,' owner is hidden from view) and basically the company is owned by the same guy in Canada whose business it is," Meunier said.

It can be extraordinarily tough to trace money through the warren of shell companies and tax havens used by those seeking to stash their loot.

"They hear you coming. They know CRA is after them," said Comeau."They can just put in a couple more trusts and companies in other jurisdictions to make the trail longer at any time. It's a never-ending rabbit hole."

The Liberal budget in April allotted $2.1 million over two years for the Industry Department to launch a new beneficial ownership registry by 2025. The government has also pledged $606 million over five years starting this year to "improve the criminal investigations program" and crack down on illicit tax schemes, including by super-rich Canadians, Lebouthillier said.

Comeau, a retired lawyer and member of Transparency International Canada's working group on beneficial ownership transparency, said the registry could be a "game changer" for tax avoidance in a country with some of the weakest financial transparency laws among liberal democracies.

"Even if it is legal, they're not paying their fair share. So there's going to be huge social pressure on those persons to unwind those dealings and actually start bringing their money back to Canada," he said.

"Many of these people are very highly respected people in the Canadian establishment."

Tax evasion -- a predicate offence, meaning it forms a component of a more serious crime, such as money laundering -- differs categorically from tax avoidance, a legal means of keeping cash out of tax collectors' hands through clever accounting.

But critics say the vast troves of wealth that remain untouchable to government authorities reveal the need to tighten tax rules as well as hunt down cheats.

"In former times we didn't see tax avoidance as a crime," said Brigitte Unger, professor of economics at Utrecht University whose book, "Combating Fiscal Fraud and Empowering Regulators," was published in March.

"But now we see the public sector needs money, and this is effectively stealing money from public coffers, and should be treated as such."

---------

This report by The Canadian Press was first published June 22, 2021.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

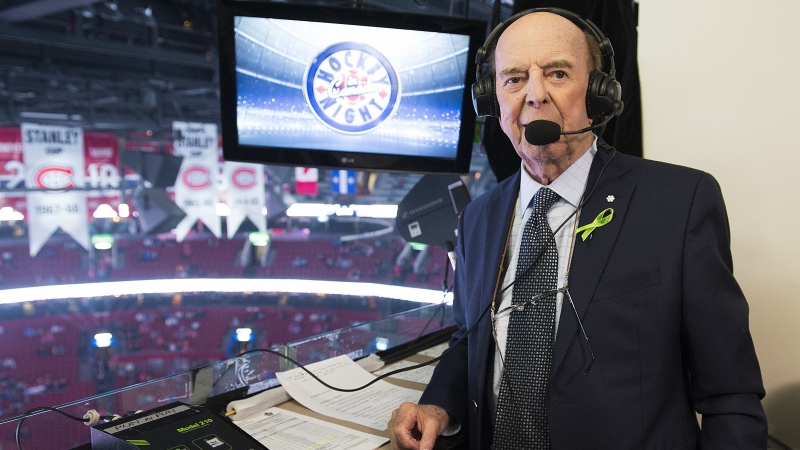

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

Invasive and toxic hammerhead worms make themselves at home in Ontario

Ontario is now home to an invasive and toxic worm species that can grow up to three feet long and can be dangerous to small animals and pets.

Opinion I just don't get Taylor Swift

It's one thing to say you like Taylor Swift and her music, but don't blame CNN's AJ Willingham's when she says she just 'doesn't get' the global phenomenon.

Decoy bear used to catch man who illegally killed a grizzly, B.C. conservation officers say

A man has been handed a lengthy hunting ban and fined thousands of dollars for illegally killing a grizzly bear, B.C. conservation officers say.

Britney Spears settles long-running legal dispute with estranged father, finally bringing ultimate end to conservatorship

Britney Spears has reached a settlement with her estranged father more than two years after the court-ordered termination of a conservatorship that had given him control of her life, their attorneys said.

Haida elder suing Catholic Church and priest, hopes for 'healing and reconciliation'

The lawyer for a residential school survivor leading a proposed class-action defamation lawsuit against the Catholic Church over residential schools says the court action is a last resort.

Last letters of pioneering climber who died on Everest reveal dark side of mountaineering

George Mallory is renowned for being one of the first British mountaineers to attempt to scale the dizzying heights of Mount Everest during the 1920s. Nearly a century later, newly digitized letters shed light on Mallory’s hopes and fears about ascending Everest.

It's 30 years since apartheid ended. South Africa's celebrations are set against growing discontent

South Africa marked 30 years since the end of apartheid and the birth of its democracy with a ceremony in the capital Saturday that included a 21-gun salute and the waving of the nation's multicolored flag.

opinion RFK Jr.'s presidential candidacy and its potential threat to Biden and Trump

Although it's still unclear how much damage Robert F. Kennedy Jr.'s candidacy can do to either Joe Biden or Donald Trump this election, Washington political columnist Eric Ham says what is clear is both sides recognize the potential threat.

An emergency slide falls off a Delta Air Lines plane, forcing pilots to return to JFK in New York

An emergency slide fell off a Delta Air Lines jetliner shortly after takeoff Friday from New York, and pilots who felt a vibration in the plane circled back to land safely at JFK Airport.

Local Spotlight

DonAir force takes over at Oilers playoff games

As if a 4-0 Edmonton Oilers lead in Game 1 of their playoff series with the Los Angeles Kings wasn't good enough, what was announced at Rogers Place during the next TV timeout nearly blew the roof off the downtown arena.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

'I'm committed': Oilers fan won't cut hair until Stanley Cup comes to Edmonton

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

'It's not my father's body!' Wrong man sent home after death on family vacation in Cuba

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

'Once is too many times': Education assistants facing rising violence in classrooms

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”