BlackBerry’s shares fell 16 per cent Friday after the troubled company announced it would be forced to cut 4,500 jobs -- and was expected to post a second-quarter loss of at least US$950 million.

It’s the latest blow to a Canadian company that created one of the leading communication devices of the past decade, considered so addictive by some that it was nicknamed the “CrackBerry.”

But after being pushed out of the market by Apple’s iPhone and Google’s Android devices, BlackBerry has now struggled to sell enough phones.

The Z10 and Q10 phones, launched this past January, were praised by many critics but failed to find a strong foothold in the marketplace.

- Can BlackBerry bounce back? Take the poll below and have your say in our comments.

BlackBerry expects to report sales of just 3.7 million phones over the second quarter next Friday, according to a market report by Gartner.

That’s a far cry from Samsung’s 71.3 million smartphone sales over the same period, and Apple’s 31.9 million sales.

BlackBerry devices accounted for about 3 per cent of the market.

“The smartphone market is a winner-takes-all market,” Manish Kacker, a professor of marketing at McMaster University’s DeGroote School of Business, told CTV News.

The company said slashing 4,500 jobs will help cut its operating costs in half by June 1, 2014.

BNN reporter Greg Bonnell told Power Play it's only the latest round of job cuts for the company.

“This is on the heels of 5,000 cuts last year, and 2,000 the year before,” he said. “So they are seriously whittling down their work force.”

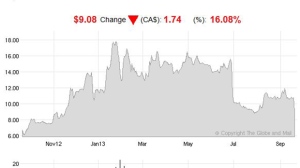

The company’s shares dropped $1.74 to finish at $9.08 on Friday. At the company’s height, it was worth $230 a share.

Analysts say BlackBerry is now streamlining operations to make it attractive to a strategic partner -- although some expect its most valuable assets will be sold off.

“The question is will it happen today, at today’s prices, roughly $9 a share, or will somebody wait until this company falls even further,” said Allan Small, senior investment advisor at DWM Securities Inc.

With a report from CTV’s Peter Akman and files from The Canadian Press