Consumers could end up paying the price as a Bank of Canada rate cut, persistently low oil prices and market uncertainty have combined to drive the loonie to its lowest point in 11 years.

The Bank of Canada cut its key interest rate by a quarter of a percentage point on July 15, lowering the rate to 0.5 per cent and sending the Canadian dollar spiralling.

One week later, the loonie fell to its lowest point in 11 years, bottoming out at 76.70 cents U.S.

On top of that, low oil prices have already impacted the dollar this year, resulting in rising costs for consumers in a number of areas.

Here are five things Canadians could end up paying more for in the coming months:

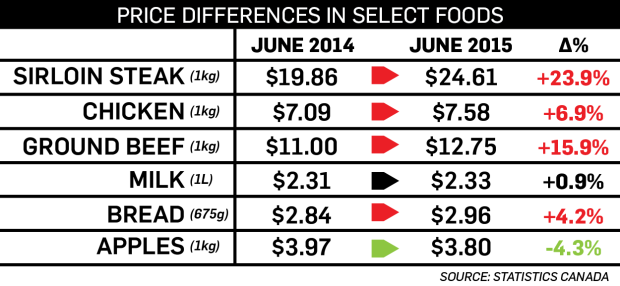

1. Groceries

Perhaps the most dramatic jump is taking place in grocery store aisles.

According to Statistics Canada, the cost of food rose 3.4 per cent between June 2014 and 2015.

In May, the head of Canada's largest grocery company warned customers that rising costs are unlikely to stabilize.

At the time of the announcement, Loblaw Companies president Galen Weston Jr. said the company was already experimenting with higher prices for fresh, preserved and frozen foods, and monitoring customer response to the changes.

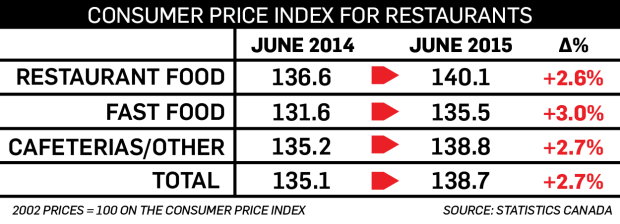

2. Dining out

As Canadians feel the pinch of stocking their pantries at home, restaurants are also facing higher food costs.

The latest figures from Restaurants Canada suggest that 65 per cent of restaurants are paying more for food in 2015 than they did last year. To deal with this, 54 per cent of eateries say they plan to raise prices in the next half a year.

Robert Walker, chair of Manitoba's Restaurant and Food Services Association, said the high cost of meat is one of the biggest reasons for the hike in prices.

Walker told CTV Winnipeg that to keep up with skyrocketing costs, he plans to raise prices for some dishes by 10 per cent at his Original Pancake House restaurants in Winnipeg.

3. Travel to the U.S.

The low loonie means the dollar won't stretch as far as it used to outside Canada's borders.

The low dollar is making for unfavourable exchange rates for Canadian travellers.

This is bad news for cross-border bargain hunters and for frequent flyers as some airlines, including Air Canada, Air Transat and Sunwing Travel, have added fuel charges to make up for the costs.

4. Technology

Earlier this year, Apple announced that it would adjust prices to make up for the difference between the Canadian and American currencies.

For years, the cheapest apps in the Apple Store were priced at 99 cents each, but the company increased that by 20 cents, to $1.19, and raised prices on other apps by 15 per cent.

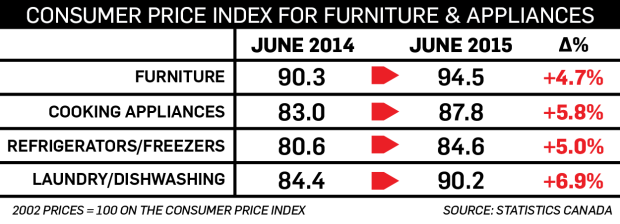

5. Appliances and furniture

According to the Bank of Canada, appliances and furniture prices are also rising at a rapid rate.

"The prices of many goods are currently growing at a much faster pace in Canada than in the United States, particularly for durable goods such as furniture and appliances," the bank said in a report released Wednesday.