Invasive and toxic hammerhead worms make themselves at home in Ontario

Ontario is now home to an invasive and toxic worm species that can grow up to three feet long and can be dangerous to small animals and pets.

In 2022, Canadians experienced high inflation levels as shifts in the global economy began to settle. Canada’s tax brackets are indexed and adjusted to account for inflation.

This means that there are going to be some changes as we move into 2023.

These changes could impact how you’re taxed when you file your 2023 income tax returns next year.

Below, I’ll outline the new tax brackets for this year and discuss some other notable changes that could affect your personal finances.

In 2023, Canada’s federal tax brackets increased by 6.3% to account for inflation.

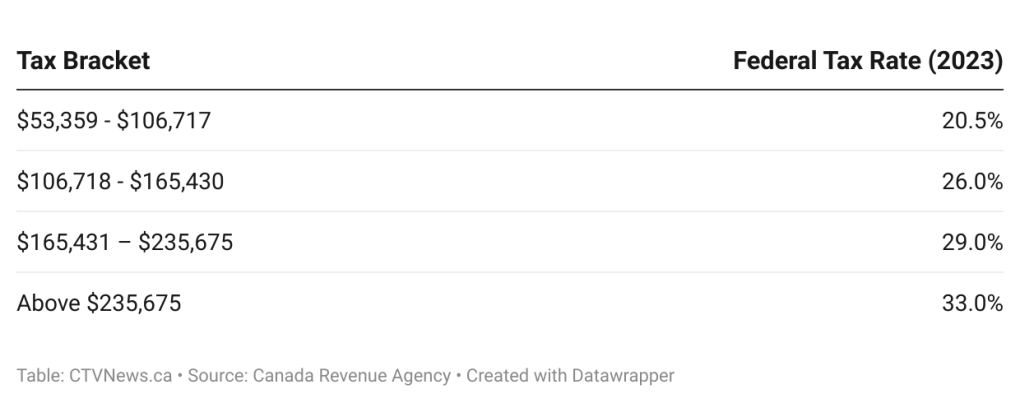

Here are the tax brackets for 2023, as outlined by the CRA:

Any Canadians earning less than $53,359 in taxable income per year (but above the basic personal amount of $15,000) will be subject to the base 15% tax rate.

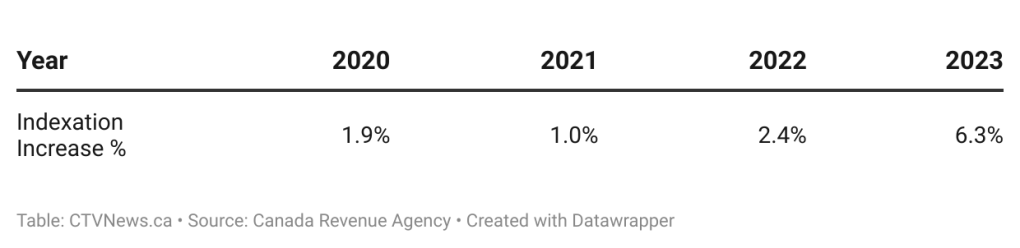

Every year, Canada incrementally changes the federal income tax brackets to account for inflation. These tax rates, along with other benefits, tax credits, and payments, are indexed to the inflation rate. Since inflation increased dramatically in 2022, the tax brackets saw considerable changes and were increased by 6.3% for 2023.

As inflation rises, the cost of consumer goods typically increases along with wages. Indexing tax brackets to inflation is a good thing, as it reduces the amount of taxes you pay. If tax brackets didn’t change to account for this, then people would be paying a disproportionately high tax rate based on their income.

For example, imagine a scenario where tax brackets aren’t indexed to inflation for 50 years. By then, wages will be much higher, and nearly everyone will be in the highest tax bracket, even if they are low-income earners. By increasing tax brackets, the government ensures that lower-income earners are not unfairly taxed at a high rate due to inflation.

That being said, Canada’s inflation rates are expected to decrease moving into 2024, likely resulting in a smaller adjustment to the federal income tax brackets.

Here’s a quick look at how the federal government’s income tax brackets have increased over the past few years to account for inflation levels, based on CRA data:

2023 saw the largest indexation increase in recent years, which is why the tax brackets have changed significantly.

The basic personal amount is a tax credit that all Canadian taxpayers can claim to help reduce the federal income tax they owe. Federal income tax rates don’t kick in until after the individual has earned more than the basic personal amount.

