MONTREAL -- Shares of Amaya Gaming Group soared more than 40 per cent after announcing a deal to buy the company that owns PokerStars and Full Tilt Poker for US$4.9 billion.

On the Toronto Stock Exchange, the shares (TSX:AYA) gained $5.96, or 42.3 per cent, to $20.04 in Friday morning trading.

Amaya says the transaction will create the world's largest publicly traded online gaming company as a result of its acquisition of the Oldford Group, parent company of the Rational Group Ltd., which owns and operates PokerStars and Full Tilt Poker.

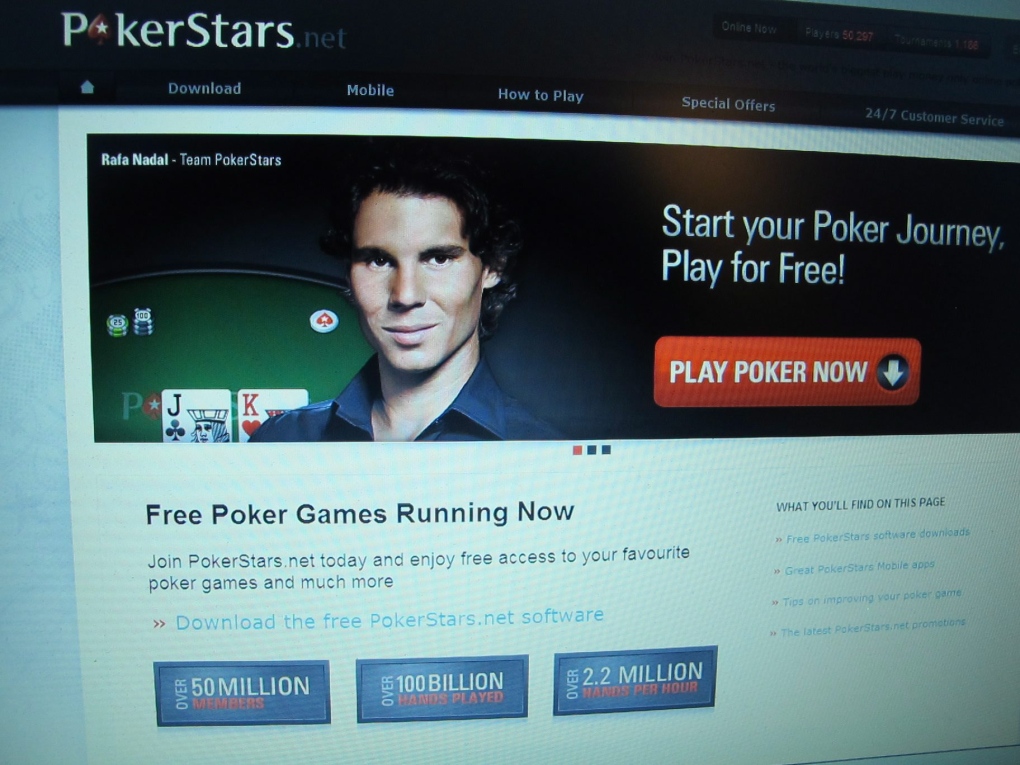

Online poker platforms PokerStars and Full Tilt Poker are globally popular brands with more than 85 million registered players on desktop and mobile devices.

"This is a transformative acquisition for Amaya, strengthening our core B2B operations with a consumer online powerhouse that creates a scalable global platform for growth" David Baazov, founder, chairman and CEO of Amaya said in a news release.

Amaya Gaming said the deal will add to its earnings and give it strong cash flow from the operations.

It said the transaction will pave the way for the entry of Rational's two online poker platforms into regulated markets, particularly the United States.

Amaya offers gaming products and services including casino, poker, sportsbook, platform, lotteries and slot machines. Amaya says some of the world's largest gaming operators and casinos are powered by its services.

It plans to provide its games to expand the Full Tilt Poker casino platform and support Rational's new gaming initiatives such as casino, sportsbook and social gaming.

The Rational Group, based in the low-tax Isle of Man off the coast of Britain, is also a producer of live poker events and poker programming for television and online audiences. It employs more than 1,700 people globally.

Rational Group Founder and CEO Mark Scheinberg said he's confident Amaya will continue to build the company he built over 14 years.

"The values and integrity which have shaped this company are deeply ingrained in its DNA. David Baazov has a strong vision for the future of the Rational Group, which will lead the company to new heights," Scheinberg said.

The boards of both companies have unanimously approved the agreement, expected to close around Sept. 30.

Baazov and several other Amaya shareholders that control about 28 per cent of the company's common shares have entered into agreements supporting the transaction, which has a break fee of at least US$50 million.

Amaya's annual meeting has been delayed until July 30, when shareholders will vote on the creation of a new class of convertible preferred shares that are part of the transaction.