Ahead of Freeland's fiscal update, how are Canadians feeling about finances?

Finance Minister Chrystia Freeland will be releasing the federal fall economic update next week, promising an affordability-focused package, amid persisting inflation. Ahead of that revised look at Canada's books, a recent survey from Nanos Research suggests most Canadians aren't feeling positive about their finances.

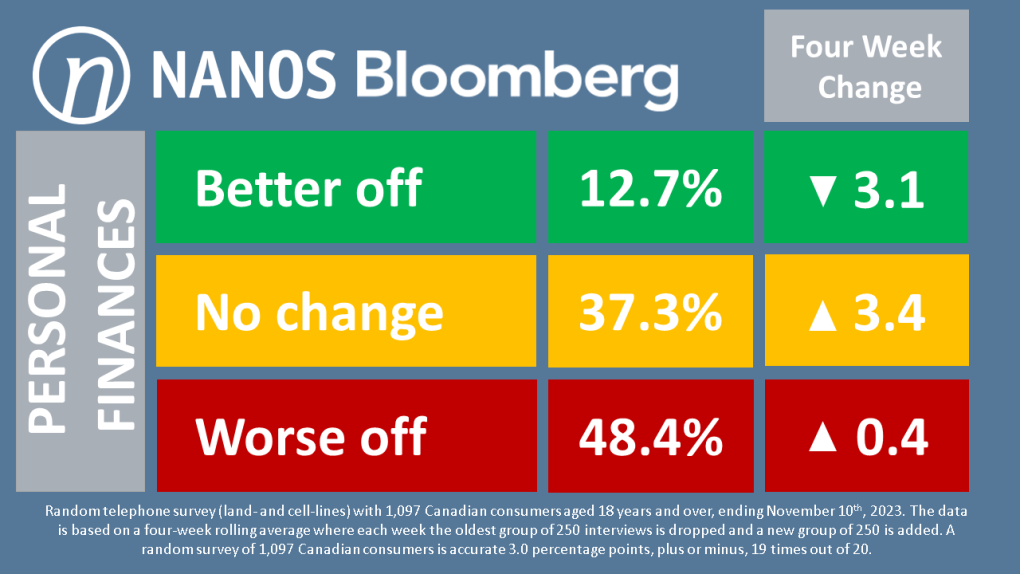

According to Nanos' weekly consumer confidence tracking for Bloomberg News, when it comes to Canadians' personal finances, 48.4 per cent of respondents said they feel worse off than they were last year.

Just 12.7 per cent of Canadians surveyed said they consider themselves better off now, while 37.3 per cent said they're feeling no change in their economic situations in the last year.

"That's almost four times as likely to say that they're worse, than better off," said Nanos Research founder Nik Nanos in the latest episode of CTV News' Trend Line.

The most notable aspect to these figures according to Nanos, is that the number of Canadians who said they feel better off, "has not been this tepid, weak, low" since the outset of the COVID-19 pandemic in 2020 when many weren't sure about whether they'd be able to keep paying the bills.

"So that's really not good news for the incumbent government, because people are saying, 'hey, you know what, I'm worse off now than I was a year ago,'" Nanos said.

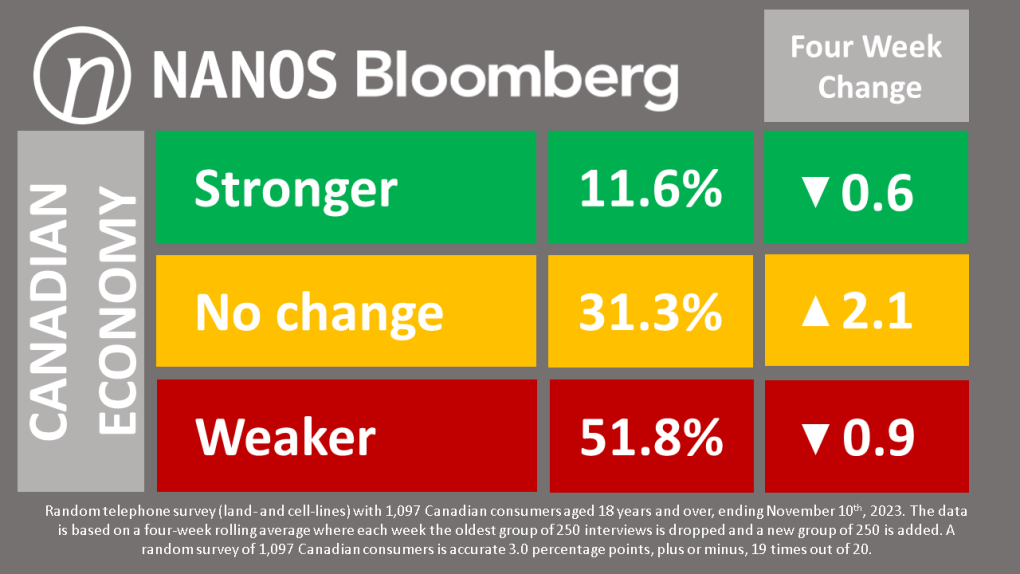

Similarly, the majority of respondents — 51.8 per cent – consider the Canadian economy to be weaker now, while just 11.6 per cent of those surveyed assessed this country's financial situation as stronger than this time last year.

