TORONTO -

Experts and advocates anticipate that more Canadians could be at risk of going hungry as inflation continues to outpace many consumers' grocery budgets.

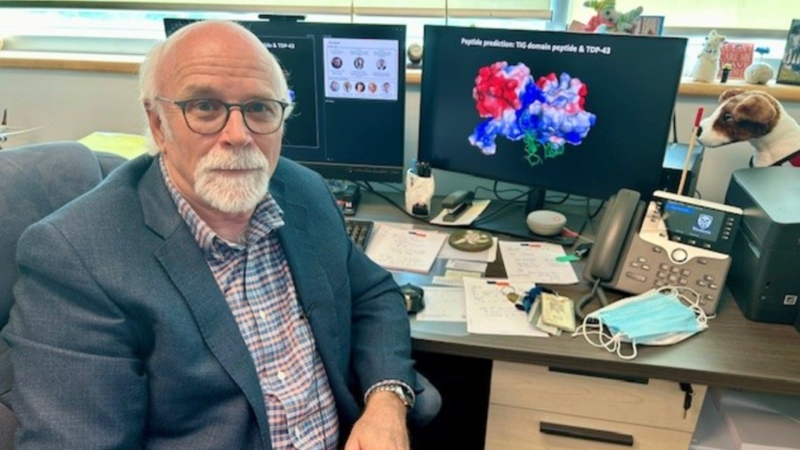

Valerie Tarasuk, a professor of nutritional sciences at University of Toronto, said steepening inflation rates are likely to increase the prevalence and severity of food insecurity in Canada. That could mean financial concerns will prompt people to reduce meal sizes, skip meals or even go a day or more without eating.

Overall food costs rose 8.8 per cent compared with a year ago, while Canadians paid 9.7 per cent more for food at stores in April, the largest increase since September 1981, Statistics Canada reported Wednesday.

Compared with a year ago, the cost of fresh fruit was up 10 per cent, fresh vegetables gained 8.2 per cent and meat rose 10.1 per cent. The cost of bread rose 12.2 per cent, while pasta gained 19.6 per cent and rice increased 7.4 per cent.

While all consumers are prone feel the pinch at the checkout aisle, these numbers pose particular concern for low-income people who are less able to absorb the price hikes, forcing some to make compromises at a detriment to their dietary needs, Tarasuk said.

“As prices of basic commodities rise, it's very worrisome to think that we have such a large swath of the Canadian population sitting in circumstances are insufficient to come up with the costs.”

The 2020 Canadian Income Survey found that 11.2 per cent of Canadians lived in households that had experienced moderate and severe food insecurity, and 4.6 per cent more had experienced marginal food insecurity.

Concerns over being able to consistently put food on the table is a pervasive and persistent problem in Canada, said Tarasuk, and as income levels lag farther behind inflation, the situation looks to get worse with far-reaching impacts.

Food insecurity is a “toxic condition” that has been linked to physical and mental health problems, Tarasuk said. As mounting costs threaten to draw more people into food security and compound the stress on those who are already struggling, inaction on this issue could have consequences for the health-care system and life expectancy, she said.

Tarasuk said only a fraction of food-insecure people turn to charity. But a couple of food banks reported that soaring food prices have accelerated the surge in demand for their services during the COVID-19 crisis.

“This is a crisis on a crisis,” said Neil Hetherington, CEO of Daily Bread Food Bank. “These (inflation) numbers are meals that people will be going without.”

The Toronto-based food charity saw 160,000 client visits in March, up from 123,000 in March 2021, said Hetherington.

He projected that number will increase to 225,000 visits per month by this time next year, but said he hopes that's an overestimate.

“I'm an incredibly optimistic guy, but I am very concerned about the next couple of years,” said Hetherington.

In the first three months of 2022, the Calgary Food Bank logged a 29 per cent year-over-year increase in demand for its food hampers, said communications co-ordinator Betty Jo Kaiser.

Last month, the organization distributed food support to nearly 9,500 people, 75 per cent of whom were first-time clients, said Kaiser.

“We do not expect a slowdown in demand,” she said. “We brace ourselves for continued and rising need.”

This report by The Canadian Press was first published May 19, 2022.