Norovirus spreading at 'higher frequency' than expected in Canada

Norovirus is spreading at a 'higher frequency' than expected in Canada, specifically, in Ontario and Alberta, according to the Public Health Agency of Canada.

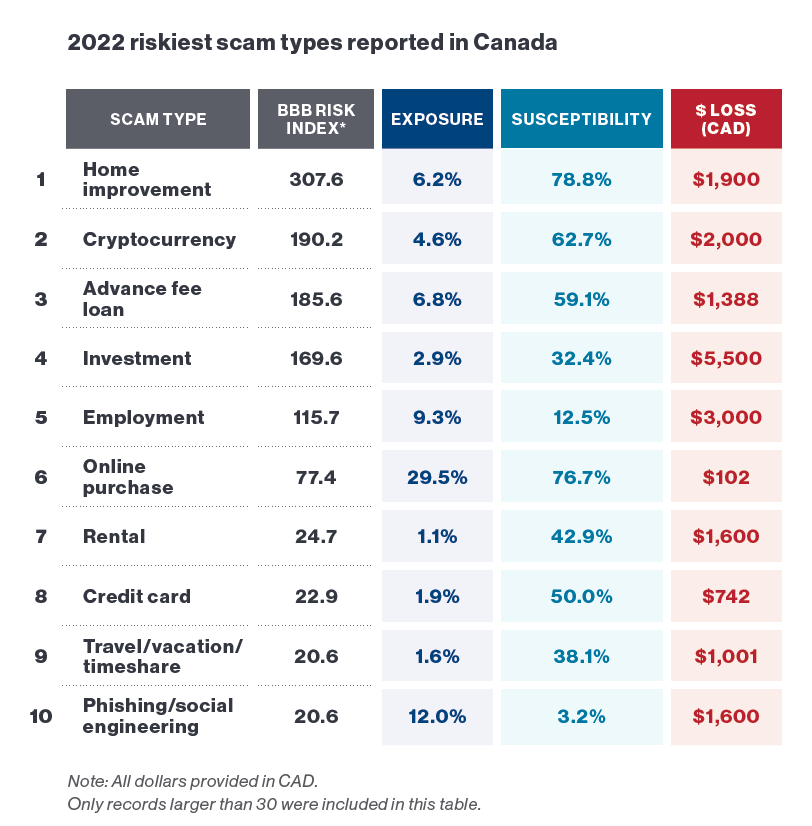

A new report from the Better Business Bureau (BBB) says the riskiest frauds in Canada are home improvement scams and cryptocurrency scams, followed by advance fee loan scams.

The organization, which advocates for education to protect consumers, says home improvement scams were the riskiest in 2022, up from the fourth-riskiest ranking in 2021.

According to the report published March 6, 1,291 scams were reported by Canadian consumers to the BBB Scam Tracker in 2022. The overall median dollar loss reported was $300, a 20-per-cent increase from the 2021 median dollar loss of $250.

More people were being targeted by websites, social media and email in 2022, but in-person contact scams resulted in the highest amount of money lost, the report found.

BBB assigns a risk index score to scams based on the exposure (volume of reports), the susceptibility (per cent of those who lost money) and the monetary loss. The higher the overall risk score the more riskier the scam is for the public.

Home improvement scams, where perpetrators pretend to be a professional in the sector, resulted in a median loss of $1,900 for Canadians. BBB gives this scam a susceptibility score of 78.8 per cent and an overall risk score of 307.6. The scams with the highest risk scores are then ranked by BBB from riskiest to less risky.

Cryptocurrency scams were second on the BBB list, with a median loss of $2,000. The risk score was 190.2 and the susceptibility score is 62.7 per cent.

Advance fee loan scams had a susceptibility score of 59.1 per cent and a risk score of 185.6, according to the BBB tracker. The median loss for the scam was $1,388.

The riskiest scams in Canada according to the Better Business Bureau. (Screenshot from report)

The riskiest scams in Canada according to the Better Business Bureau. (Screenshot from report)

Different scams are targeted at certain demographics, the report explains.

