$4.6B in COVID-19 financial aid went to ineligible recipients, audit finds

Canada's auditor general says that while the federal government effectively delivered emergency COVID-19 benefits during the pandemic, deciding to not front-end verification resulted in $4.6 billion in overpayments to ineligible individuals.

After sending out an estimated $211 billion in COVID-19 aid, a performance audit tabled in the House of Commons on Tuesday found that the Canada Revenue Agency and Employment and Social Development Canada are "falling short" when it comes to following through on belatedly verifying recipients' eligibility.

The audit notes that, in initially rolling out benefits like the Canada Emergency Response Benefit (CERB) and the wage subsidy starting in 2020, in order to expedite financial assistance to those who needed it the government chose to rely on attestation information provided by applicants and limited federal pre-payment checks before the funding was provided. As the pandemic evolved, these payment verification plans were put off further, while knowing at the time that money could have gone out the door to people who weren’t eligible.

Now that these massive financial aid programs have stopped, auditor general Karen Hogan says that the federal bodies responsible for the programs are still tallying up how much money may have gone to those who aren’t eligible. And, with legislated deadlines approaching, the federal government "may be running out of time" to identify and recover the amounts owing and it's likely a significant amount of the funds will not be recovered.

In her report, Hogan also noted that despite these issues, the federal aid prevented a rise in poverty, benefitted individuals most impacted by the pandemic, and did assist in Canada's economic rebound from the global crisis.

Of the $4.6 billion in overpayments to ineligible recipients, the audit found that $3.1 billion was paid to 1.8 million recipients who received an advance lump-sum EI overpayment. This, the report states, could have been either through the initial Employment Insurance Emergency Response Benefit, or the later evolution of that program into the Canada Emergency Response Benefit (CERB), while $1.5 billion went to more than 710,000 recipients who received more than one benefit per period.

The auditor general found that, in addition to the billions of dollars in overpayments, another estimated $27.4 billion in payments to individuals and employers should be "investigated further" for potential ineligibility, including $15.5 billion that went out through the wage subsidy program.

Hogan said she was flagging this additional chunk of potentially problematic funding, because through her audit she was "pretty confident" there are indicators that certain individuals and businesses were not eligible for the amounts that they received, such as not meeting the income metrics or not showing sufficient revenue declines.

"A more definitive estimate of payments made to ineligible recipients and amounts to be recovered by the government will be determined only after the agency and the department have completed their post-payment verifications," reads the report.

So far, the CRA's efforts to collect overpayments have largely been limited to responding to Canadians looking to voluntarily pay back their COVID-19 benefits, the audit found. Through these efforts, approximately $2.3 billion has been recovered as of this summer.

Asked by reporters on Tuesday how much she thinks the overpayments are a result of good-faith mistakes by Canadians versus what may be fraud, Hogan said she couldn’t confidently say because of the limited information the CRA had when she was doing her audit.

WHAT IS NEEDED TO RECOVER BILLIONS?

Hogan is now calling for a series of changes to see as much of the improperly-paid funding returned as possible, including:

- Updating the government's post-payment verification plans to "include all activities to identify payments to ineligible recipients of COVID 19 benefit programs";

- Ensuring appropriate data is collected from applicants going forward to better assess outcomes; and

- Pursuing implementing a real-time payroll system.

The auditor general also advocated for the CRA to, before the end of the year "put system functionalities in place to apply refunds against COVID-19 amounts owed," in order to "increase the recovery of COVID-19 amounts owed and reduce the administrative burden."

While the federal government has agreed at least in part with Hogan's findings, they were defensive about their "risk-based" approach—which was backed by Parliament— ultimately supporting millions of Canadians.

The CRA has already suggested, in its response to Hogan, that they won't be going after all of the ineligible funds. The CRA said this is because: "It would not be cost effective nor in keeping with international and industry best practices to pursue 100 per cent of all potentially ineligible claims."

Responding to this, Hogan said that the government is required under current legislation to take action when it comes to money being sent to those who shouldn't have received it, and if the Liberals choose a different approach, such as writing off these losses, they "must be clear and transparent with Canadians."

HOW MUCH DID THE FEDS PAY IN COVID-19 AID?

In addition to detailing the overpayment and ineligibility concerns, the audit provides a clear breakdown of how much the federal government paid out through each of its COVID-19 benefit programs.

Here's the bill:

- Canada Emergency Wage Subsidy: $100.7 billion

- Employment Insurance Emergency Response Benefit/Canada Emergency Response Benefit: $74.8 billion

- Canada Recovery Benefit: $28.4 billion

- Canada Recovery Caregiving Benefit: $4.4 billion

- Canada Recovery Sickness Benefit: $1.5 billion

- Canada Worker Lockdown Benefit: $0.9 billion

In the audit, Hogan found that while Employment and Social Development Canada did adjust certain benefit programs to try to address disincentives to work, there wasn’t enough data to assess how effective the wage subsidy program was, in part because employers weren’t required submit any information on rehiring.

In their response to the report the Liberals made a point of emphasising how many people benefitted from each of these programs, stating that for the $211 billion spent, the programs had helped:

- Canada Emergency Wage Subsidy: 460,000 businesses to keep 5.3 million employees on the payroll

- Employment Insurance Emergency Response Benefit/Canada Emergency Response Benefit: 8.5 million people

- Canada Recovery Benefit: 2.3 million people

- Canada Recovery Caregiving Benefit: 560,000 people

- Canada Recovery Sickness Benefit: 1.2 million people

- Canada Worker Lockdown Benefit: 455,000 people

"I remain incredibly proud of the way our government responded to the economic and public health challenges of the pandemic," Minister of Employment, Workforce Development and Disability Inclusion Carla Qualtrough told reporters on Parliament Hill on Tuesday. "We made it clear that eligibility would be verified after, and this process remains ongoing.

