TORONTO -- The investor sometimes called Canada's Warren Buffett says he remains bullish on global economic growth led by the United States, despite the turmoil in President Donald Trump's White House.

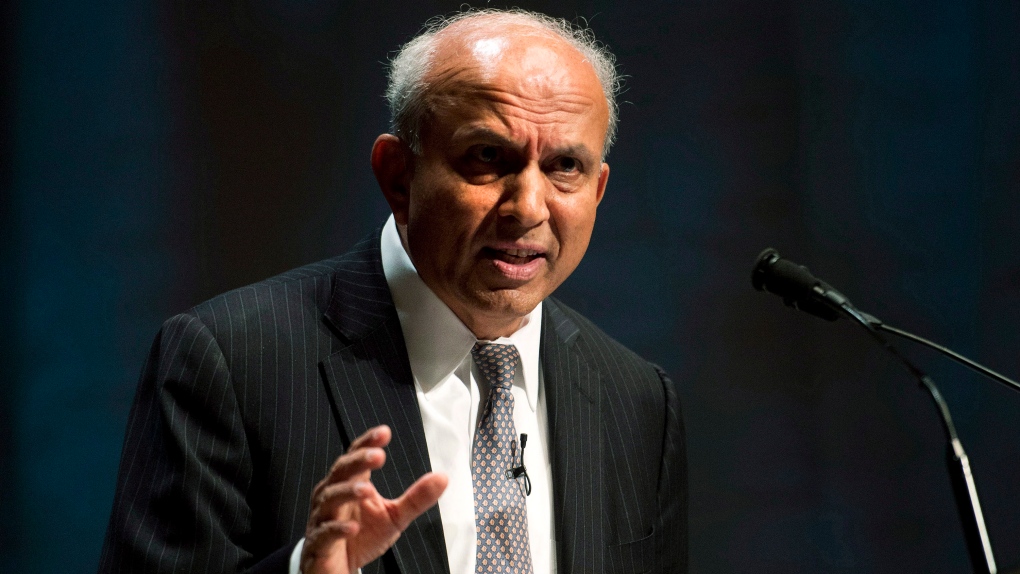

"We still haven't changed our minds that the United States is going to have significant growth and we'll all prosper from it," said Prem Watsa, founder and CEO of Fairfax Financial Holdings Ltd. (TSX:FFH).

Watsa, who made comments during a speech to the Canadian Club of Toronto, said Trump's plans to cut corporate taxes, roll back regulations and boost infrastructure spending could bolster growth.

"(If) they're able to do that, I think we could be in for a long period of growth."

When the United States does well, Watsa said, so does the rest of the world, including Canada.

"But it'll be up and down. It won't be in a straight line," he said.

On Wednesday, the Toronto Stock Exchange's main index posted its biggest one-day loss of the year, while New York markets also plunged as the drama surrounding former FBI Director James Comey's firing continued and investors worried the fallout may hinder Trump's ability to realize his business-friendly policies.

Watsa told reporters after his speech that Fairfax has hedged its bet, making it well protected on the downside. But, he said the company always looks at the downside and it did not indicate a change in approach.

The investor, who still carries a BlackBerry-made smartphone, the Priv, also said Fairfax remains a large shareholder in the company.

BlackBerry (TSX:BB) will do well now because of CEO John Chen, Watsa said. Chen has shifted the company's focus from hardware to software.

On Tuesday, BlackBerry's shares jumped 5.25 per cent, closing at $13.84, and hit a new 52-week high of about $14.15 in intra-day trading on the Toronto Stock Exchange.

The jump came after Macquarie Research analyst Gus Papageorgiou said in a note that the company's shares could rise to US$45 by 2020 and US$11.80 within 12 months. His 12-month Canadian-dollar target is $16.20.

Watsa did not say whether he agreed with the possibility of a US$45 BlackBerry share within three years.