In 2022, the basic personal amount was $14,398. This year, however, the basic personal amount was increased to $15,000. Moving forward, the federal government announced that it would begin indexing the basic personal amount to inflation (which it previously wasn’t).

For higher-income earners, the basic personal amount tax credit decreases incrementally. If you’re in the 29% tax bracket and earn less than $235,675 per year, then you’ll be entitled to claim the full $15,000 basic personal amount.

However, once you reach the 33% tax bracket and earn over $235,675 per year, your basic personal amount decreases to $13,521.

Here are some of the other notable changes that may affect your 2023 taxes.

1. TFSA contribution room increase

This year, the annual contribution room for tax-free savings accounts is $6,500, up from the $6,000 contribution room in 2022. Those who have been eligible for the TFSA program since 2009 (when it began) now have a total contribution room of $88,000.

2. EI premiums increase

In 2023, Employers Insurance (EI) premiums are increasing for both employees and employers. Employees are now subject to a 1.63% EI premium, and employers are now subject to a 2.28% EI premium.

3. Introduction of First Home Savings Account (FHSA) in 2023

This year, the government is introducing an excellent new initiative to help Canadians save for their new homes. The First Home Savings Account (FHSA) allows your contributions to grow tax-free as you prepare to purchase your first home.

As long as the money is withdrawn and put towards your first home, it’s non-taxable, like a TFSA. Additionally, the contributions you make to an FHSA are tax-deductible, similar to an RRSP.

Tax brackets are indexed for inflation to help keep the tax rate steady, despite changing economic conditions. It’s good to be aware of the updated tax brackets, so you can plan for the year and maximize your RRSP contributions and tax deductions.

The updated tax brackets will help all of those earning $50,197 or more (that was the first threshold for the 20.5% tax rate in 2022), which is now $53,359 in 2023, a significant increase. While tax brackets aren’t that important during salary negotiations, inflation should definitely be mentioned. For example, if you got less than a 6.3% raise in 2022, your buying power will be less than it was in 2021. That point could be brought up during performance reviews with your boss.

If you’re unsure of how to account for the changes yourself, it may be helpful to speak with a licensed financial advisor or accountant.

Christopher Liew is a CFA Charterholder and former financial advisor. He writes personal finance tips for thousands of daily Canadian readers on his Wealth Awesome website.

Do you have a question, tip or story idea about personal finance? Please email us at dotcom@bellmedia.ca.

Ontario is now home to an invasive and toxic worm species that can grow up to three feet long and can be dangerous to small animals and pets.

It's one thing to say you like Taylor Swift and her music, but don't blame CNN's AJ Willingham's when she says she just 'oesn't get' the global phenomenom.

Tornadoes wreaked havoc Friday in the Midwest, causing a building to collapse with dozens of people inside and destroying and damaging hundreds of homes, many around Omaha, Neb.

Although it's still unclear how much damage Robert F. Kennedy Jr.'s candidacy can do to either Joe Biden or Donald Trump this election, Washington political columnist Eric Ham says what is clear is both sides recognize the potential threat.

State-sponsored actors targeted security devices used by governments around the world, according to technology firm Cisco Systems, which said the network devices are coveted intrusion points by spies.

A loud explosion was heard across Hamilton on Friday after a propane tank was accidentally destroyed and detonated at a local scrap metal yard, police say.

A man has been handed a lengthy hunting ban and fined thousands of dollars for illegally killing a grizzly bear, B.C. conservation officers say.

George Mallory is renowned for being one of the first British mountaineers to attempt to scale the dizzying heights of Mount Everest during the 1920s. Nearly a century later, newly digitized letters shed light on Mallory’s hopes and fears about ascending Everest.

The first criminal prosecution of a former president began in earnest with opening statements and testimony in a lower Manhattan courtroom. But the action quickly spread to involve more than half a dozen cases in four states and the nation's capital. Twice during the week, lawyers for Trump were simultaneously appearing in different courtrooms.

As if a 4-0 Edmonton Oilers lead in Game 1 of their playoff series with the Los Angeles Kings wasn't good enough, what was announced at Rogers Place during the next TV timeout nearly blew the roof off the downtown arena.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.

A family from Laval, Que. is looking for answers... and their father's body. He died on vacation in Cuba and authorities sent someone else's body back to Canada.

A former educational assistant is calling attention to the rising violence in Alberta's classrooms.

The federal government says its plan to increase taxes on capital gains is aimed at wealthy Canadians to achieve “tax fairness.”