Indian envoy warns of 'big red line,' days after charges laid in Nijjar case

India's envoy to Canada insists relations between the two countries are positive overall, despite what he describes as 'a lot of noise.'

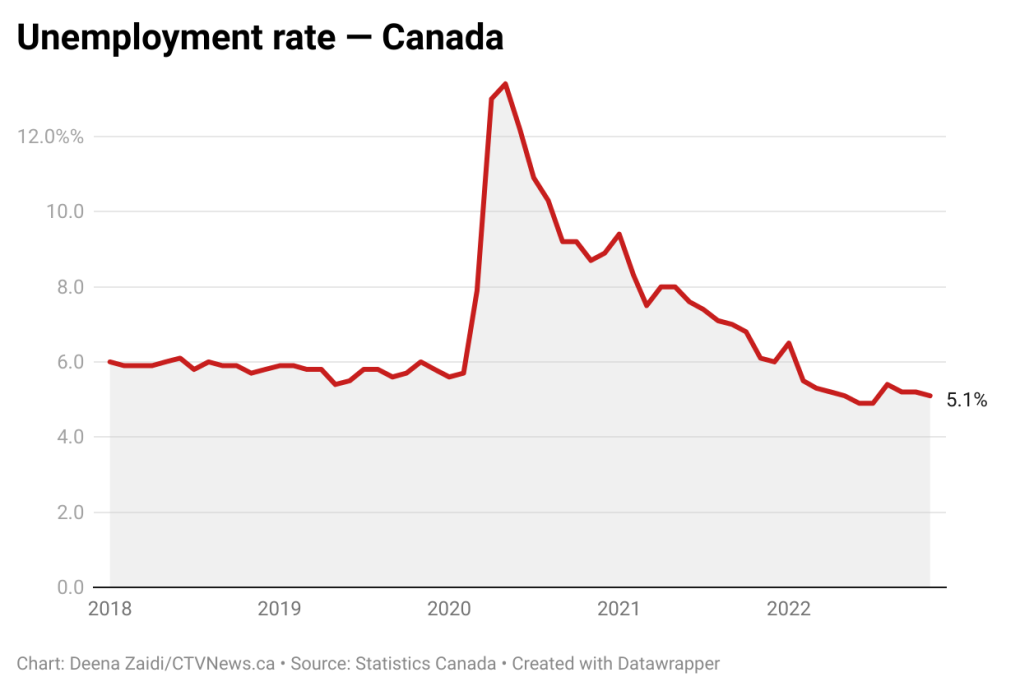

The unemployment rate in Canada declined slightly to 5.1 per cent in November, according to new data released by Statistics Canada Friday.

The agency says the unemployment rate decreased for the second time in three months, edging it closer to its record low of 4.9 per cent seen in June and July.

“Wage growth is showing no signs of slowing down,” says Mahmoud Khairy, Canadian Chamber of Commerce economist. “This will surely raise flags for the Bank of Canada as it looks to reel inflation in with aggressive hikes.”

Since March, the Bank of Canada has raised its policy rate six times to 3.75 per cent, to tackle inflation.The bank is widely expected to hike its rate again on Dec. 7.

Canada added just 10,000 new jobs in November, compared to the 108,000 jobs added in October.

“Economic growth is still widely expected to slow in the fourth quarter and into the first half of next year,” says Khairy.” As the cumulative impact of rising interest rates and the slowing global economy take a toll.”

Industries such as finance, real estate, insurance and manufacturing saw gains in employment. In contrast, jobs in construction fell by 25,000 and retail trade and wholesale saw a loss of 23,000 jobs.

The number of workers working full time increased by 51,000 this month and has grown by 460,000 year-over-year. Part-time employment remained the same in November, but is down by 91,000 jobs compared to last year.

Employment among women aged 25 to 54 reached 81.6 per cent, its highest level since Statistics Canada began collecting data in 1976.

From The Canadian Press:

Here are the jobless rates last month by province (numbers from the previous month in brackets):

Statistics Canada also released seasonally adjusted, three-month moving average unemployment rates for major cities. It cautions, however, that the figures may fluctuate widely because they are based on small statistical samples. Here are the jobless rates last month by city (numbers from the previous month in brackets):

India's envoy to Canada insists relations between the two countries are positive overall, despite what he describes as 'a lot of noise.'

With Donald Trump sitting just feet away, Stormy Daniels testified Tuesday at the former president's hush money trial about a sexual encounter the porn actor says they had in 2006 that resulted in her being paid to keep silent during the presidential race 10 years later.

The U.S. paused a shipment of bombs to Israel last week over concerns that Israel was approaching a decision on launching a full-scale assault on the southern Gaza city of Rafah against the wishes of the U.S.

Footage from dozens of security cameras in the area of Drake’s Bridle Path mansion could be the key to identifying the suspect responsible for shooting and seriously injuring a security guard outside the rapper’s sprawling home early Tuesday morning, a former Toronto homicide detective says.

A chicken farmer near Mattawa made an 'eggstraordinary' find Friday morning when she discovered one of her hens laid an egg close to three times the size of an average large chicken egg.

Susan Buckner, best known for playing peppy Rydell High School cheerleader Patty Simcox in the 1978 classic movie musical 'Grease,' has died. She was 72.

Accused killer Jeremy Skibicki could have a challenging time convincing a judge that he is not criminally responsible for the deaths of four Indigenous women, a legal analyst says.

A Calgary bylaw requiring businesses to charge a minimum bag fee and only provide single-use items when requested has officially been tossed.

Two Nova Scotia men are dead after a boat they were travelling in sank in the Annapolis River in Granville Centre, N.S., on Monday.

An Ontario man says he paid more than $7,700 for a luxury villa he found on a popular travel website -- but the listing was fake.

Whether passionate about Poirot or hungry for Holmes, Winnipeg mystery obsessives have had a local haunt for over 30 years in which to search out their latest page-turners.

Eighty-two-year-old Susan Neufeldt and 90-year-old Ulrich Richter are no spring chickens, but their love blossomed over the weekend with their wedding at Pine View Manor just outside of Rosthern.

Alberta Ballet's double-bill production of 'Der Wolf' and 'The Rite of Spring' marks not only its final show of the season, but the last production for twin sisters Alexandra and Jennifer Gibson.

A mother goose and her goslings caused a bit of a traffic jam on a busy stretch of the Trans-Canada Highway near Vancouver Saturday.

A British Columbia mayor has been censured by city council – stripping him of his travel and lobbying budgets and removing him from city committees – for allegedly distributing a book that questions the history of Indigenous residential schools in Canada.

Three men in Quebec from the same family have fathered more than 600 children.

A group of SaskPower workers recently received special recognition at the legislature – for their efforts in repairing one of Saskatchewan's largest power plants after it was knocked offline for months following a serious flood last summer.

A police officer on Montreal's South Shore anonymously donated a kidney that wound up drastically changing the life of a schoolteacher living on dialysis.