The federal government has introduced a new income-splitting benefit for couples with children under the age of 18 as part of a series of proposed new tax measures designed to appeal to young families.

The proposal consists of three new measures the government says will provide about $4.6 billion in tax relief for some four million Canadian families.

The new measures include:

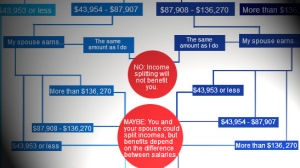

- The Family Tax Cut, which will allow a higher earning spouse to transfer up to $50,000 of taxable income to a spouse in a lower income bracket. The measure will provide eligible families with a maximum of $2,000 a year in tax relief.

- An increase to the Universal Child Care Benefit for children under the age of 6 from $100 to $160. A well, a new benefit of $60 per month is being created for children aged six to 17. While the enhanced child care benefit will come into effect on Jan. 1, 2015, payments will begin in July of that year, meaning the first payment will be a lump sum from the first six months of the year.

- The maximum amount that can be claimed under the Child Care Expense Deduction will be increased by $1,000.

Prime Minister Stephen Harper announced the new measures Thursday afternoon at a community centre in Vaughan, Ont., just north of Toronto.

“Under the plan we have announced today, every single Canadian family with children will benefit, everyone will have more money in their pockets,” Harper told the robust crowd.

On average, families with children under the age of 18 will receive $1,140 in tax relief and benefits per year, he said.

Income-splitting opposition

The government says the Family Tax Cut will benefit 1.7 million families.

However, prior to Harper’s announcement, the opposition ripped into the income-splitting plan, saying it will cost the federal and provincial governments billions of dollars and would only benefit 14 per cent of Canadian families.

The government estimates that the Family Tax Cut will cost the federal government about $2.4 billion in 2014-15 and $1.9 billion in 2015-16. The measure has been designed to have no impact on provincial revenues.

The Liberals and the NDP also pointed out that former finance minister Jim Flaherty appeared to back-track on support for the policy not long before he died. Income splitting was a key plank in the Conservatives’ election platform in the 2011 campaign.

“A tax plan that does nothing for nine out of 10 Canadian families,” NDP Leader Thomas Mulcair said during Thursday’s question period. “As Jim Flaherty asked, how does that benefit our society?”

Minister of State for Finance Kevin Sorenson replied that Canadian seniors have saved thousands of dollars due to pension income splitting, and that benefit should be extended to more Canadians.

“Income splitting is good policy for Canadians, it’s good policy for Canadian seniors, it will be good policy for Canadian families,” Sorenson said.

Liberal finance critic Scott Brison said income splitting does nothing for 1.5 million single parents who are struggling financially.

Sorenson responded by accusing the Liberals of wanting to repeal the Conservatives’ tax breaks.

Liberal Leader Justin Trudeau has previously said he would repeal income-splitting for families if he becomes prime minister, saying the money could be used for education and infrastructure projects.

Trudeau told reporters late Thursday afternoon his party will focus on helping the middle class “and Canadians hoping to join it.”

“Income splitting is an idea that will give a $2,000 tax break to families like mine or Mr. Harper’s,” Trudeau said while stumping with his byelection candidate in the Ontario riding of Whitby-Oshawa.

“That’s not good enough.”

After Harper’s announcement, NDP finance critic Nathan Cullen said that at first glance, “this appears to be an incredibly expensive and unfair proposal put forward by the government.”

The proposed changes “skew disproportionately to wealthier families,” Cullen told reporters. The party will look at the details, he said, but ultimately the NDP wants to stop the plan.

“We have grave concerns about its equity.”

Many economists have said that income splitting mainly benefits higher-income families and stay-at-home parents who have high-earning spouses.

“If you have higher-income people, maybe with one child at a high marginal tax rate, they will get considerably more benefit than two spouses (who are) both working with four younger children,” said Fred O’Riordan, a national tax services advisor at Ernst & Young.

Child care benefit

The boost to the Universal Child Care Benefit will mean families will receive up to $1,920 per year for each child under the age of 6, and up to $720 for each child between the ages of 6 and 17.

The government estimates that the measure will cost about $1.1 billion in 2014-15 and $4.4 billion in 2015-16.

The enhanced benefit will replace the Child Tax Credit, a move that will boost government revenue by about $400 million in 2014-15 and by $1.8 billion in 2015-16.

The enhanced benefit will help four million families, the Finance Department said in a release, “including families with income too low to be taxable and who could not have previously benefitted.”

Child care deduction

The dollar limits that parents can claim under the Child Care Expense Deduction will be increased by $1,000. That means, the maximum limits will now be:

- $7,000 per child under age 7;

- $4,000 per child aged 7 to 16;

- $10,000 for children eligible for the Disability Tax Credit, no matter what age.

These changes also come into effect for the 2015 tax year. The change will cost federal coffers about $15 million in 2014-15 and $65 million in 2015-16. More than 200,000 will benefit from the increases, the government said.