Less than a quarter of Canadians are happy with how the government spends money: Ipsos survey

Less than a quarter (23 per cent) of Canadians think the federal government is properly spending money on the most important issues facing the country, according to new survey data from Ipsos.

The survey, conducted on behalf of the Montreal Economic Institute, also found 64 per cent of people think the government is doing an ineffective job allocating funds to address important problems, while 13 per cent said they don't know or preferred not to answer.

More than half of Canadians (55 per cent) said the government spends too much money, while 27 per cent think it is an acceptable level, according to the poll. Only nine per cent of Canadians said government spending is too low, while another nine per cent said they don't know or preferred not to answer.

The majority of those surveyed (67 per cent) think they pay too much money in income tax, while one per cent think they don’t pay enough. According to Ipsos, 65 per cent of men and 70 per cent of women believe the amount they pay in income tax is too high. Younger Canadians (aged 18 to 34) are more likely to think taxes are too high (72 per cent) compared to Canadians aged 55 and older (63 per cent).

The poll also found most people (63 per cent) are unhappy with the accountability and transparency of the government's spending practices—31 per cent said they were satisfied with them.

The poll gauged Canadians' thoughts on carbon pricing, which people are generally slightly more likely to dislike. Ipsos says 25 per cent of Canadians strongly oppose it and another 20 per cent somewhat oppose it—in total, 41 per cent of people said they support carbon pricing while 45 per cent oppose it. Fifteen per cent of people said they don't know or preferred not to answer. According to the data, 68 per cent of people from Atlantic Canada oppose carbon pricing, while 47 per cent of Quebecers support it.

More than six in ten Canadians think higher government spending over the past three years is causing higher levels of inflation, while 26 per cent disagree. A similar amount of men (26 per cent) and women (25 per cent) said they disagree that government spending is driving inflation up.

TAXING THE RICH

A third of Canadians (33 per cent) believe people who earn more than $250,000 per year can be considered rich, while just over a quarter (27 per cent) say it should be people who make more than $500,000 per year. According to the survey, to be considered a rich person, 17 per cent of people said you need to make more than $100,000, 16 per cent said more than $1 million and seven per cent said more than $5 million.

Ipsos data also shows 71 per cent of Canadians say increasing corporate taxes will drive up prices for consumers, 80 per cent of people from Quebec feel the same, while 24 per cent of people from Ontario disagree. Sixty-one per cent of Canadians say higher taxes will discourage wealthy people from staying in Canada, a similar percentage of people across all regions agree.

However, more than 43 per cent of people believe the rich should pay more than half of their income in taxes while 33 per cent say the rich pay their fair share. Western Canadians were more likely to disagree that the rich should pay 50 per cent of their income in tax, and 35 per cent of people from the same region say the rich shouldn't be taxed further. Sixty-nine per cent of people aged 55 and older say the rich do not pay their fair share of taxes in Canada, while just under half (49 per cent) of people aged 18 to 34 agree.

METHODOLOGY

These are the findings of an online Ipsos poll conducted on behalf of the Montreal Economic Institute. A sample of 1,020 Canadian residents aged 18 years and over was interviewed between the June 29th and July 3rd, 2023. Weighting according to age, gender and region was employed to ensure that the sample's composition is representative of the overall population according to the latest census information. The precision of Ipsos online polls is measured using a credibility interval. In this case, the results are accurate to within +/- 3.5 percentage points, 19 times out of 20 , of what the results would have been had all Canadian adults been polled. Some totals may not add up to 100 per cent due to rounding.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

World No. 1 golfer charged with police officer assault before PGA Championship second round

World number one golfer Scottie Scheffler was arrested and charged with the assault of a police officer in what he called a 'chaotic situation' before being released in time to start his second round at the PGA Championship on Friday.

LIVE @ 11:30 MT Four 1970s homicides linked to serial killer, Alberta Mounties to reveal Friday

A dead serial sexual offender and killer has been linked to four homicides in the 1970s in Alberta, RCMP say.

With today's high rates, should you consider an interest-free halal mortgage?

A halal mortgage complies with the Islamic religious, or Shariah, law, which forbids the use of "riba" (interest). Here's what mortgage experts say those considering "no-interest" halal mortgages should know.

