Canadian home sales were down sharply in August, according to new numbers released by the Canadian Real Estate Association on Monday.

The CREA said home sales across the country dropped a startling 5.8 per cent from July to August -- the largest month-to-month drop in over two years, likely the result of tougher mortgage regulations imposed by Ottawa.

The CREA bases its numbers on transactions processed through the Multiple Listings Service.

“Declines were reported in about two-thirds of all local markets representing 80 per cent of national activity, with monthly sales declines in almost all large urban centres, including Greater Toronto, Greater Montreal, Greater Vancouver, the Fraser Valley, Calgary, Edmonton, and Ottawa,” stated the CREA in its report.

When compared to sales from August 2011, the numbers mark a decline in home sales of 8.9 per cent – the largest year-over-year drop since April 2011.

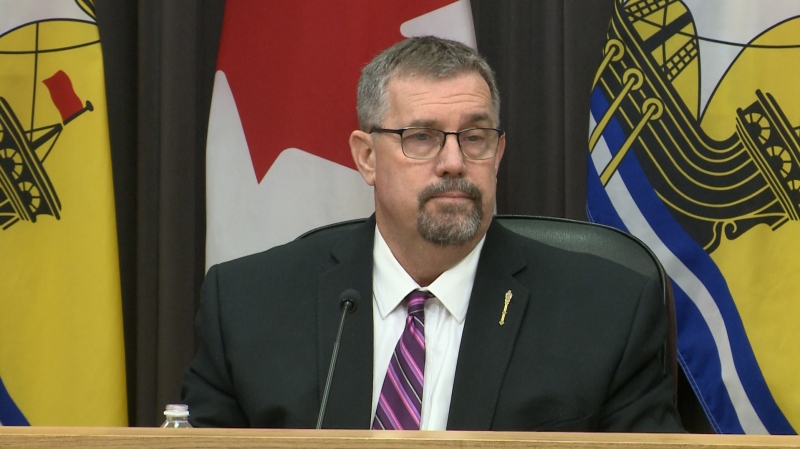

CREA President Wayne Moen cautioned that national housing market trends often run contrary to trends in local markets, especially in smaller, more affordable markets where sales could actually be on the rise.

Gregory Klump, the CREA’s chief economist, said the declining sales are likely the result of measures recently brought in by the federal government aimed at cooling the market – such as lowering the maximum amortization period.

“August’s sales figures will no doubt provide comfort to policymakers, providing the first clear indication that the recent changes to mortgage regulations aimed at cooling the market are working as intended,” Klump said in a release.

Because the government introduced the new regulations with a relatively short timeline for implementation, there was little time for buyers to jump into the market before the new rules took effect.

“As a result, demand didn’t pick up just before the changes took effect, while sales declined once they did,” Klump said.

The result of the tougher restrictions, he said, is that fewer first-time home buyers now qualify for a mortgage, causing a ripple effect that is being felt throughout the rest of the market.

The CREA said 334,208 homes have been sold over MLS this year, an increase of 2.8 per cent in the same period last year.

The national average home price in August was $350,192, a slight increase of three-tenths of one per cent from the same month last year.

Following are some additional key details from the CREA report:

- The year-over-year price increase for one-storey single family homes held steady at 5.6 per cent in August.

- The year-over-year price increase for two-storey homes fell slightly to 5.2 per cent.

- Townhouses and apartments experienced price increases of 1.7 per cent and 1.8 per cent respectively compared to last year.

- The national average home price was up 0.3 per cent compared to August last year.

- On a national level, the housing market is balanced in terms of the number of homes being listed, versus those being purchased.