TORONTO -- The Toronto stock market was slightly higher Thursday, reflecting rising commodities prices along with strong economic data and record performance on U.S. markets.

The S&P/TSX composite index edged up 5.35 points to 12,837.31 while the TSX Venture Exchange was ahead 5.66 points to 1,115.4.

The Canadian dollar rose 0.11 of a cent to 97.06 cents US as Statistics Canada said the trade deficit with the world narrowed to $237 million in January from $332 million in December.

Exports rose 2.1 per cent to $39.1 billion while imports decreased 1.9 per cent to $39.3 billion.

Meanwhile, the U.S. trade deficit widened in January, reflecting a big jump in oil imports and a drop in exports.

The U.S. Commerce Department says the deficit rose to US$44.4 billion, an increase of 16.5 per cent from December. U.S. exports dropped 1.2 per cent to $184.5 billion while imports rose 1.8 per cent to $228.9 billion as oil imports surged 12.3 per cent.

In New York, the Dow Jones industrials moved further into record territory for a third straight day. The index rose 51.8 points to 14,348.04.

The Nasdaq composite index added 6.2 points to 3,228.57 while the S&P 500 index gained 2.98 points to 1,544.44.

Stocks have advanced this week after traders were reassured that China's leadership will do what it takes to deliver economic growth of 7.5 per cent this year, and data showing better than expected expansion in the U.S. service sector and rising house prices.

Traders also looked to Friday's release of the U.S. non-farm payrolls report. Expectations for job creation were ratcheted up after payroll firm ADP said Wednesday that the private sector created 198,000 jobs last month.

Optimism rose further Thursday after the Labour Department said that the number of Americans seeking unemployment aid fell by 7,000 last week, driving the four-week average to the lowest point in five years.

Canadian job creation figures also come out Friday. Economists looked for the economy to have created around 7,500 jobs during February.

There was some negative news from the American retailing sector. The International Council of Shopping Centers says retailers are reporting modest sales gains for February. Overall, 15 retailers reported on Thursday that revenue at stores open at least a year -- a key indicator of retail health -- rose an average of 1.7 per cent, a sharp slowdown from the 4.5 per cent pace in January when shoppers splurged on holiday clearances.

The base metals sector led TSX advancers, up one per cent while May copper rose two cents to US$3.52 a pound. First Quantum Minerals (TSX:FM) advanced 21 cents to C$18.90.

The energy sector also climbed one per cent with the April crude contract on the New York Mercantile Exchange up 88 cents to US$91.31 a barrel. Suncor Energy (TSX:SU) improved by 46 cents to C$31.74.

Shares in Canadian Natural Resources (TSX:CNQ) were ahead 61 cents to $31.77 as the Calgary-based oil and gas producer posted 33 cents per share of adjusted earnings in the fourth quarter, six cents below estimates of 39 cents per share.

Net income was $352.8 million or 32 cents per diluted share, down from $832 million or 76 cents per share in the fourth quarter of 2011.

Canadian Natural's revenue was higher than expected at $3.7 billion but half a billion lower than in the fourth quarter of 2011.

It is, however, raising its quarterly dividend for the 13th year in a row.

The consumer staples sector also provided lift with convenience store chain Alimentation Couche Tard (TSX:ATD.B) ahead 73 cents to $55.07.

The gold sector lost early momentum to turn down 0.4 per cent while April bullion was up $1.10 to US$1,576 an ounce. Goldcorp Inc. (TSX:G) faded 31 cents to C$34.13.

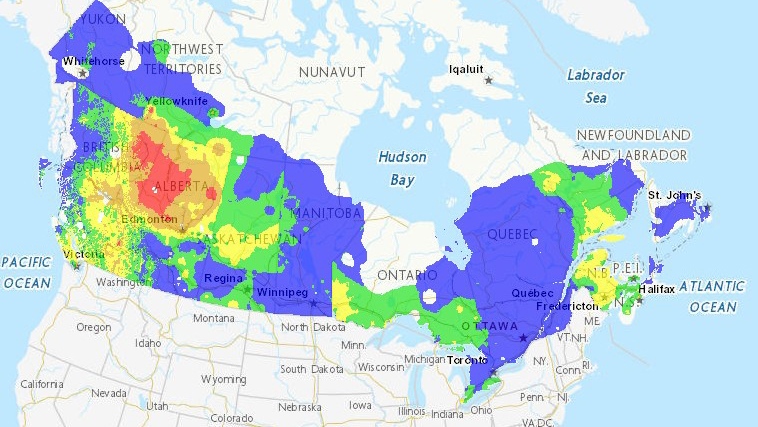

The telecom sector led decliners, down 1.06 per cent as the federal government announced that its long-awaited wireless spectrum auction for the telecom industry will begin on Nov. 19. The auction aims to have at least four wireless-service providers in every region of the country, in an effort to increase competition and push down consumer prices. Telus Corp. (TSX:T) shed $1.49 to $69.91.

Meanwhile, Facebook Inc. is getting ready to unveil a new version of News Feed, the flow of status updates, photos and advertisements its users see on the site. The world's biggest social networking company is hosting an event at its Menlo Park, Calif., headquarters on Thursday to show off a "new look for News Feed." The company offered no other details.

London's FTSE 100 index rose 0.3 per cent after the Bank of England opted against injecting more money into the ailing British economy, which has one foot in recession. The bank also kept its main interest rate at the record low of 0.5 per cent.

Other European bourses were higher as the European Central Bank left its benchmark interest rate unchanged at a record low of 0.75 per cent, holding off on further stimulus even though the euro area remains stuck in recession.

Frankfurt's DAX gained 0.16 per cent while the Paris CAC 40 was ahead 0.57 per cent.