A Calgary couple is warning other Canadians after losing nearly $20,000 to a fraudster who electronically transferred money out of their bank account.

Carmen and Dave Jordan say they were shocked to discover somebody could access their account and steal money via e-Transfers.

"(We were) the victims of some kind of fraud that I didn't even know was possible," Carmen told CTV Calgary.

The pair discovered the fraud while checking their bank statements, and say they have no idea how their account number and password was compromised.

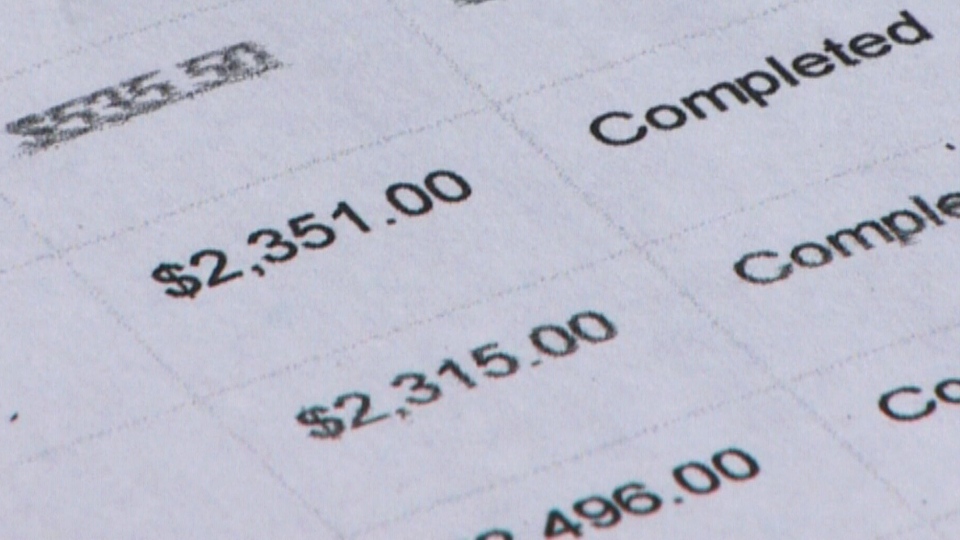

Armed with that information, the fraudster was able to log into the Jordans' online banking, email $19,000 out, and then transfer that money to a new bank account under a false name.

The couple say their bank, First Calgary Financial, didn't seem surprised when they first got on touch about the loss.

Instead, Carmen told CTV Calgary, her husband was told to leave the branch and that someone would call them back. "I just thought they'd be more shocked."

The bank reimbursed the couple the full amount, but says it isn't at fault for the security breach.

"It actually has nothing to do with our banking system. The person's information has gotten into the wrong hands," the bank's communications director Alison Archambault said.

How to protect yourself

Experts say thieves can use a number of techniques to compromise online bank account security.

Some use threats or rewards to convince people to give out private information over the phone. Others use a fake website to gather that information, a technique called "phishing." Often, victims are lured to fraudulent websites through emails that appear to be legitimate.

To prevent phishing, the RCMP says Canadians should be suspicious of any email or text message that urgently requests personal information. They also say to never send out personal or financial information via e-mail, and to avoid clicking on links in emails that claim to be secure.

Thieves also use a third technique to steal banking information without the account holder's knowledge. Fraudsters can install viruses and malware directly onto devices and track the users' keystrokes to crack passwords.

Cell phones and tablets are the most popular targets of this kind of fraud, a Calgary computer expert said.

"We have full computers that just happen to also work as a phone," said Daniel Ginter, a computer expert from Calgary's Tech Squad Inc. "So we need to defend them as if we were treating an actual computer."

To arm against viruses, Ginter recommended installing anti-virus software on phones and tablets, just as you would on a full computer.

He said the advice applies to both Apple and Microsoft powered devices, though viruses and malware target Apple products less frequently.