TORONTO -- Barrick Gold Corp. (TSX:ABX) said Tuesday it is working to strengthen its governance practices and is looking to add new independent directors to its board.

The gold miner, which has been under pressure from shareholders to make changes, said it is also looking at making improvements to its executive compensation practices.

"Progress on these initiatives is expected by the end of the year," Barrick spokesman Andy Lloyd said.

Barrick currently has seven independent directors on its 13-member board.

The comments came amid a report by the Wall Street Journal that an unidentified group of shareholders in Europe is preparing to send a letter to the company to push for changes.

Barrick has faced pressure since before its annual meeting earlier this year when shareholders voted against a largely symbolic an executive pay resolution.

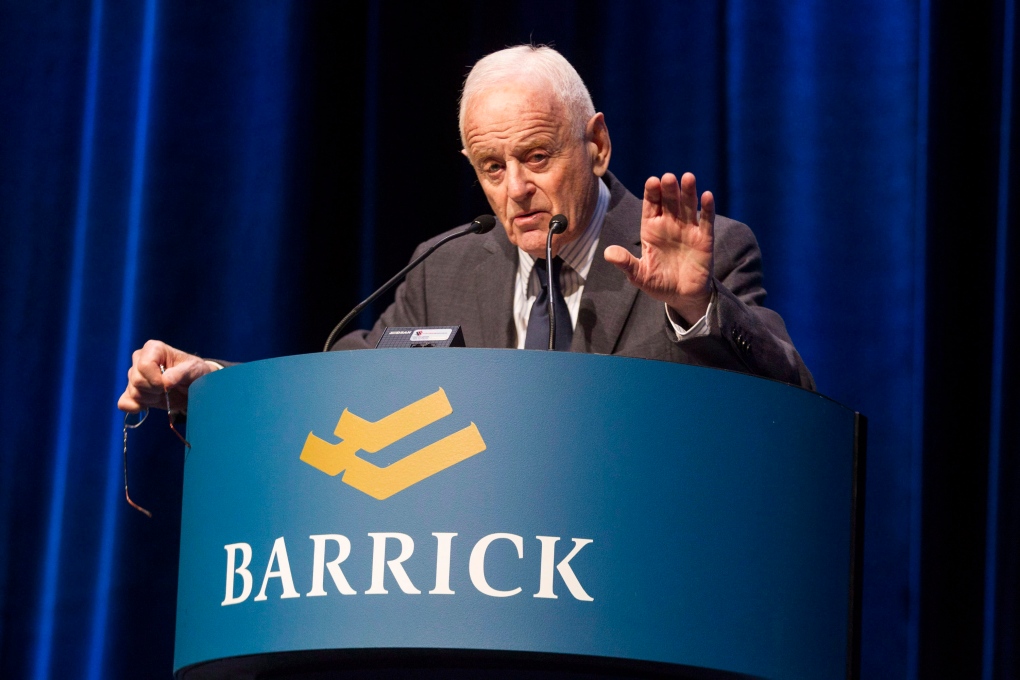

The company was criticized for a $11.9-million signing bonus paid to co-chairman John Thornton that was part of a $17-million payment package he received last year.

A group of eight institutional investors including the Caisse de depot et placement du Quebec, the Canada Pension Plan Investment Board, the Ontario Teachers' Pension Plan, the Ontario Municipal Employees Retirement System, Alberta Investment Management Corp., the B.C. Investment Management Corp. and international firm Hermes Equity Ownership Services. objected to the signing bonus.

"Since our last annual general meeting, independent directors of the board have been meeting with shareholders to hear their perspectives and gather feedback on governance matters, including executive compensation," Lloyd said Tuesday.

Earlier this month, U.S. hedge fund Two Fish Management repeated its call for changes at Barrick including the break up of the company and the addition of a mining engineer and geologist to its board.

Since Two Fish first wrote to Barrick demanding changes in April, the gold miner has agreed to sell off its Barrick Energy subsidiary in a series of deals worth a total of $455 million and three high-cost mines in Western Australia to South Africa-based miner Gold Fields Ltd. for $300 million.

But Two Fish wants more and to that end, the fund has produced a 78-page presentation detailing the changes it thinks are needed.

Barrick has recently struggled with problems at its Pascua-Lama project in South America and a falling price for gold.

The company's shares are down about 45 per cent so far this year and it slashed its quarterly dividend to a nickel per share from 20 cents.

Barrick, one of the world's largest gold producers, has been taking steps to decrease operating costs by lowering capital spending and staffing levels.

It has said it will trim $1.5 billion to $1.8 billion from its costs over 2013 and 2014 by cutting capital spending, including laying off staff.