We have become an economy of part-time positions.

Over the last 12 months, approximately 190,000 part-time positions were added, while the economy saw full-time positions up by 86,000.

This lack of confidence in hiring shouldn’t come as a surprise, as our economy has been hit by a two-year slump in oil prices and our non-energy exports simply haven’t picked up the slack.

Yet, many Canadians want full-time jobs. With full-time jobs you have income and that helps boost confidence, both of which have been lacking.

Wage growth has only grown a measly 1.2 per cent in the past 12 months, standing at an 18-year low. This could easily be seen as recessionary numbers.

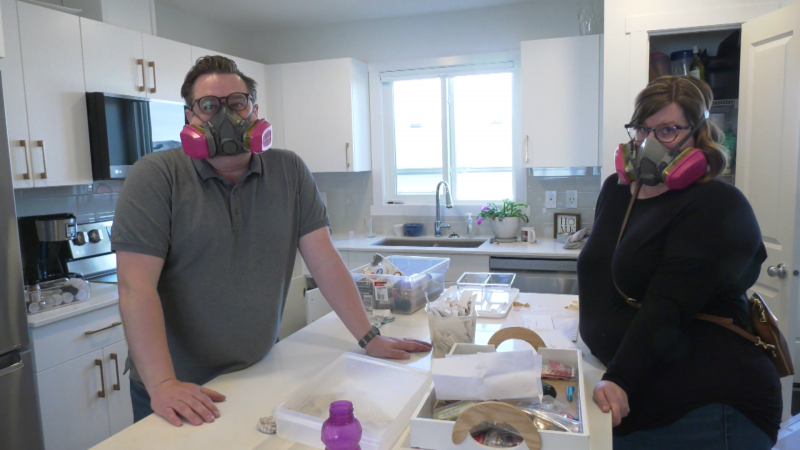

To be fair, the real-world dynamics of living on part-time work isn’t always told in the statistics. Some take part-time work because they can't find full-time jobs; others, because they're going to school; others yet, because they fell into the part-time life and liked it better.

The most recent Statistics Canada report on the country's unemployment rate gives a glimmer of hope, if you buy into the stats as 105,000 full-time positions were added while 90,000 part-time jobs lost.

It’s encouraging to think there are jobs to be found, so if you are in the camp of being a part-timer wanting full-time work, here are a few tips to bridge the financial gap.

Working part-time

- Manage your finances according to the part-time salary. Some continue to live as though they were still working full-time when they aren’t. Recognize you may not qualify for benefits, so try to plan for health care. Consider your finances the same way you would if you were self-employed or working as a freelancer.

- No question the budget will get tighter and now is the time to prioritize the most important expenses you have. As many have witnessed, drastic measures may be needed to get by, such as: moving back home, taking in a roommate and shutting down all discretionary spending.

- Be prepared to do what others may not – look for multiple streams of income. Evaluate your skill sets and look for ways to monetize them. For example, I love personal finance and in the past have explored writing books, presentations, articles for magazines, etc. You get the point. It’s time to get creative. You might even consider working the shifts that no one wants.

- Build a personal business plan with a realistic time frame and special goals. Map out concrete steps of what you will do each week to try to find a full-time job. It is hard work looking for a full-time job and it can be draining. Network, explore alternate career paths, reach out to people and use social media in a constructive way.

There are jobs to be found. It just takes time.

Tax tips you need to know

Before you even start to prepare your 2016 tax return, now is the time to review your 2015 tax return and notice of assessment for any important information.

When it comes to taxes, there are typically three primary objectives for most of us. Look for ways to: deduct income; divide income; and defer income to the greatest extent possible to lower your taxes paid.

Strategies to make this happen include carrying forward balances that you can claim as a deduction (unused RRSP contributions or unused losses from prior years) or as a credit (unused donations, tuition and/or education credits, or student loan interest) on your 2016 tax return.

In speaking with Aurele Courcelles, assistant vice president, tax and estate planning with Investors Group, he highlights tax changes that could affect the filing of your 2016 tax return:

- Both the children’s arts and fitness tax credits have been reduced for 2016 (no more than $250 and $500 of qualifying expenses respectively) and will be eliminated for 2017.

- The family tax cut has been eliminated for 2016 and later years.

- Beginning in 2016, eligible educators (teachers and early childhood educators) can claim a 15 per cent federal refundable tax credit on up to $1,000 of purchases or eligible teaching supplies.

- Beginning in 2016, the disposition of a principal residence must be reported on your income tax return, even if the full gain is exempt from taxation thanks to the principal residence exemption. You need to complete a new section of Schedule 3 on your personal income tax return to report the disposition.

We all have to pay taxes but no one wants to pay more than their fair share.