Twitter-prone U.S. president-elect Donald Trump is a primary risk facing businesses in 2017 and they will soon start firing back, says a Washington-based crisis communications expert.

"Your first and primary goal is to preserve share value, protect the stockholders,” Richard Levick, chairman and CEO Levick Communications told CTV’s Your Morning on Monday.

“And that’s why you see so many companies genuflecting early, that is, coming to the president(-elect) on bended knee, giving him the easy victory lap. Later in time is when you stand your ground, but for now, give him the easy victory lap.”

Trump, known for late-night emotional and aggressive tweets to his more than 6 million followers, is “the main enterprise risk” facing business in 2017, says Levick. Publicly traded companies need to burn any standard crisis handbook because this is unprecedented.

“The best you can do is use your peace time wisely. What we’re seeing here, and this is remarkable, the president-elect has the ability to impact stock with the single use of two thumbs. He really has extraordinary powers and companies have to anticipate that now.”

Levick advises corporations, countries and institutions around the world and has spearheaded some huge communications campaigns, including Guantanamo Bay, the Catholic Church, the Wall Street crisis, and the Gulf oil spill.

He says companies have to be prepared to find themselves in Trump’s crosshairs because, in today’s digital landscape, they might only have moments to respond. The president-elect’s early-morning negative tweets have targeted about half a dozen companies -- including Boeing, General Motors, Toyota and air conditioner maker Carrier – and in some cases, sent stock prices plummeting.

Toyota Motor said will build a new plant in Baja, Mexico, to build Corolla cars for U.S. NO WAY! Build plant in U.S. or pay big border tax.

— Donald J. Trump (@realDonaldTrump) January 5, 2017

Levick says a defensive plan would include clearly planning a social media message, identifying allies (in the case of both GM and Carrier, union leaders played significant roles as communicators defending jobs) and assembling pictures and videos that add emotive support to a response.

Appealing to emotions is critical, he says.

“We now exist in this post-truth and highly disruptive era and companies have to anticipate that, in fact, they are going to be dealing with a president who does not seem to be very concerned about the facts.”

Levick expects to see consumer-oriented companies, such as those in technology, calculate that, at some point in the near future, it will be better to go on the offense against Trump’s White House. A few will lead and others will follow suit.

“When a business-to-consumer company starts to go back at the president, starts to stand up for their position, then it’s no longer going to be smart to kowtow, to genuflect.”

During the presidential campaign, Trump criticized Ford Motor Co., claiming that it was planning to “fire all their employees in the United States” and move the jobs to Mexico. The company’s CEO Mark Fields responded that the allegation was incorrect and “it’s really unfortunate when politics get in the way of the facts.”

But, since Trump won the presidency, Ford has taken a less confrontational approach. And on Jan. 3, it announced it was shelving a $1.6-billion expansion in Mexico in favour of creating new jobs in Michigan.

That same day, Trump turned his sights on General Motors, attacking its production of its compact Chevrolet Cruze. GM’s stock immediately fell by $2.

General Motors is sending Mexican made model of Chevy Cruze to U.S. car dealers-tax free across border. Make in U.S.A.or pay big border tax!

— Donald J. Trump (@realDonaldTrump) January 3, 2017

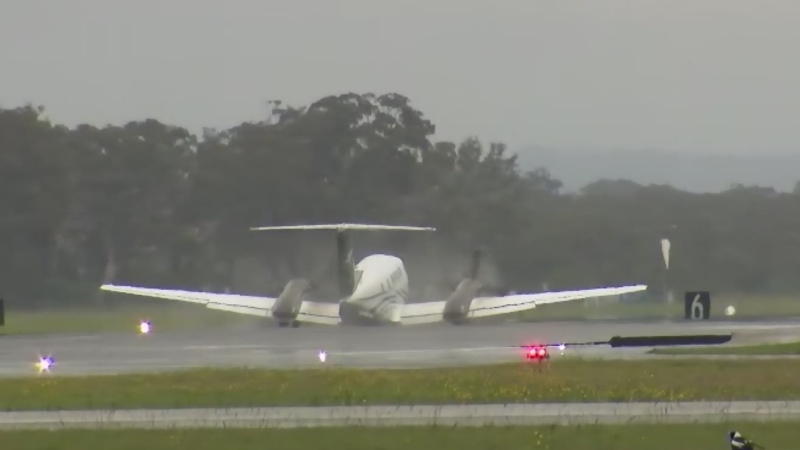

Boeing’s shares lost almost 1 per cent a few hours after Trump tweeted that a new 747 Air Force One for future presidents would cost more than $4 billion. Boeing responded that it was involved only in a $170-million early development phase and the Air Force clarified that $3.2 billion had been budgeted for two planes.

Boeing is building a brand new 747 Air Force One for future presidents, but costs are out of control, more than $4 billion. Cancel order!

— Donald J. Trump (@realDonaldTrump) December 6, 2016

Military contractor Lockheed Martin’s shares fell more than 5 per cent after Trump said Dec. 12 that the cost of the F-35 fighter jet program is “out of control.”