A new scam targeting recipients of the carbon tax rebate has Canada’s tax agency on alert.

Fake text message and email campaigns trying to get money and information out of unsuspecting Canadian taxpayers have started circulating, just months after the federal government rebranded the carbon tax rebate the Canada Carbon Rebate.

"The Canada Carbon Rebate (CCR) is a tax-free amount to help eligible individuals and families offset the cost of the federal pollution pricing. To receive your CCR payment see…“ one circulating text message campaign says.

It’s unclear when the phishing campaign started, but the Canadian Anti-Fraud Centre says it has received at least 18 reports of phishing text messages and emails claiming to offer the Canada Carbon Rebate in recent weeks.

Numbers could be higher

It estimates the number of people affected is likely much higher given that only 5 to 10 per cent of victims report to the anti-fraud centre.

“It’s not surprising at all,” said Jeff Horncastle, the acting client and communications outreach officer for the Canadian Anti-Fraud Centre. “Fraudsters always try to capitalize on any new benefits announced whether it’s by the provincial government or the federal government, whatever the case may be.”

So far this year the anti-fraud centre says it has received 10,735 reports of fraud. It estimates $123 million has been lost to fraud as of March 31, 2024.

“A lot of these messages are getting more sophisticated and legitimate looking,’ Horncastle warned. “They want to use your personal information to apply for credit cards, apply for bank accounts, cell phones, whatever they can. If you are not sure … reach out to the agency directly.”

Increase in phishing scams

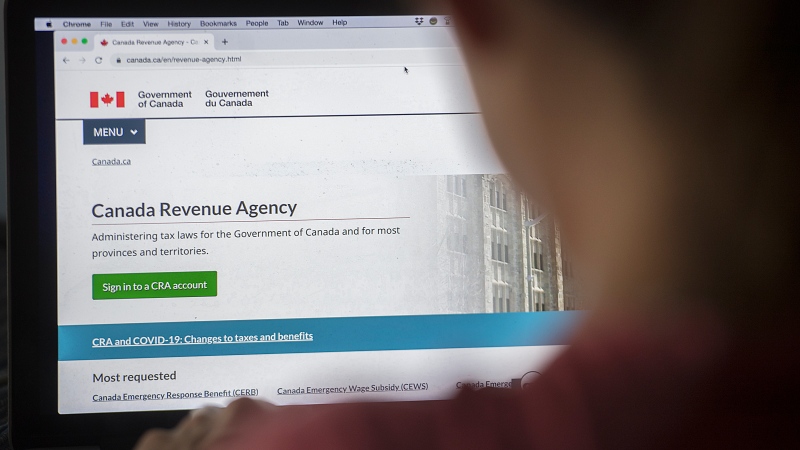

The Canada Revenue Agency says it is seeing an increase in phishing scams and has been made aware of this recent campaign, posting a warning this week on its website. The agency warns some text messages include images taken from Government of Canada social media accounts to make their scam messages look more legitimate.

“Be even more vigilant because they are smart and they are getting smarter,” said CRA spokesperson Charles Drouin. “They are finding ways to get your trust.”

The tax agency says it will not use text messages or instant messages to start a conversation about your taxes or benefits. It also says the agency will never send or ask taxpayers to click on a link to get anything. If you are concerned a call, email or text message may be a scam, Drouin advises Canadians to call the CRA at 1-800-959-8281.

“We are aware of that and has taken action” Drouin said. “Once we are aware there is a scam going on we put the information on our website, as soon as possible to let people know what is most popular right now.”

In February, the federal government renamed the Climate Action Incentive Payment as the Canada Carbon Rebate in an effort to clarify the payment's function and relationship to the carbon pricing system. Ottawa admitted the old name was too difficult to understand and was not easily connected to the carbon tax rebate.

"If we can speak the language that people speak because people say the words 'carbon,' they say the words, 'rebate,' right? And if we can speak that language that's important, so people understand what's going on here," Labour Minister Seamus O'Regan said at the time.

Ottawa's carbon tax system includes a corresponding rebate system that offers payments of anywhere from a low of $760 a year to a family of four in New Brunswick to a high of $1,800 for the same-sized family in Alberta. Taxpayers in the provinces where the federal backstop does not apply are not entitled to the payment.

Anyone who filed their taxes electronically by March 15 should have already received a payment. The CRA says those who filed after that date can expect the payment to be deposited in their account, or mailed out by cheque, 6-8 weeks after the tax return was assessed.

The Canada Revenue Agency says rebates are only given to Canadians through direct deposit or a cheque issued every three months. Drouin advises Canadians to sign up for direct deposit and subscribe to the online services, My Account.

The CRA recently launched an escape room campaign to make Canadians more aware of some of the most common phishing campaigns. That initiative will be in the Greater Toronto Area next week.

With files from CTV News’ Rachel Aiello