"The percentage of Canadians who reported losing money after being targeted by a scam (susceptibility) increased for several age groups," the BBB report reads. "In 2022, ages 35-44 reported higher susceptibility (57.2 per cent) than other age groups."

Those aged 35 to 44 had a median dollar loss of $500 in 2022, higher than any other age group.

Combining all data from the BBB report, those aged 18 to 34 were more likely to fall for employment scams.

Online shopping scams tended to be riskiest for people aged 35 to 64 and home improvement scams were the riskiest for those aged 65 and older.

According to the whole report using data from the U.S. and Canada, the companies most likely to be impersonated by fraudsters, according to BBB, were Amazon, Geek Squad, Publishers Clearing House, the U.S. Postal Service and Norton.

Employment and online shopping scams were deemed riskiest overall, based on all the data.

"Employment scams, which peaked at #1 on our list in 2019, are seeing a resurgence,” Melissa Lanning Trumpower, executive director of the BBB Institute for Marketplace Trust, said in the press release. “This is a high-touch scam in which perpetrators spend more time with their targets in the hope of stealing more money from each target.

The report says that, overall, cryptocurrency scams dropped in 2022 from the second spot to third, due to a decrease in people reporting the scam type. One reason for the drop is that fewer people fell for cryptocurrency scams resulting in less median dollars lost overall.

For home improvement scams, BBB recommends saying no to cash-only deals and anyone with "pressure sales tactics." The organization says high upfront payments and "handshake deals" are signs of a potential home improvement scam.

"Whenever possible, work with businesses that have proper identification, licensing, and insurance," the BBB report reads.

Asking for references and getting quotes from other businesses is encouraged by BBB before hiring someone to work on a home.

With more perpetrators using social media and the internet to scam, BBB says to be "extremely cautious when dealing with anyone you've met online."

Never send money to someone without meeting face-to-face and be aware of oversharing on social media, the company says.

"Don’t click on links or open attachments in unsolicited email or text messages," the BBB report says.

Norovirus is spreading at a 'higher frequency' than expected in Canada, specifically, in Ontario and Alberta, according to the Public Health Agency of Canada.

The same storm system that brought deadly tornadoes to parts of the U.S. is heading north, hammering some Canadian provinces with rain and snow, according to latest forecasts.

A boycott targeting Loblaw is gaining momentum online, with what could be thousands of shoppers taking their money elsewhere in May.

Jim Arner was always interested in genealogy and discovering more about his ancestry. But after submitting his own DNA test, he learned an old work colleague was actually a distant cousin.

McGill University says the growing encampment on its lower field in solidarity with Palestinians in Gaza violates its policies.

French actor Gérard Depardieu has been taken into police custody in Paris to face questioning, his lawyer told CNN Monday.

Three women diagnosed with HIV after getting 'vampire facial' procedures at an unlicensed medical spa are believed to be the first documented cases of people contracting the virus through a cosmetic procedure using needles.

On a three-lane test track along the Monongahela River, an 18-wheel tractor-trailer rounded a curve. No one was on board.

Health Minister Mark Holland says while he is 'deeply appreciative' of the work doctors in Canada do, the federal government has no plans to scrap the proposed capital gains tax changes outlined in the latest budget, despite opposition from the Canadian Medical Association.

Police in Oak Bay, B.C., had to close a stretch of road Sunday to help an elephant seal named Emerson get safely back into the water.

Out of more than 9,000 entries from over 2,000 breweries in 50 countries, a handful of B.C. brews landed on the podium at the World Beer Cup this week.

Raneem, 10, lives with a neurological condition and liver disease and needs Cholbam, a medication, for a longer and healthier life.

The lawyer for a residential school survivor leading a proposed class-action defamation lawsuit against the Catholic Church over residential schools says the court action is a last resort.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

A property tax bill is perplexing a small townhouse community in Fergus, Ont.

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.

The giant stone statues guarding the Lions Gate Bridge have been dressed in custom Vancouver Canucks jerseys as the NHL playoffs get underway.

A local Oilers fan is hoping to see his team cut through the postseason, so he can cut his hair.