Many Canadians have continued to see an increase in their rental rates in 2023. The average cost of rent across Canada has increased by 12.2 per cent from December 2021 to December 2022, according to the latest 2023 rental report posted by Rentals.ca. This report accounts for all property types, from small studio units to larger multi-family units.

Below, I’ll explain how much of your monthly income should go towards rent and give you some helpful tips on how to stay on top of your budget and how to calculate how much rent you can afford.

What percentage of my income should go towards rent?

You should plan to allocate a set percentage of your monthly income toward your monthly rental costs. This will help you stay on top of your bills and prevent you from falling behind or having to make budget cuts in other essential areas.

Some economists recommend that your rent shouldn’t surpass more than 25-35 per cent of your monthly after-tax income. While rental rates can vary from one city to another, you should try to stay within the 25-30 per cent range or lower if possible.

This will allow you to allocate the remaining 70-75 per cent of your income to pay for other important things, such as:

- Utility bills

- Transportation costs

- Car payments

- Groceries

- Subscriptions

- Insurance

- Investing

- Emergency savings

Calculate how much rent you can afford

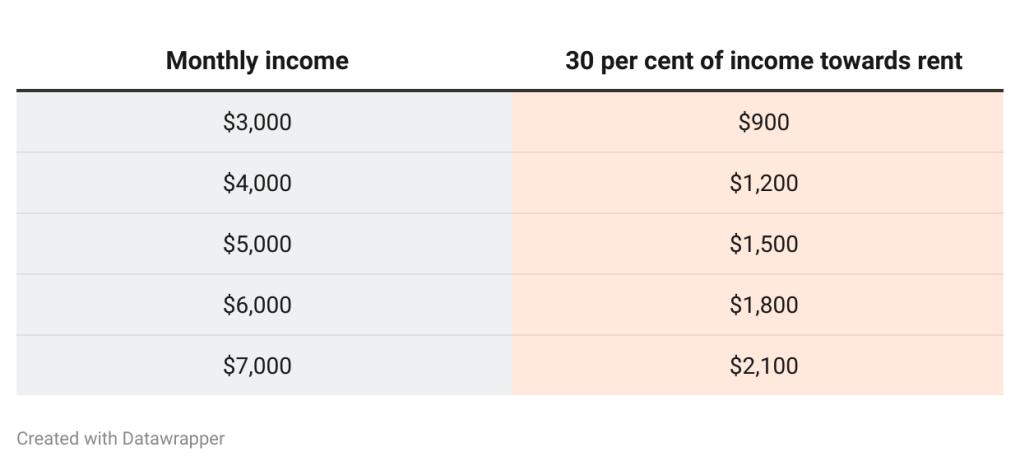

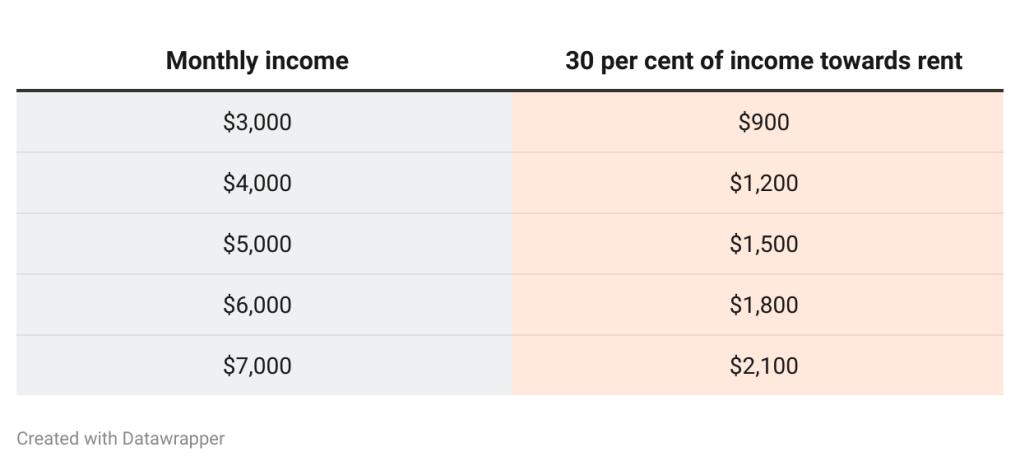

If you earn a set monthly salary, then it should be pretty simple to calculate how much rent you can afford. Here’s an example of how much rent the average Canadian can afford, based on their monthly income:

Currently, the average rental rate for a one-bedroom apartment in Canada is $1,714, while the average rent for a two-bedroom apartment is $2,095. Based on the “30 per cent rule”, the average Canadian must earn around between $5,000 and $6,000 monthly just to afford the average rent for a one-bedroom apartment.

For more accurate numbers, you can use the Canada Mortgage and Housing Corporation’s (CMHC) free rent affordability calculator.