"We're trying to work with Canadians in a very difficult time, and I wouldn't mistake a lack of aggressive pursuit for not doing it," Qualtrough said. "It's just, we're being compassionate."

CONSERVATIVES BALK AT 'WASTE'

Reacting to the auditor general's findings, the federal Conservatives weren't buying the Liberals' compassion argument, telling reporters instead that this potential multi-billion dollar loss was indicative of a pattern of wasteful Liberal spending.

"Today the auditor general confirmed what Conservatives have been warning about since 2020," said Conservative MP and finance critic Jasraj Singh Hallan. "The lack of controls put in place by the Liberal government as identified by the auditor general undoubtedly contributed to this mess that taxpayers will be forced to pay."

The Conservatives are now calling for the Liberals to present a plan "that shows that they're going to take this report seriously and put in the controls that the auditor general is also calling for."

Responding for the NDP—who throughout the pandemic pushed for the Liberals to go further in offering financial assistance—MP and finance critic Daniel Blaikie focused on how the AG's office noted how needed this income supports were.

"New Democrats do not believe that Canadians who applied in good faith to these programs and do not have the money to pay it back should be persecuted," Blaikie said, calling for a low-income "repayment amnesty."

"This will allow the government to apply its limited resources to pursuing fraudsters and those who have the financial means to repay their debt," Blaikie suggested.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

More than 115 cases of eye damage reported in Ontario after solar eclipse

More than 115 people who viewed the solar eclipse in Ontario earlier this month experienced eye damage after the event, according to eye doctors in the province.

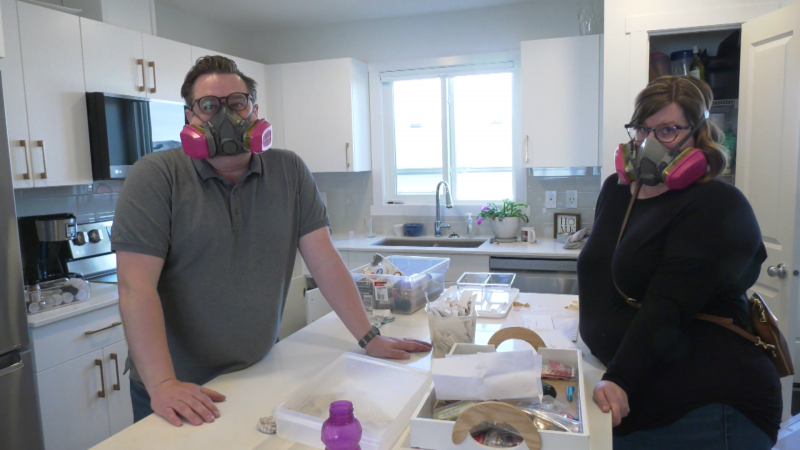

Toxic testing standoff: Family leaves house over air quality

A Sherwood Park family says their new house is uninhabitable. The McNaughton's say they were forced to leave the house after living there for only a week because contaminants inside made it difficult to breathe.

Decoy bear used to catch man who illegally killed a grizzly, B.C. conservation officers say

A man has been handed a lengthy hunting ban and fined thousands of dollars for illegally killing a grizzly bear, B.C. conservation officers say.

B.C. seeks ban on public drug use, dialing back decriminalization

The B.C. NDP has asked the federal government to recriminalize public drug use, marking a major shift in the province's approach to addressing the deadly overdose crisis.

OPP responds to apparent video of officer supporting anti-Trudeau government protestors

The Ontario Provincial Police (OPP) says it's investigating an interaction between a uniformed officer and anti-Trudeau government protestors after a video circulated on social media.

An emergency slide falls off a Delta Air Lines plane, forcing pilots to return to JFK in New York

An emergency slide fell off a Delta Air Lines jetliner shortly after takeoff Friday from New York, and pilots who felt a vibration in the plane circled back to land safely at JFK Airport.

Sophie Gregoire Trudeau on navigating post-political life, co-parenting and freedom

Sophie Gregoire Trudeau says there is 'still so much love' between her and Prime Minister Justin Trudeau, as they navigate their post-separation relationship co-parenting their three children.

Last letters of pioneering climber who died on Everest reveal dark side of mountaineering

George Mallory is renowned for being one of the first British mountaineers to attempt to scale the dizzying heights of Mount Everest during the 1920s. Nearly a century later, newly digitized letters shed light on Mallory’s hopes and fears about ascending Everest.

Loud boom in Hamilton caused by propane tank, police say

A loud explosion was heard across Hamilton on Friday after a propane tank was accidentally destroyed and detonated at a local scrap metal yard, police say.

Local Spotlight

DonAir force takes over at Oilers playoff games

As if a 4-0 Edmonton Oilers lead in Game 1 of their playoff series with the Los Angeles Kings wasn't good enough, what was announced at Rogers Place during the next TV timeout nearly blew the roof off the downtown arena.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

'I'm committed': Oilers fan won't cut hair until Stanley Cup comes to Edmonton

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

'It's not my father's body!' Wrong man sent home after death on family vacation in Cuba

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

'Once is too many times': Education assistants facing rising violence in classrooms

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”