WATCH Infectious disease expert warns measles 'a very real threat'

A Canadian epidemiologist is warning the measles presents a 'very real threat' to public health if Canada doesn't maintain a high vaccination rate.

NEW What a wildfire survivor says she regrets not grabbing before leaving home

Carol Christian had 15 minutes to evacuate her home during the Fort McMurray wildfires in 2016. She ended up losing the house and everything inside. Now, she wants to share the lessons she learned.

Newly mapped lost branch of the Nile could help solve long-standing pyramid mystery

Egypt’s Great Pyramid and other ancient monuments at Giza exist on an isolated strip of land at the edge of the Sahara Desert.

Ontario sees first measles death in more than a decade after young child dies

A young child has died of measles in Ontario, marking the first death in the province from the highly contagious virus in more than 10 years, a Public Health Ontario report confirms.

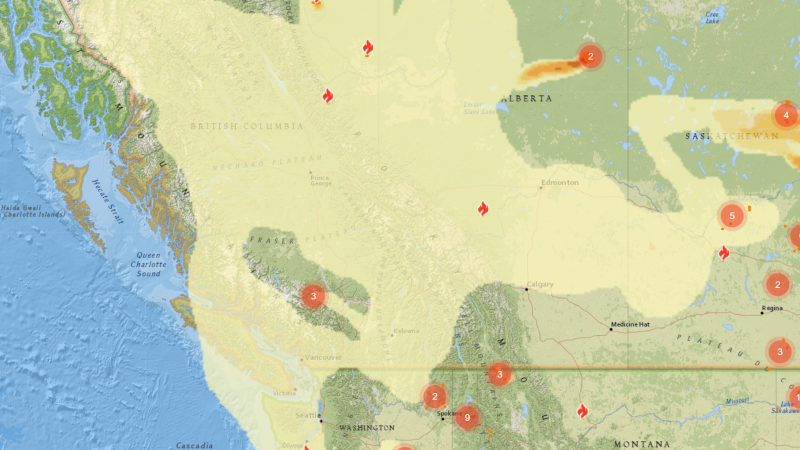

Wildfires are dampening against cool, rainy weather, but there's plenty left to contain

An opportune system of cool, wet weather Friday is dampening the spread of wildfires across Western Canada, but there's still plenty of work for responders and residents alike.

Think twice before sharing 'heartbreaking' social media posts, RCMP warn

Mounties in B.C. are urging people to think twice before sharing "heartbreaking posts" on social media.

Local Spotlight

'Another pair of eyes watching over me:' How a B.C. woman's guide dog saved her from drowning

A B.C. woman says her guide dog pulled her from a lake moments before she had a seizure, saving her life.

Starbucks fan on decades-long journey to visit every store in the world

A Starbucks fan — whose name is Winter — is visiting Canada on a purposeful journey that began with a random idea at one of the coffee chain's stores in Texas.

'Sacred work': Sask. First Nation learning how to conduct its own underground searches

Members of Piapot First Nation, students from the University of Winnipeg and various other professionals are learning new techniques that will hopefully be used for ground searches of potential unmarked grave sites in the future.

'It could mean a cure': Cautious optimism for groundbreaking ALS research at Western

ALS patient Mathew Brown said he’s hopeful for future ALS patients after news this week of research at Western University of a potential cure for ALS.

B.C. musician's song catches attention of Canucks

When Adam Kirschner wrote 'Slap Shot,' he never imagined the song would be embraced by his favourite team.

'We're on standby': Team ready to help entangled right whale in Gulf of St. Lawrence

A team is ready to help an entangled North Atlantic right whale in the Gulf of St. Lawrence.

Thieves caught on camera stealing pet chicken from North Vancouver backyard

A $200 reward is being offered by a North Vancouver family for the safe return of their beloved chicken, Snowflake.

Adopted daughter in the Netherlands reunited with sister in Montreal and mother in Colombia, 40 years later

Two daughters and a mother were reunited online 40 years later thanks to a DNA kit and a Zoom connection despite living on three separate continents and speaking different languages.

'Reimagining Mother's Day': Toronto woman creates Motherless Day event after losing mom

Mother's Day can be a difficult occasion for those who have lost or are estranged from their mom.