Facing questions in recent days about what may or may not be included in the Nov. 21 fiscal snapshot, Freeland has declined to offer any hints or previews, but given the Liberals' recent focus on finding federal savings and a slowing economy, it is not expected to be a big-spending package.

"Our government absolutely recognizes the challenging macroeconomic environment," Freeland told reporters in Ottawa on Nov. 7. "Every single Canadian is facing real challenges when it comes to the cost of living. Every single Canadian is facing real challenges when it comes to housing."

"The macroeconomic environment with elevated interest rates and the impact they're having on growth is of course consequential for the federal government," Freeland said.

"What we are going to do in dealing with this challenging global macroeconomic environment is what we have always done, which is work really hard to find a balance between the necessary and essential investments in Canadians… and at the same time, to maintain the fiscal responsibility which is foundational for Canada."

Setting up his expectations for the fall economic update, NDP Leader Jagmeet Singh told reporters in Toronto on Wednesday that he wants the statement to focus on housing and food costs.

"We want to see investments to make housing more affordable, not just any old housing. We need homes that are affordable," Singh said. "We also need action to bring down the price of groceries."

For months, Conservative Leader Pierre Poilievre has been calling on Freeland to put an end to Liberal "inflationary spending," and present a plan to get the federal budget back to balance, something the last budget projected wouldn't be happening before 2028 at the earliest.

Speaking to what specifically he wants to see out of Tuesday's fiscal update, Poilievre told reporters on Friday he wants the Liberals to squash plans to increase the carbon tax, bring down interest rates and inflation by balancing the budget, and adopt his proposal to "build homes, not bureaucracy."

Watch the full episode of Trend Line in our video player at the top of this article. You can also listen in our audio player below, or wherever you get your podcasts. The next episode comes out Wednesday, Nov. 29.

Methodology: Random telephone survey (land- and cell-lines) with 1,097 Canadian consumers aged 18 years and over, ending Nov. 10, 2023. The data is based on a four-week rolling average where each week the oldest group of 250 interviews is dropped and a new group of 250 is added. A random survey of 1,097 Canadian consumers is accurate 3.0 percentage points, plus or minus, 19 times out of 20.

IN DEPTH

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

'One of the greatest': Former prime minister Brian Mulroney commemorated at state funeral

Prominent Canadians, political leaders, and family members remembered former prime minister and Progressive Conservative titan Brian Mulroney as an ambitious and compassionate nation-builder at his state funeral on Saturday.

'Democracy requires constant vigilance' Trudeau testifies at inquiry into foreign election interference in Canada

Prime Minister Justin Trudeau testified Wednesday before the national public inquiry into foreign interference in Canada's electoral processes, following a day of testimony from top cabinet ministers about allegations of meddling in the 2019 and 2021 federal elections. Recap all the prime minister had to say.

As Poilievre sides with Smith on trans restrictions, former Conservative candidate says he's 'playing with fire'

Siding with Alberta Premier Danielle Smith on her proposed restrictions on transgender youth, Conservative Leader Pierre Poilievre confirmed Wednesday that he is against trans and non-binary minors using puberty blockers.

Supports for passengers, farmers, artists: 7 bills from MPs and Senators to watch in 2024

When parliamentarians return to Ottawa in a few weeks to kick off the 2024 sitting, there are a few bills from MPs and senators that will be worth keeping an eye on, from a 'gutted' proposal to offer a carbon tax break to farmers, to an initiative aimed at improving Canada's DNA data bank.

Opinion

opinion Don Martin: Gusher of Liberal spending won't put out the fire in this dumpster

A Hail Mary rehash of the greatest hits from the Trudeau government’s three-week travelling pony-show, the 2024 federal budget takes aim at reversing the party’s popularity plunge in the under-40 set, writes political columnist Don Martin. But will it work before the next election?

opinion Don Martin: The doctor Trudeau dumped has a prescription for better health care

Political columnist Don Martin sat down with former federal health minister Jane Philpott, who's on a crusade to help fix Canada's broken health care system, and who declined to take any shots at the prime minister who dumped her from caucus.

opinion Don Martin: Trudeau's seeking shelter from the housing storm he helped create

While Justin Trudeau's recent housing announcements are generally drawing praise from experts, political columnist Don Martin argues there shouldn’t be any standing ovations for a prime minister who helped caused the problem in the first place.

opinion Don Martin: Poilievre has the field to himself as he races across the country to big crowds

It came to pass on Thursday evening that the confidentially predictable failure of the Official Opposition non-confidence motion went down with 204 Liberal, BQ and NDP nays to 116 Conservative yeas. But forcing Canada into a federal election campaign was never the point.

opinion Don Martin: How a beer break may have doomed the carbon tax hike

When the Liberal government chopped a planned beer excise tax hike to two per cent from 4.5 per cent and froze future increases until after the next election, says political columnist Don Martin, it almost guaranteed a similar carbon tax move in the offing.

