CRA issuing one-time grocery rebate payments July 5

The Canada Revenue Agency (CRA) will be issuing the long-promised "grocery rebate" payments to eligible Canadians on July 5.

Months after Parliament passed the one-time benefit first unveiled as part of the 2023 federal budget, the payments will be hitting Canadians' bank accounts on Wednesday.

The food-inflation focused affordability measure is set to roll out to approximately 11 million low- and modest-income Canadians.

Essentially a re-branded GST rebate boost, the payment will be issued through Canada's GST/HST tax credit system, alongside the regular quarterly GST/HST payments.

Individuals and families that were entitled to receive a GST/HST credit payment for January 2023, and have filed their latest tax returns, should expect to receive this rebate.

The grocery rebate will be equivalent to double the GST/HST credit amount received in January.

The amount those eligible can expect to see, is calculated based on each family's situation and adjusted family net income.

For example, if you are single you could receive a maximum payment of:

- $234 if you have no children

- $387 if you have one child

- $467 if you have two children

- $548 if you have three children

- $628 if you have four children

And, if you are married or have a common-law partner, you could receive up to:

- $306 if you have no children

- $387 if you have one child

- $467 if you have two children

- $548 if you have three children

- $628 if you have four children

Though, CRA has flagged that it's possible that some individuals may be entitled to the grocery rebate, but not the July GST/HST credit, or vice versa.

"The Grocery Rebate is calculated based on your 2021 tax return, but the next quarterly GST/HST credit payment in July 2023 is calculated based on your 2022 tax return," said the tax agency.

Unveiled as a measure to help Canadians offset higher grocery bills due to inflation, the rebate comes with a price tag of $2.5 billion for the federal government.

This spring, CTVNews.ca spoke to Canadians about how they plan to use the grocery rebate, and the responses ranged from fresh fish to children's snacks.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

Ontario to ban use of cellphones in school classrooms starting in September

Ontario is introducing a suite of measures that will crack down on cellphone use and vaping in schools.

'Do not consume': Gift Chocolate recalled due to undeclared milk, soy

The Canadian Food Inspection Agency has issued a recall for a specific chocolate brand sold in Ontario and Quebec.

Have you heard the one about Trump? Biden tries humour on the campaign trail

U.S. President Joe Biden is out to win votes by scoring some laughs at the expense of Donald Trump, unleashing mockery with the goal of getting under the former president's thin skin and reminding the country of his blunders.

Quebec to invest $603 million to protect the French language

Quebec is investing $603 million over the next five years to counter what its French-language minister describes as the decline of the French language in the province.

Murder charge laid after man falls to death from Toronto apartment balcony

One person has been charged with second-degree murder in connection with the death of a man who fell from a balcony following an altercation inside a Toronto apartment building.

Ukraine's army chief reports tactical retreat in the east, and warns of front-line pressure

Ukraine's troops have been forced to make a tactical retreat from three villages in the embattled east, the country's army chief said Sunday, warning of a worsening battlefield situation as Ukrainian forces wait for much-needed arms from a huge U.S. aid package to reach combat zones.

Invasive and toxic hammerhead worms make themselves at home in Ontario

Ontario is now home to an invasive and toxic worm species that can grow up to three feet long and can be dangerous to small animals and pets.

Kitchener family says their 10-year-old needs life-saving drug that cost $600,000

Raneem, 10, lives with a neurological condition and liver disease and needs Cholbam, a medication, for a longer and healthier life.

Laurentian University to spend millions on recommendations in second budget post insolvency, but nothing new to reopen pool

Laurentian University's board of governors approved a budget of just over $201.7 million for the 2024-2025 fiscal year.

Local Spotlight

DonAir force takes over at Oilers playoff games

As if a 4-0 Edmonton Oilers lead in Game 1 of their playoff series with the Los Angeles Kings wasn't good enough, what was announced at Rogers Place during the next TV timeout nearly blew the roof off the downtown arena.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Fergus, Ont. man feels nickel-and-dimed for $0.05 property tax bill

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

Mystery surrounds giant custom Canucks jerseys worn by Lions Gate Bridge statues

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

'I'm committed': Oilers fan skips haircuts for 10 years waiting for Stanley Cup win

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

'It's not my father's body!' Wrong man sent home after death on family vacation in Cuba

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

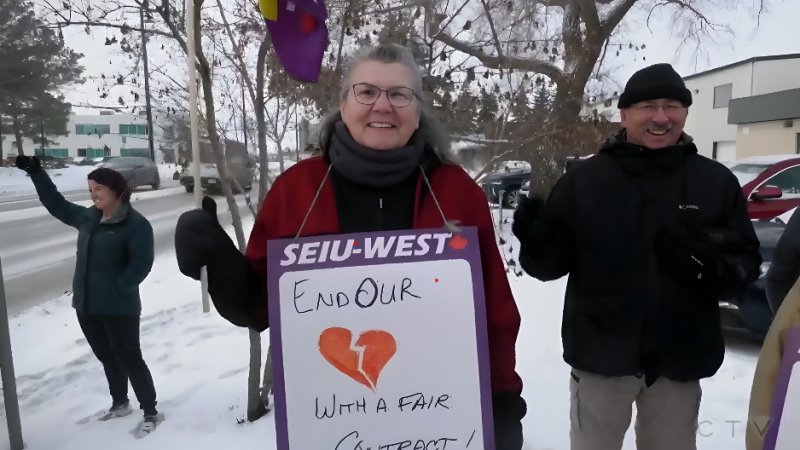

'Once is too many times': Education assistants facing rising violence in classrooms

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

What is capital gains tax? How is it going to affect the economy and the younger generations?

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”