The bad news for investors continues to mount as stocks on Wall Street and the TSX keep tumbling.

Two weeks ago, the S&P/TSX composite index entered correction territory and the S&P 500 plunged into a bear market. On Thursday, the S&P/TSX fell another 300 points while the S&P 500 posted its worst first-half result in 52 years.

But while it can be easy for your emotions to take over if you've got money invested in the market, experts agree that there's no need to panic if you're invested in the right type of portfolio with the right level of risk.

"The sage advice -- I can't remember who said it -- is that your investments are like a bar of soap. The more you touch them, the smaller they get," author and personal finance educator Kelley Keehn told CTVNews.ca over the phone on Thursday.

WHEN TO MAKE CHANGES TO YOUR PORTFOLIO

If the state of the markets has you feeling especially anxious, it may be a sign that you weren't in the right risk bracket in the first place.

"If you can't sleep at night, maybe you weren't in the proper portfolio and this really is the time to talk to your investment advisor," Keehn explained.

If this applies to you, it may be necessary to de-risk your portfolio by reallocating some of your investments in stocks and equities into bonds, GICs or savings accounts.

"A lot of people think they can take on more risk than they actually can and that's been very evident now with the crypto crash," said personal finance expert and CTVNews.ca contributor Christopher Liew in a phone interview on Thursday. "People were investing in crypto, which generally is extremely highly volatile and risky. But when things are going up, people don't really care. But now that it's crashed, a lot of people that couldn't handle that risk are now really feeling that pressure."

Your risk tolerance could also shift based on changes in your life. If you're planning on retiring or buying a house soon, for example, that could warrant shifting your portfolio to one that is more low-risk.

"If nothing has changed, if it's just that the markets are going bananas, then you should just leave it alone. But if something significant has changed … that really changes what you're doing now. It doesn't mean that you drastically slam on the brakes on the highway and start selling. These things should have some forethought," said Keehn.

DON'T CONSTANTLY LOOK AT YOUR PORTFOLIO

It can be disheartening to see the value of your portfolio appearing to be in freefall and experts advise that it's not a good idea to be checking your portfolio every day.

"If you're invested in what you should be invested in, then yeah, you shouldn't be looking at it," Keehn said.

While shorter term investors may need to check their portfolios more frequently, Liew says longer term investors should only be checking their money every few months, or if they're planning on making any new contributions.

"I would say check it as less often as you can, because if you don't need the money for 10, 20 or even 30 years, it doesn't make sense to check it daily," he said.

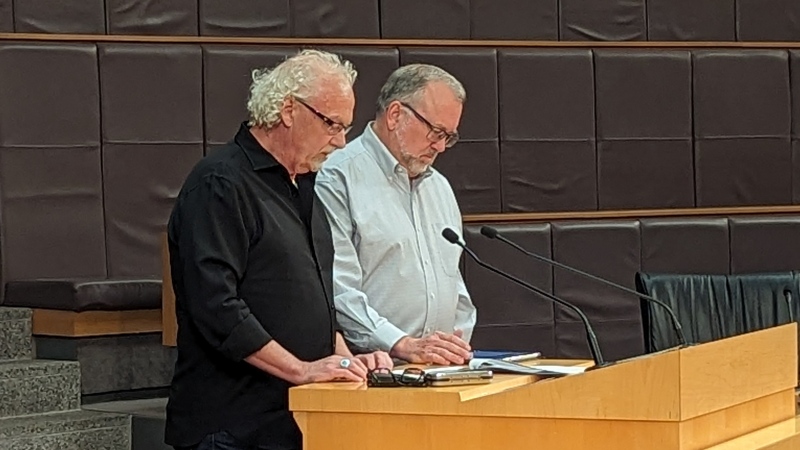

Steve Joordens, a psychology professor at the University of Toronto Scarborough Campus, says that constantly checking your portfolio could worsen your mental health and cause you to make rash decisions.

"You're getting information that you want, but you can overdo it." he told CTVNews.ca over the phone on Wednesday. "Every moment you spend looking at that is going to feed your brain and put it into that stressful state."

While the recent market downturn may feel painful, Keehn says that in the long run, this is simply a "blip." While the S&P/TSX Composite Index is down nearly 13 per cent since the start of April, it has still increased an average of 4.63 per cent annually over the last five years and 5.10 per cent over the last 10 years.

HOW ECONOMIC DOWNTURNS AFFECT THE BRAIN

Joordens says economic downturns can be quite stress-inducing and it can be easy to make emotional knee-jerk reactions.

"When we see the downturns start to happen, that becomes a big problem for us because it becomes a threat. And we have a very natural and primitive response to threat," he said.

While our brain's frontal lobes are in charge of rational decision making, the brain's limbic system activates the primitive "flight or fight" response when we're faced with a threat.

"Quite often that works out well for us. If a bear steps in front of us that's what we want to happen. We want our primitive limbic survival system to take control and get us through this," Joordens explained.

But while our limbic systems works well when it comes to responding to something like a bear, it's not well-suited to respond to a bear market.

"Where you have weird threats, like a crashing stock market, the limbic system still does what it always has done. It hasn't changed and it wants you to fight or flee. And that's what makes it so damn uncomfortable," said Joordens.

If the markets have you feeling anxious, Joordens recommends finding "cognitive palate cleansers" in things that make you laugh and smile, such as your favourite TV show.

"Try to change the channel on your mind and the way you can do that is through what you experience in the world," he said. "The idea here is you've removed the taste of that negative stressor from your mind, rather than watching it and then walking away and carrying it with you in your mind."