TORONTO -

The rising cost of living and added burden of COVID-19 are forcing Canadians further into debt, a new survey suggests.

The 2021 BDO Affordability Index, released Monday, suggests that many Canadians' quality of life is diminishing further as more debt is accumulated and the pandemic drags on.

The survey, conducted by Angus Reid Group in partnership with BDO Debt Solutions, found that 43 per cent of Canadians added to their existing debt because of the pandemic, up four per cent compared to last year.

The survey reports that 26 per cent of Canadians incurred at least one new type of debt, the most common being credit card debt, and 70 per cent of these Canadians said the new debt has made their standard of living worse.

According to the BDO Affordability Index, only 51 per cent of this group said they will be able to restore their standard of living to pre-pandemic levels.

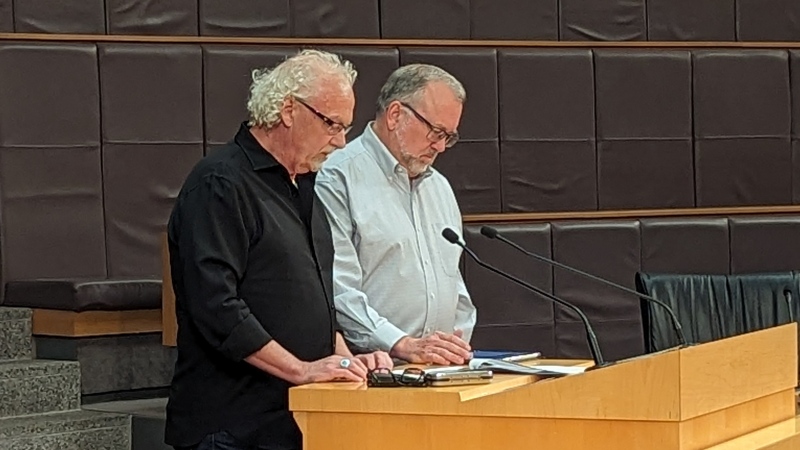

Nancy Snedden, national leader of the BDO Debt Solutions practice, said in a press release that many Canadians are "not seeing a light at the end of the tunnel, which is cause for concern."

"This year's BDO Affordability Index underscores the affordability challenges faced by Canadian families more than a year into the pandemic – and it's clear many are feeling the combined pressure of rising costs of living and the ongoing impact of COVID-19," Snedden said.

The survey reports that increased spending on essentials, job loss and reduced income are also taking a greater toll on Canadians' savings compared to last year.

Of the 42 per cent of Canadians who were saving less or not at all during the pandemic, 57 per cent said it was due to an increase in spending on groceries and housing, while 51 per cent said it was due to reduced income or job loss.

BDO reports that the proportion of debt-ridden Canadians with increasing debt has remained steady year-over-year at 11 per cent. However, of those whose debt is increasing, 70 per cent say the main reason is the rising cost of living.

The survey notes that overspending was not a major factor and is actually down 15 per cent compared to last year.

The survey reported that those who said they are saving less or not at all since the start of the pandemic include women (45 per cent), Canadians aged 34 to 54 (48 per cent) and Atlantic Canadians (50 per cent).

In addition, the survey found that those who relied on government pandemic benefits did so "heavily."

According to the index, 29 per cent of those surveyed accessed government benefits, and 76 per cent of these Canadians describe the financial aid as "very important" or "essential."

While only four per cent of those surveyed continue to receive COVID-19 benefits, BDO notes that they are "deeply dependent" on them, with 65 per cent of these Canadians reporting that they are unsure if they could maintain current standards of living once they stop receiving benefits.

RETIREMENT, HOME OWNERSHIP OUT OF REACH

With household budgets tightened by higher costs, the survey reports that 60 per cent of Canadians are not on track to retire based on their current retirement savings.

In addition, BDO reports that Canadians are "increasingly facing affordability barriers" when it comes to home ownership with 45 per cent of Canadians saying housing costs are a "challenge."

The survey suggest that the high cost of housing is forcing Canadians to put off home ownership, with nearly half saying they’re unable to save enough for a down payment.

Canadians are also experiencing more difficulties in affording necessities when compared to earlier in the pandemic, according to the survey.

BDO says 23 per cent of Canadians find it challenging to put food on the table for themselves and their families, up four per cent compared to last year.

The survey reports that 31 per cent of those surveyed indicated that paying for utilities is a challenge and 35 per cent said the same about transportation and clothing costs.

With this in mind, the survey suggests that Canadians' priorities for 2022 have shifted with most wanting to save money for emergencies, retirement and a major purchase such as a home, car or cottage.

According to the data, 60 per cent of Canadians said their priority is saving for an emergency fund or nest egg. The index notes that this is a major priority for Canadians between the ages of 18 and 34 (64 per cent) and those making less than $50,000 a year (67 per cent).

The survey reports that saving for retirement is a priority for 51 per cent of Canadians, specifically those between the ages of 35 and 54 (59 per cent), as well as those making more than $100,000 a year (62 per cent).

Spending money on travel (40 per cent), non-essentials including eating out and entertainment (31 per cent), and paying down debt incurred by the pandemic (37 per cent) will also be top priorities for some Canadians in 2022, according to the survey.

Snedden says the rising cost of living in Canada is "definitely" contributing to many people's debt, and said Canadians shouldn't be hesitant to speak to a professional, such as a licenced insolvency trustee, about their situation.

She explained that a licenced insolvency trustee can provide a "full range of debt relief options" including budgeting strategies, debt consolidation and bankruptcy, to help Canadians "get their finances on track to start fresh."

"With restrictions easing across the country, the temptation for Canadians to increase spending on non-essentials may be high. But as we look ahead, we continue to stress the importance of paying down debt and adhering to household budgets to help avoid adding new debt," Snedden said in the release.

METHODOLOGY

The fourth-annual BDO Affordability Index, which examines how affordable life is in Canada, was conducted via a randomized, online survey of 2,015 Canadians in early September. Those surveyed are members of the Angus Reid Forum. For comparison purposes only, a probability sample of this size would yield a margin of error of +/- 2.2%, 19 times of out 20. Discrepancies in or between totals are due to rounding, according to BDO.