A new poll suggests that many Canadians are feeling some extra stress this holiday season, and are already planning to make things easier by starting their shopping ahead of time.

The poll from the Angus Reid Institute, published on Thursday, found that 35 per cent of respondents indicated that they had begun shopping earlier than usual, while 59 per cent said they did not change their behaviour.

“Either driven because they're hearing about supply issues or because they are have experienced it or are experiencing it, we do see a significant number of Canadians who say that they're starting their Christmas shopping earlier than they would,” Shachi Kurl, president of the Angus Reid Institute, told CTVNews.ca in a phone interview.

“That process is already underway. Of course, what we don't know is the extent to which it might further exacerbate or drive supply chain issues.”

Holiday shoppers are already having a tough time finding what they want. Forty-nine per cent of in-person shoppers are having at least some difficulty tracking down items, and about 40 per cent of online shoppers.

Many Canadians are choosing to cut back: 30 per cent of respondents said they would be spending less this season.

“When you're worried about how much groceries are costing at the moment or how much a litre of gas has spiked or other staples and everyday items are increasing in their cost, Christmas shopping is … just one more stressor,” Kurl said.

MANY REPORTING HIGHER STRESS THAN NORMAL

The poll also found that 53 per cent of Canadians are feeling more emotional stress this year compared to most, while 41 per cent are feeling more financial stress than other years.

Kurl said several factors -- including the pandemic and emerging COVID-19 variants, labour shortages, and flooding in B.C. and Atlantic Canada -- could be playing a part in the increased stress levels among Canadians this holiday season.

The poll also found that 38 per cent of respondents are feeling the same emotional stress as other years, while 45 per cent are feeling the same about of financial stress. Just seven and 12 per cent of respondents reported less emotional and financial stress, respectively.

The also poll found that women and people in the lowest income bracket were feeling the most vulnerable to holiday stress.

“For many lower-income households, this has been a more stressful time of year on many fronts,” Kurl said.

“Households across the country are experiencing … some amount of emotional stress at the end of two years of uncertainty around the pandemic and living through that, and then for many households -- depending on their income -- it also has to do with the extent to which they're feeling stressed out financially.”

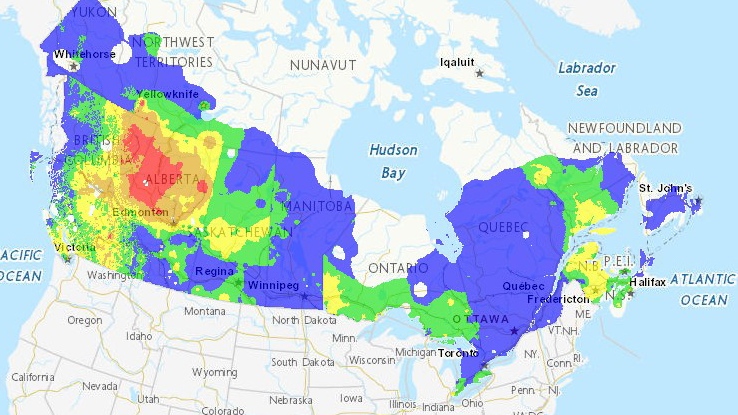

Meanwhile, Quebec was the least stressed region of the country with just 42 per cent of respondents indicating they are more emotionally stressed than usual, and 33 per cent indicating they are more financially stressed than usual. Quebec is the only region in Canada with less than half of respondents indicating that they are more emotionally stressed than normal.

METHODOLOGY

The Angus Reid Institute conducted an online survey from Nov. 26 – Nov. 29, 2021 of a randomized sample of 2,005 Canadian adults, all of them members of the Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of plus or minus two percentage points, 19 times out of 20.