TORONTO -- The Toronto stock market pushed higher Tuesday with gains across several key sectors, including energy and financials.

The S&P/TSX composite index closed up 124.05 points at 15,081.26.

Driving the market was the energy sector, which gained 1.2 per cent, as the May crude oil contract inched up six cents to settle at US$47.51 on the New York Mercantile Exchange.

Stronger banking stocks helped drive the financial sector ahead 0.5 per cent, while the less influential consumer staples sector was the biggest gainer by far, surging 2.7 per cent.

The Canadian dollar was down 0.02 of a cent to 79.99 cents US.

In the U.S., the Labor Department said higher costs at the gas pump and broad gains in other categories pushed the consumer price index up 0.2 per cent in February -- the first increase of overall consumer prices in four months.

The Dow Jones industrial average was down 104.90 points at 18,011.14, while the Nasdaq index slid 16.24 points at 4,994.73. The S&P 500 index fell 12.92 points to 2,091.50.

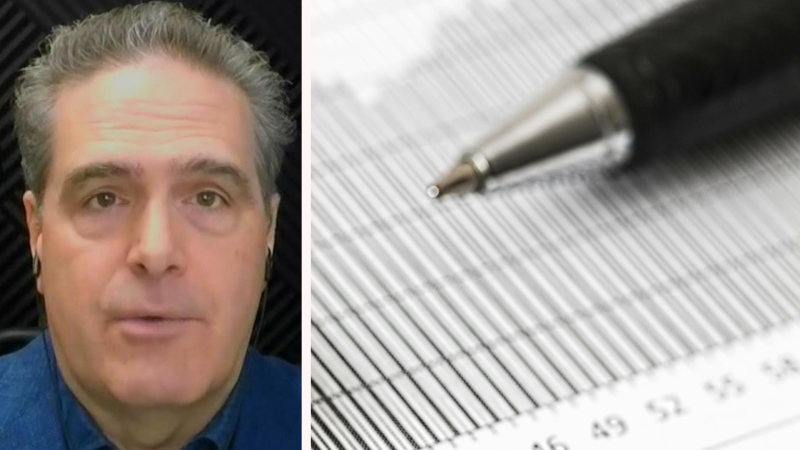

Sid Mokhtari, a market technician at CIBC World Markets, said trader confidence in the U.S. appears to be moving away from international large cap companies and into mid- and small-cap public companies.

"There's a certain shift in the character of the market, and that's something we haven't seen since last year," he said in an interview.

A weekly analysis at CIBC of stock market leaders has shown a shift into smaller cap companies, which suggests the strength of the U.S. dollar has been adding pressure to multinational corporations, Mokhtari said.

"Because the TSX is somewhat smaller cap relative to the U.S., and other global indices, that could have positive implications for the TSX index," he added.

Attention has also focused on the fading strength in the Chinese economy. HSBC's preliminary measurement on the country's manufacturing sector fell to an 11-month low in March on fewer new orders.

China's economy faced its slowest growth rate in nearly a quarter century last year, and its widely expected by economists that a slowdown will continue into next year.