TORONTO -- Ontario is releasing more details of its proposed provincial pension plan, saying it can't wait years for a national consensus on improving the Canada Pension Plan.

The Ontario Retirement Pension Plan will offer a maximum $12,816 a year for about four million workers in the province who don't have a workplace pension, and would come on top of the maximum CPP benefit of $13,110 a year.

The provincial plan will cover up to $90,000 in pensionable earnings, compared with $54,900 for the CPP, and unlike the CPP will offer lump sum payments to spouses if a member dies before retirement or a survivor pension.

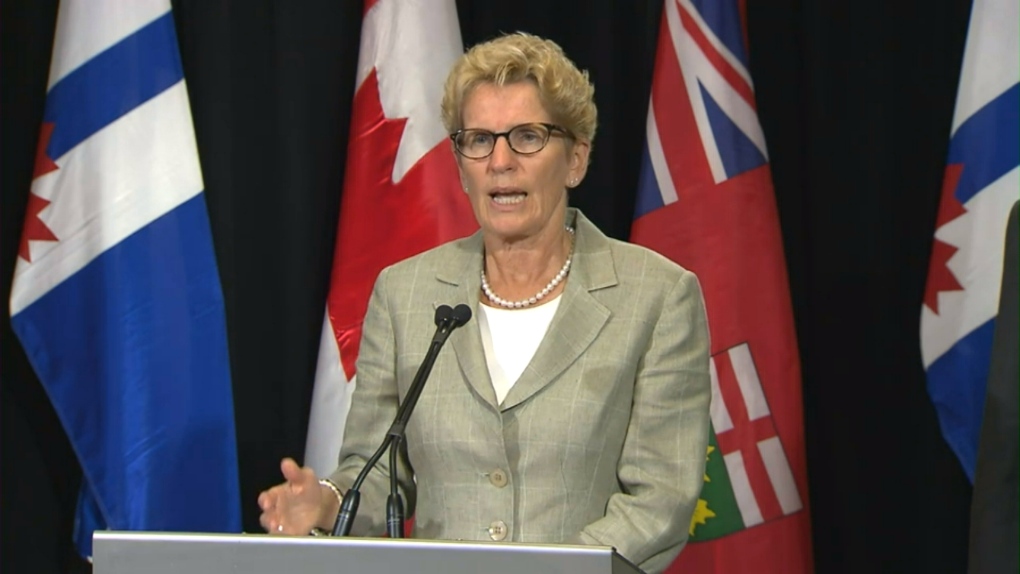

Premier Kathleen Wynne says there's a "generational divide" in retirement incomes because three-quarters of workers between ages 25-and-34 don't have a pension plan, compared with half of workers aged 45-to-54.

The ORPP will require mandatory contributions of 1.9 per cent of a workers' salary from employers, and a matching amount from the employee, to a maximum of $1,643 a year from each, and starts Jan. 1, 2017 for companies with 500 or more workers.

The Ontario Chamber of Commerce calls the timeline for starting the provincial pension "very, very aggressive," and says it will require a "herculean" effort on the part of government and large employers to get it implemented in time.

"Our next call is for government to really heighten their collaboration with these employers to figure out how they're going to get this right," Chamber president Allan O'Dette said in an interview. "I think this puts a tremendous amount of pressure on both the employers and the government to meet these timelines."