OTTAWA -- Interim Conservative leader Rona Ambrose says she's worried young Canadians will move south of the border to escape what she says are rising taxes for professionals.

"A lot of young people aspire to go into these careers because they are good-earning careers. And your taxes are going up if you run your own professional corporation, you're a small business owner," Ambrose said in an interview on CTV's Your Morning Thursday.

"Anyone who considers themselves a small business owner, they are sending [the CRA] after you."

The federal government announced in Wednesday's budget that certain professions would no longer be able to use billed-basis accounting, which lets them claim income when they bill for it rather than while the work is in progress at the end of the year. The change applies to accountants, dentists, lawyers, physicians, veterinarians and chiropractors, and will be phased in starting next year.

Ambrose says she fears young people in those professions will pick up and move to the U.S., comparing it to the so-called brain drain of the 1990s.

"They're going to look to the south and they're going to think, 'Wow, I have a student loan to pay off, cost of living is high in Canada. Look at Mr. Trump, he's offering me all these income tax breaks, he's also offering huge business tax breaks.' Why wouldn't young people go to the States?" she said.

"I am worried about it because no, this budget did not protect us from what's going to happen south of the border," she added, referring to Trump's promised tax cuts.

Ambrose says she's worried about the projected $28.5 billion deficit and the lack of plan to balance the books. The last year projected in the 2017 budget is 2021-22, with a deficit of $18.8 billion.

"It's three times what he promised and the spending isn't even on things that he promised to spend on, so there's a lot of things in this budget that we're concerned about," she said.

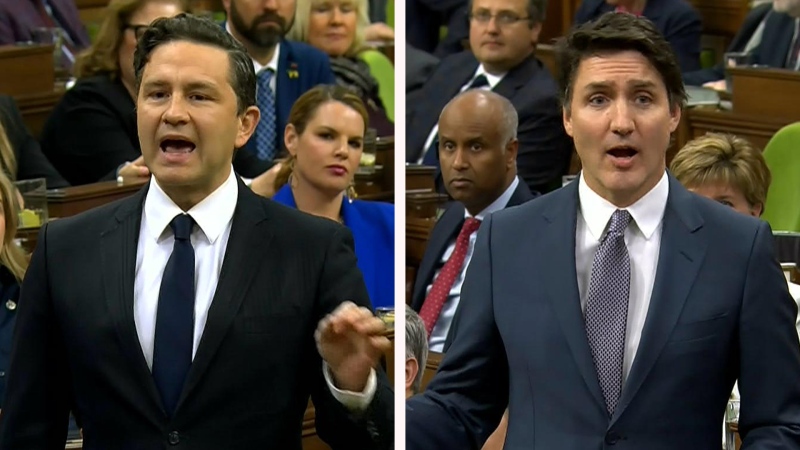

MPs started debating the budget Thursday morning in the House of Commons.