If you’re like most people, you have at least some debt. Your mortgage, car payment, credit card balance, and student loans are all liabilities that contribute to your total debt.

Have you ever stopped to wonder how much debt is normal for your age, though?

Below, I’ll outline the average and median debt by age in Canada, so you can see how your finances compare. Then I’ll explain some of the key reasons why Canadians’ debt is increasing.

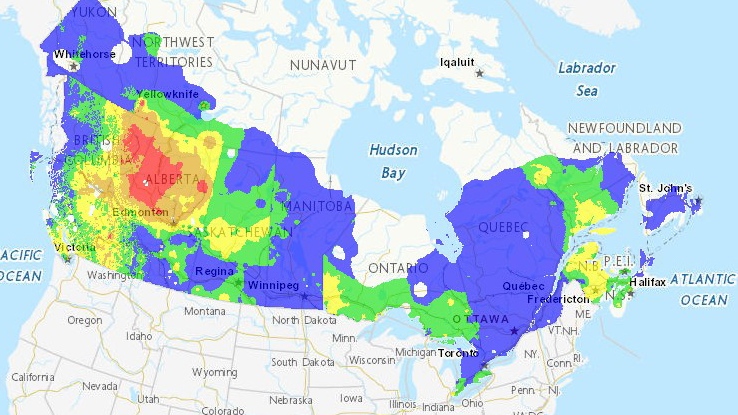

Average debt by age group in Canada

First of all, it’s important to understand that debt is normal. Very few Canadians are 100% debt-free. Even those with near-perfect credit scores likely have an auto or student loan they’re paying down.

These are the debt metrics measured by Statistics Canada during census surveys.

Here’s the average debt by age group in Canada as of 2019, according to the latest data sets from Statistics Canada:

Note - this data applies to individuals who are not in an economic family. The numbers differ for economic families, which include married/common-law partners and families with dependent children.

The total debt measured includes:

-

Mortgage debt

-

Lines of credit

-

Credit card debt

-

Student loans

-

Vehicle loans

-

Other debt (doesn’t fit in the categories above)

Median debt by age group in Canada

Looking at average debt provides a decent overview of the data. However, the averages are very skewed by the debt incurred by Canada’s ultra-wealthy taxpayers.

When calculating the average, all values are added together and divided by the total number of values. This means that a few extreme values can greatly influence the result.

In contrast, the median is the middle value in a dataset when values are arranged in order. As such, it is less affected by outliers and provides a more accurate representation of typical values.

For example, a multi-millionaire with a $2-million mortgage will skew the average higher than the average Canadian.

For a more accurate look at Canadian debt, I find that the median data as of 2019 provides more accurate insight:

Why is consumer debt increasing in Canada?

Over the past year, consumer debt has notably increased. This is especially true for credit card debt. The average monthly spending per credit card increased by 17.5 per cent in the first quarter of 2022 compared to the previous year, according to a recent report by Equifax Canada.

In the report Rebecca Oakes, vice-president of Advanced Analytics at Equifax Canada, stated that “Gen Z and Millennials are driving up higher consumer spending the most.”

Even though inflation is slowly easing, it’s still relatively high. The high inflation has driven up the cost of everyday goods, including groceries and fuel. This, in turn, means that Canadians are spending more per month than they were before 2022, when inflation started to rise.

Unfortunately, workers’ pay hasn’t grown with inflation. This means that the average Canadian simply has less money to spend, increasing their reliance on credit cards to purchase daily necessities.

-

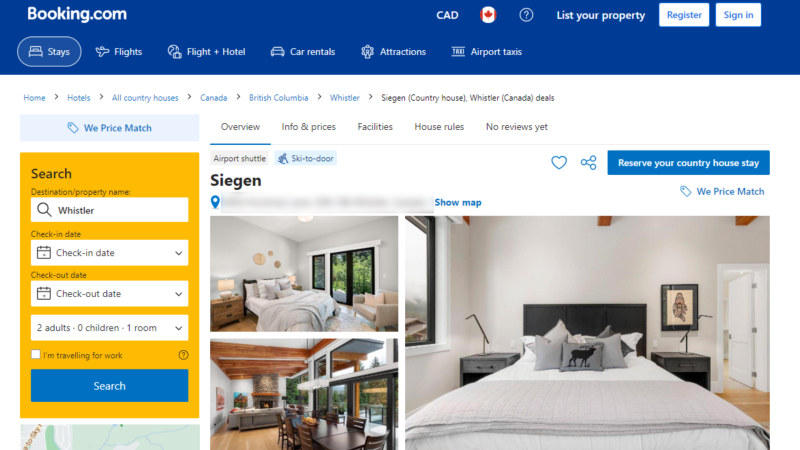

Pent-up demand and travel

Oakes goes on to state that “Pent-up demand and increased travel with the easing of COVID restrictions, combined with soaring inflation, have led to some of the highest increases in credit card spending we’ve ever seen.”

It makes sense that Canadians would be eager to travel after several years of travel restrictions, even if it means incurring more credit card debt.

To keep inflation under control, the Bank of Canada steadily increased interest rates throughout 2022 and is discussing more rate hikes this year. As the federal interest rate has increased, variable interest rates, such as those offered by credit card companies, have also increased.

Those who carry a credit balance over to the next month must now pay even more interest on their credit card debt, increasing their overall debt.

Creating a plan to manage your debt

Accruing debt in the short-term may be inevitable due to high-interest rates and inflation. However, it’s important to create a plan to get your debt under control.

A reliable budget plan paired with consistent action is the best way to get out of debt.

Revisit your monthly budget to find areas where you can save, try to pay down high-interest credit card debt as quickly as possible, and consider taking up a side hustle to earn extra money that you can put towards your debt.

Christopher Liew is a CFA Charterholder and former financial advisor. He writes personal finance tips for thousands of daily Canadian readers on his Wealth Awesome website.