TORONTO -- Barrick Gold Corp. (TSX:ABX) says it has agreed to sell off three mines in Western Australia known as the Yilgarn South assets to South Africa-based miner Gold Fields Ltd.

Barrick says it will receive $300 million from the sale, which is subject to customary closing conditions, including approval by Australia's Foreign Investment Review Board.

The company says the three mines that comprise the Yilgarn South assets produced a total of 452,000 ounces of gold in 2012 and a further 196,000 ounces in the first half of this year.

The transaction is expected to close on Oct. 1, 2013. Proceeds will be used for general corporate purposes, including debt repayment, and will be recorded in the fourth quarter of 2013.

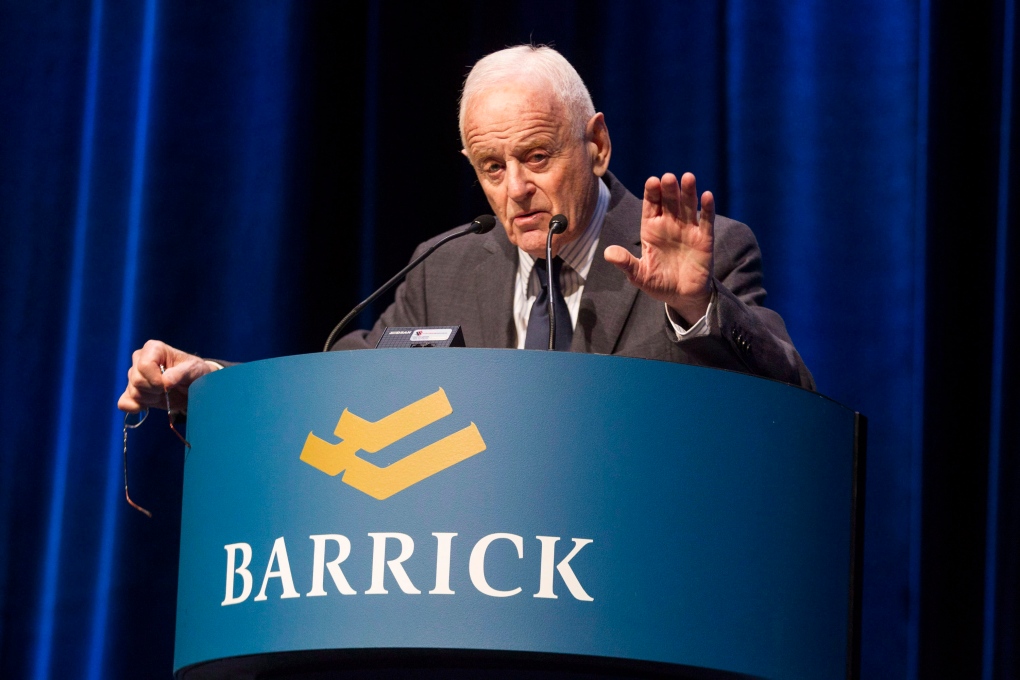

"The agreement to divest Yilgarn South demonstrates further progress as we work to optimize the company's portfolio and maximize free cash flow," said Barrick president and CEO Jamie Sokalsky.

"I'd like to extend my gratitude and appreciation to our Yilgarn South employees, who have made a significant contribution to Barrick over many years."

Barrick, one of the world's largest gold producers, has been taking steps to decrease operating costs by lowering capital spending and staffing levels. It has said it will trim $1.5 billion to $1.8 billion from its costs over 2013 and 2014 by cutting capital spending, including laying off staff, at its project in Argentina.

Excluding unusual items, Barrick had adjusted earnings of US$663 million or 66 cents in the quarter ended June 30 -- 10 cents better than analysts had been expecting but down from 82 cents per share last year.

Barrick shares have plummeted over the past year, falling to $14.22 from a peak of $42.08 in trading on the Toronto Stock Exchange. They closed Wednesday at $19.96.