TORONTO -

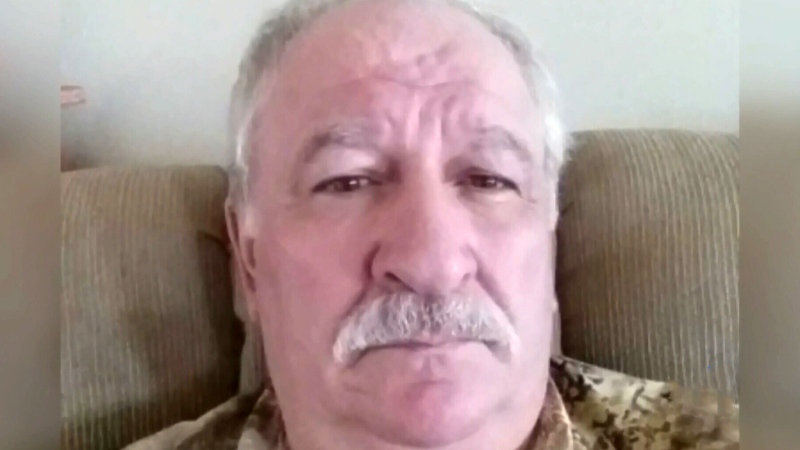

The price of gas appears to be on a trajectory to approach $2 per litre in some parts of Canada within the next 13 months, according to Canadians for Affordable Energy president Dan McTeague.

A combination of rising oil prices, the state of the Canadian dollar, provincial taxes and the federal government's Clean Fuel Standard (CFS), which comes into effect Dec. 1, 2022, could result in gas stations advertising prices higher than a toonie, he said.

He points to a statement from BlackRock, the world's largest asset management company, which said this week at a conference in Saudi Arabia there's a "high probability" of oil reaching $100 a barrel. Oil is currently hovering at around $84 per barrel.

"I think $100 a barrel is not unthinkable, and it's quite likely to be through 2022," McTeague told CTVNews.ca on Thursday. "So that would add to the average price [of gas] in Canada, which is about $1.47, that would add probably 18 cents a litre.

"So now you're in the $1.65 range. You have the federal carbon tax of 2.21 cents, plus HST, so 2.3-2.4 cents," he continued. "Then you have on top of that the Clean Fuel Standard. So now you're up to about $1.82, $1.83 a litre. Just to get to $100 a barrel."

British Columbia and Newfoundland and Labrador, which record some of the highest gas prices in the country, according to McTeague, could see staggering numbers.

"You can see a scenario playing out where we get awfully close to $2 a litre in those regions with average prices in Canada probably, at minimum, $1.75 a litre," he said.

The CFS is a program designed to get suppliers of liquid fuels, such as gasoline and diesel, to gradually cut the amount of carbon in their product in an attempt to reduce greenhouse gas emissions. If reduction targets cannot be met, credits can be purchased from other companies producing cleaner fuel or suppliers can pay into a compliance fund.

British Columbia, which already has its own Low Carbon Fuel Standard in place, is trading credits for about $475. If the CFS uses that as a standard, McTeague estimates every province outside of B.C. will see an immediate increase of 16 cents per litre on Dec. 1, 2022.

Although he's confident this is the direction gas prices will be going in Canada, McTeague left the door open to unforeseen circumstances.

"We might see a fifth wave of COVID-19," he said. "We might see a gigantic economic recession, which many people feel might happen as a result of supply chain problems and more demand and more growth and higher interest rates."

All things that could bring the global economy to a standstill and drop the price of oil, he said.

With files from Reuters