MINNEAPOLIS -

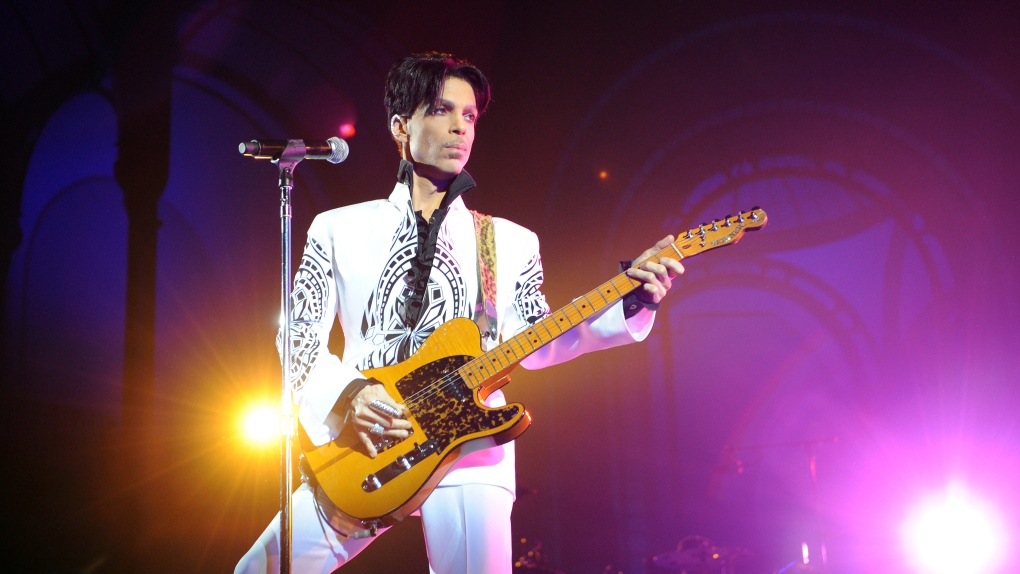

The six-year legal battle over pop superstar Prince's estate has ended, meaning the process of distributing the artist's wealth could begin next month.

The Minneapolis Star Tribune reports that the Internal Revenue Service and the estate's administrator, Comerica Bank & Trust, agreed to value Prince's estate US$156.4 million, a figure that the artist's heirs have also accepted.

The valuation dwarfs Comerica's earlier US$82.3 million appraisal. The Internal Revenue Service in 2020 had valued the estate at US$163.2 million.

Prince, who died of a fentanyl overdose in 2016, did not leave a will.

Since then, lawyers and consultants have been paid tens of millions of dollars to administer his estate and come up with a plan for its distribution. Two of Prince's six sibling heirs, Alfred Jackson and John R. Nelson, have since died. Two others are in their 80s.

"It has been a long six years," L. Londell McMillan, an attorney for three of Prince's siblings, said at a hearing Friday in Carver County District Court.

In the end, the estate will be almost evenly divided between a well-funded New York music company -- Primary Wave -- and the three oldest of the music icon's six heirs or their families.

The IRS and Comerica settled last spring on the real-estate portion of Prince's estate. But the trickier task of valuing intangible assets such as rights to Prince's music was not completed until October.

As part of the agreement, the IRS dropped a $6.4 million "accuracy-related penalty" it had levied on Prince's estate. The Minnesota Department of Revenue, which agreed on the estate's valuation, also has dropped an accuracy penalty, the filing said.

Taxes on Prince's fortune will run into the tens of millions of dollars.

Just over US$5 million of Prince's estate will be exempted from taxes under federal law, but thereafter the tax rate is 40%. In Minnesota, the first US$3 million is tax-exempt; after that, much of Prince's estate will likely be taxed at 16%.

In mid-2020, Comerica sued the IRS in U.S. Tax Court, saying the agency's calculations of the estate's value were riddled with errors. A tax trial set for March in St. Paul has been cancelled because of the settlement.

Comerica, in a court filing Friday, said that while the IRS settlement was "fair and reasonable," it believes it would have "prevailed" in the tax court case. Comerica said it told Prince's heirs that if lowering estate taxes was their "primary interest" they should continue pressing the IRS and -- if need be -- go to trial.

"Instead, the members of the heir group have uniformly communicated to (Comerica) their strong desire that the estate settle with the taxing authorities," the filing said.