CTVNews.ca Top Stories

'Some structural damage' from wildfire near Fort Nelson, B.C., mayor confirms

More than one home has been damaged or lost due to a massive wildfire outside of the B.C. community of Fort Nelson, the mayor confirmed Wednesday.

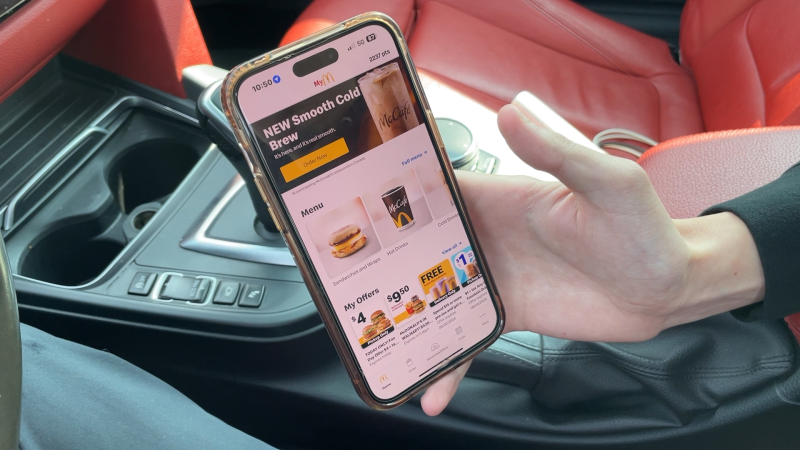

'Very expensive lunch': Sask. driver says he got a cellphone ticket for using his points app in the drive-thru

A warning from a Saskatoon driver about using your fast-food app while in the drive-thru line — a trip to get some free lunch cost him a lot more than he bargained for.

B.C. YouTuber ordered to pay $350K for 'relentless' online defamation campaign

An 'unrepentant' YouTuber has been ordered to pay $350,000 in damages as compensation for a 'relentless' campaign of defamation waged online against a business owner and his company, the B.C. Supreme Court has ruled.

Chief says grave search at B.C. residential school brings things 'full circle'

Chief Robert Michell says relief isn't the right word to describe his reaction as the search begins for unmarked graves at the site of a former residential school he attended in northern British Columbia.

'Endless Shrimp' just one misstep for Red Lobster as it eyes bankruptcy protection

While it's unclear what these closures might mean for the 27 restaurants in Canada, Red Lobster is expected to file for bankruptcy protection in the U.S. this month.

B.C. man shot sex worker in the back during drug-fuelled birthday, court hears

A man from B.C.'s Lower Mainland has been sentenced to four years behind bars after shooting a sex worker in the back during a drug-fuelled 43rd birthday.

'Inhumane conditions': 68 dogs pulled from Winnipeg home

Nearly six dozen dogs were seized from a home Wednesday morning by the Winnipeg Humane Society. It is the largest known seizure of animals in the city’s history.

Ontario's 'Crypto King' Aiden Pleterski arrested

Of the $40-million Aiden Pleterski was handed over two years, documents show he invested just over one per cent and instead spent $15.9 million on "his personal lifestyle." The 25-year-old Oshawa, Ont. man was arrested and charged with fraud and money laundering on Tuesday.

Driver said he smoked pot oil, took medication before Florida crash that killed 8 Mexican workers

A man with a long record of dangerous driving told investigators he smoked marijuana oil and took prescription drugs hours before he sideswiped a bus, killing eight Mexican farmworkers and injuring dozens more, according to an arrest report unsealed Wednesday.

Local Spotlight

B.C. musician's song catches attention of Canucks

When Adam Kirschner wrote 'Slap Shot,' he never imagined the song would be embraced by his favourite team.

'We're on standby': Team ready to help entangled right whale in Gulf of St. Lawrence

A team is ready to help an entangled North Atlantic right whale in the Gulf of St. Lawrence.

Thieves caught on camera stealing pet chicken from North Vancouver backyard

A $200 reward is being offered by a North Vancouver family for the safe return of their beloved chicken, Snowflake.

Adopted daughter in the Netherlands reunited with sister in Montreal and mother in Colombia, 40 years later

Two daughters and a mother were reunited online 40 years later thanks to a DNA kit and a Zoom connection despite living on three separate continents and speaking different languages.

'Reimagining Mother's Day': Toronto woman creates Motherless Day event after losing mom

Mother's Day can be a difficult occasion for those who have lost or are estranged from their mom.

Chris Hadfield inspires youth musical in Sudbury

YES Theatre Young Company opened its acclaimed kids’ show, One Small Step, at Sudbury Theatre Centre on Saturday.

Ottawa pizzeria places among top 20 deep-dish pizzas in the world at international competition

An Ottawa pizzeria is being recognized as one of the top 20 deep-dish pizzas in the world.

From outer space? Sask. farmers baffled after discovering strange wreckage in field

A family of fifth generation farmers from Ituna, Sask. are trying to find answers after discovering several strange objects lying on their land.

Wilfrid Laurier football player drafted despite only playing 27 games in his entire life

A Listowel, Ont. man, drafted by the Hamilton Tigercats last week, is also getting looks from the NFL, despite only playing 27 games of football in his life.