Parents of infant who died in wrong-way crash on Ontario's Hwy. 401 were in same vehicle

Ontario’s Special Investigations Unit has released new details about a wrong-way collision in Whitby on Monday night that claimed the lives of four people.

The Bank of Canada has raised its policy interest rate again, making the cost of borrowing more expensive.

The 25-basis-points hike brings the central bank’s overnight rate to five per cent, the highest it’s been since 2001.

“We’ve come a long way, and we don’t want to squander the progress we’ve made,” Bank of Canada Governor Tiff Macklem said Wednesday. “We need to stay the course to restore price stability.”

In its Monetary Policy Report, the Bank of Canada says the rate increase was necessary to help slow economic growth and reduce core inflation. Three-month rates of core inflation have been higher than the Bank’s expectation, hovering around 3.5 per cent to four per cent since September 2022.

“The stubbornness of core inflation in Canada suggests that inflation may be more persistent than originally thought,” the Bank’s Monetary Police Report states.

Since the Bank of Canada started raising rates in March 2022, inflation has dropped from a peak of 8.1 per cent last summer to 3.4 per cent in May. This is the 10th interest rate hike since March 2022.

While the Bank acknowledges inflation has been declining due to falling energy prices, easing supply constraints and interest rate hikes, it predicts inflation will remain elevated around three per cent over the next year. The Bank says economic growth isn’t slowing as quickly as expected, citing more momentum for demand and stronger-than-anticipated consumer spending in the first quarter of 2023.

The downward momentum in inflation is waning, Macklem said, warning that it could trend back up if the Bank is not careful.

“It’s too early to talk about cuts,” Macklem said, when asked where the interest rate may go in the coming months.

The central bank’s mandate is to keep inflation around two per cent, and its forecasters are currently predicting inflation will return to that two per cent level in the middle of 2025, two quarters later than previously projected.

The Bank’s forecasters say the change to the inflation outlook is due to excess demand, higher-than-expected housing prices, and higher-than-expected prices for tradable goods. The next stage in the inflation decline, the Bank says, will take longer and is more uncertain.

“The substantial drop in inflation over the past year is welcome news for all Canadians, but monetary policy still has work to do,” Macklem said. “Our job is not done until inflation is centered on our two per cent target.”

Since inflation has already been above its two per cent target for a few years, and isn’t expected to return to target until 2025, the Bank also warns that “it is possible that inflation expectations will remain higher for longer,” and that “progress towards the two per cent target could stall, jeopardizing the return to price stability.”

Right now, however, the Bank projects the Canadian economy will achieve a soft landing and avoid a recession.

“We do think there is a path back to price stability with the economy still growing,” he said.

Due to higher interest rates, the Bank expects Canada’s real GDP growth to slow to 1.5 per cent in the second quarter of 2023 and hover around one per cent through the second half of 2023 and into the first half of 2024. The Bank expects economic growth will pick up again in 2025 with GDP growth expected to hit 2.4 per cent.

Macklem said the Bank is trying to mitigate the risks of doing too much or doing not enough. If the Bank doesn’t do enough now, Macklem said the central bank will have to do “even more later.”

“Governing Council decided monetary policy was not restrictive enough,” Macklem said, adding there was a clear consensus “we didn’t see a clear benefit of waiting.”

The Bank of Canada’s next rate decision is set for Sept. 6.

And the Governor of the Bank of Canada is not ruling out another hike if the economy does not cool down, saying the Bank is taking it one decision at a time.

An earlier version of this article said the latest increase was the 10th consecutive hike. It's the 10th since March 2022, but because the Bank of Canada opted to pause the rate earlier this year, it is not the 10th consecutive hike.

Ontario’s Special Investigations Unit has released new details about a wrong-way collision in Whitby on Monday night that claimed the lives of four people.

Three men in Quebec from the same family have fathered more than 600 children.

Jurors in the hush money trial of Donald Trump heard a recording Thursday of him discussing with his then-lawyer and personal fixer a plan to purchase the silence of a Playboy model who has said she had an affair with the former president.

A British Columbia mayor has been censured by city council – stripping him of his travel and lobbying budgets and removing him from city committees – for allegedly distributing a book that questions the history of Indigenous residential schools in Canada.

Fake text message and email campaigns trying to get money and information out of unsuspecting Canadian taxpayers have started circulating, just months after the federal government rebranded the carbon tax rebate the Canada Carbon Rebate.

Montreal police are facing pressure to move in and dismantle a pro-Palestinian encampment on McGill University campus on Thursday, as a growing number of universities across this country grapple with the tough decision of how to handle the protests.

A pro-Palestinian activist group says its international co-ordinator, who was arrested in a Vancouver hate-crime investigation, was released with an order not to attend any protests for the next five months.

A Conservative MP is challenging claims by House of Commons administration that a China-backed hacking attempt did not impact any members of Parliament, because the attack was on his personal email.

Loblaw chairman Galen Weston and the company's new CEO are pushing back against critics who blame the grocery giant for soaring food prices, as a month-long boycott of the retailer gets underway.

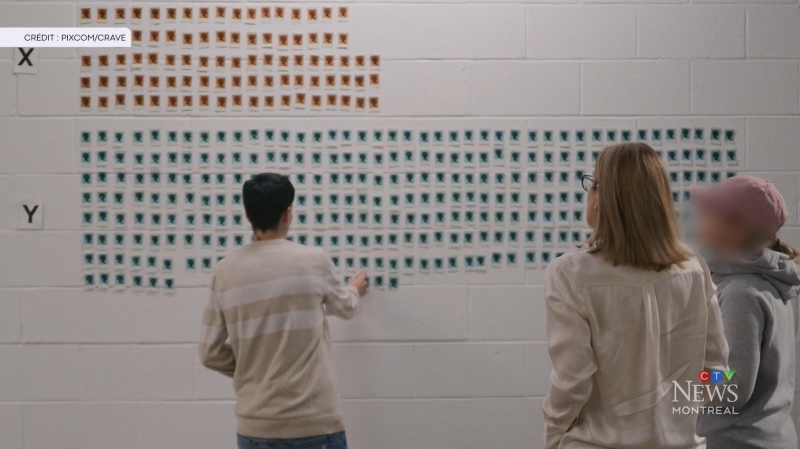

Three men in Quebec from the same family have fathered more than 600 children.

A group of SaskPower workers recently received special recognition at the legislature – for their efforts in repairing one of Saskatchewan's largest power plants after it was knocked offline for months following a serious flood last summer.

A police officer on Montreal's South Shore anonymously donated a kidney that wound up drastically changing the life of a schoolteacher living on dialysis.

Since 1932, Montreal's Henri Henri has been filled to the brim with every possible kind of hat, from newsboy caps to feathered fedoras.

Police in Oak Bay, B.C., had to close a stretch of road Sunday to help an elephant seal named Emerson get safely back into the water.

Out of more than 9,000 entries from over 2,000 breweries in 50 countries, a handful of B.C. brews landed on the podium at the World Beer Cup this week.

Raneem, 10, lives with a neurological condition and liver disease and needs Cholbam, a medication, for a longer and healthier life.

The lawyer for a residential school survivor leading a proposed class-action defamation lawsuit against the Catholic Church over residential schools says the court action is a last resort.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.