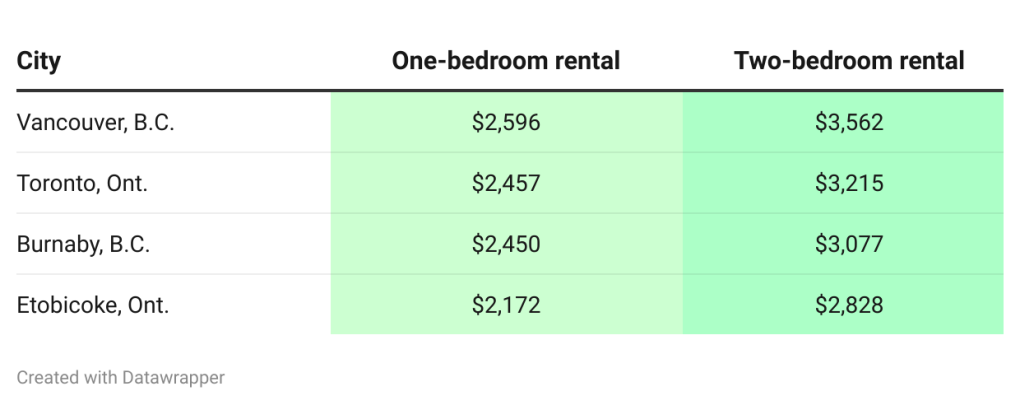

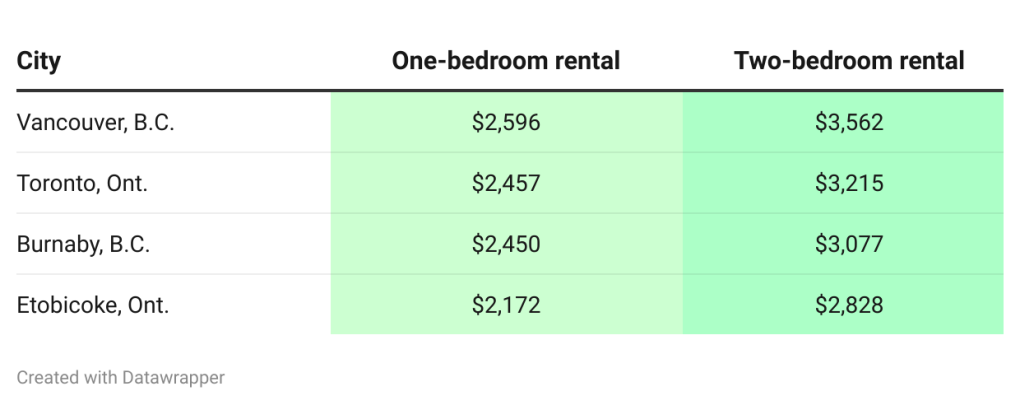

Here are the most expensive cities to live in, according to the 2023 national rent report outlined by Rentals.ca:

Although Toronto recently surpassed Vancouver as Canada’s most expensive city overall, rental rates in Vancouver remain slightly higher than Toronto.

Other factors to consider:

While the 30 per cent rule is a good rule of thumb, several other factors should also be considered. Here are some things that could affect your monthly rental budget.

One of the best ways to save money on rent is to live with a roommate or a partner who splits the bills and rent with you.

For example, two roommates renting a two-bedroom Vancouver apartment for $3,562 per month would only need to pay $1,781 each per month. Using the 30 per cent rule, each roommate would need to earn around $5,900 monthly, totalling a household income of $11,800 to afford a nice apartment together.

Roommates can also split utilities such as hydro, water, and internet bills, which can further reduce the cost of living.

Generally speaking, rent increases the closer you are to major city centres. However, financial opportunities also increase the closer an individual is to a major city.

From restaurant and hospitality jobs to corporate sales positions, major cities such as Vancouver and Toronto offer higher-paying job opportunities that often justify the higher cost of the rent.

On the other hand, remote workers can save substantially by living in the more affordable suburbs and smaller cities in Canada.

If you have children, then you’re likely going to need at least a two-bedroom rental. The only difference is that your children won’t be able to split the rent and bills with you. With this in mind, parents may opt to live outside of major cities in more affordable suburbs, where they can rent a two-bedroom unit for a lower rate.

- Accessibility to public transportation

One argument for living in a more expensive city centre is that there’s greater access to public transportation. Relying on public transportation can help you cut out the costs of financing or leasing a vehicle and paying for auto insurance, fuel, and repairs.

If you primarily rely on low-cost public transportation, you can budget more than 30 per cent of your income toward your rent. The extra money you’ll save by not paying for your own vehicle can be put toward your rental costs.

Preparing for high rental rates in 2023

Aside from the recent increase in inflation, the CMHC also reported that Canada is experiencing a housing shortage. When combined, these two factors are likely going to contribute to even higher rental rates throughout 2023.

For now, the best ways to prepare are to reduce your cost of rent by living with a roommate or moving outside of expensive city centres, staying on top of your personal budget, and finding creative ways of bringing in additional income with a side hustle.

Christopher Liew is a CFA Charterholder and former financial advisor. He writes personal finance tips for thousands of daily Canadian readers on his Wealth Awesome website.

Do you have a question, tip or story idea about personal finance? Please email us at dotcom@bellmedia.ca.