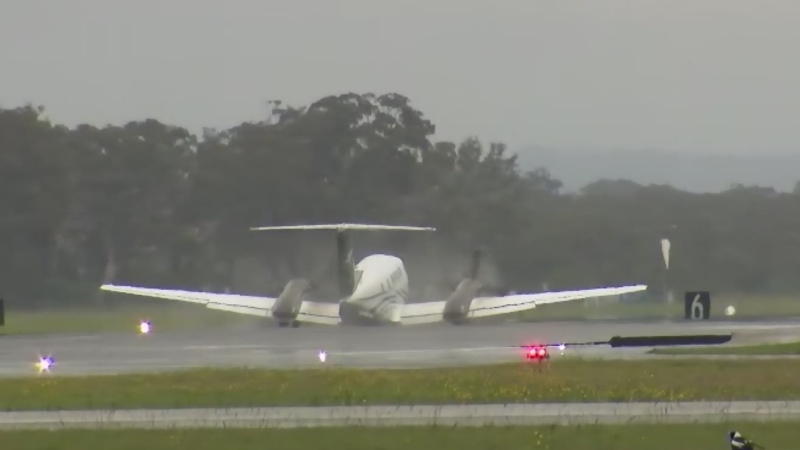

MIRABEL, Que. -- Canadian plane and train maker Bombardier Inc. (TSX:BBD.B) says there is a global market worth US$820 billion over the next 20 years for 12,550 commercial planes the size it produces.

The 100- to 150-seat segment, which includes its C Series passenger jets, will lead the way with 6,800 deliveries valued at US$580 billion at 2017 list prices.

Bombardier said it expects to capture about half the global market with its controversial C Series.

The Montreal-based company said Tuesday in a market update that regional aircraft between 60 and 100 seats are forecast to have 5,750 deliveries valued at US$240 billion.

The company's C Series jets have been at the centre of an ongoing trade battle with United States-based Boeing, which has accused Bombardier of selling the jets to U.S.-based Delta Airlines at an unfairly low price with help from government subsidies in Canada.

On Tuesday, Canada's ambassador to the U.S. David MacNaughton said Boeing walked away from talks with Canadian officials aimed at resolving the trade dispute with the Montreal-based company. It was the first revelation that the Trudeau government spoke directly with Boeing about the dispute, which has become a flashpoint for the Liberals.

On Monday, media reports revealed that British Prime Minister Theresa May, who will visit Canada next week, defended Bombardier during a recent call with U.S. President Donald Trump.

In its market update, Bombardier said it believes its C Series planes will dominate routes up to 926 kilometres, while single-aisle planes up to 150 seats will allow airlines to add new direct routes where larger planes aren't economic.

"The outlook for our markets is strong," said Fred Cromer, president of Bombardier Commercial Aircraft.

Bombardier says it is well-positioned because it is the world's only aircraft manufacturer to make commercial planes for all segment sizes of this market.

After looking to increase the size of aircraft in recent years, it says airlines will look at taking smaller planes as they focus on buying the right-sized plane to deliver sustainable profits and improve the passenger experience.

Cromer added that airlines are shifting their focus from cost to profit as they make aircraft purchase decisions.

"With this thinking in the forefront, more airlines are investing in right-sized aircraft that maximize their profits."

The company says North America and Europe will continue to be the world's largest aircraft markets, with 46 per cent of deliveries.