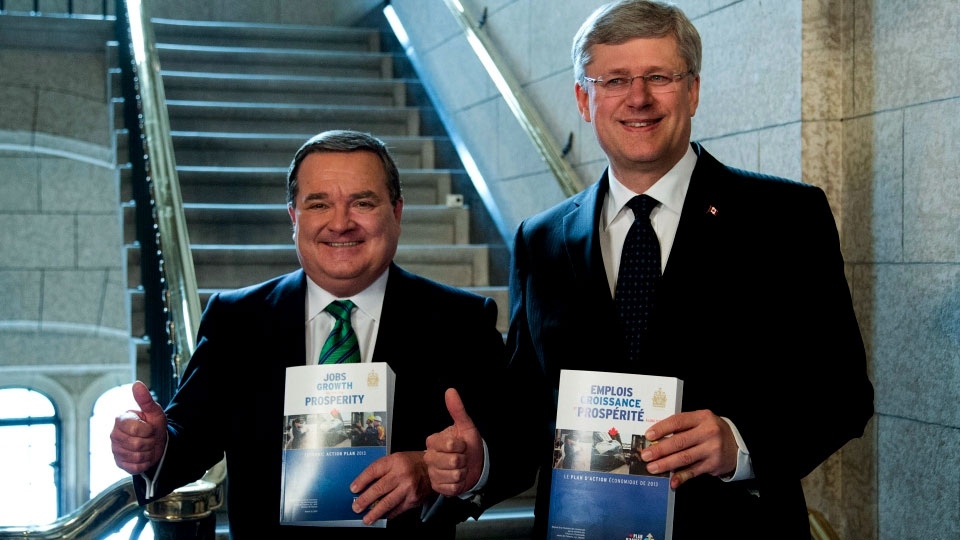

OTTAWA -- Finance Minister Jim Flaherty is promising to balance the books without delving deeper into government coffers, by shuffling resources to boost skills training, infrastructure projects and the manufacturing industry.

Flaherty’s 2013 federal budget, released Thursday, proposes a new Canada Job Grant that will provide up to $5,000 per person for job training – an amount that must be matched by provinces or territories and employers for a total of $15,000.

The goal is to match unemployed Canadians with more than 220,000 current job vacancies across Canada and provide more job opportunities for disabled people, youth and aboriginals.

Flaherty said the focus on skills training comes from the Conservative government’s consultations with employers and unions, who identified gaps in training as one of the biggest obstacles to economic growth.

However, Flaherty’s job grant plan is contingent on provinces and territories agreeing to it. There is also no new money involved.

The grants will have to be negotiated as part of the annual $500-million labour market agreements between Ottawa and provinces. The current agreements don’t expire for another year.

“I think that if and when there is a new training program, it won’t look anything like this because the provinces will have a big say in it,” economist and Queen’s University professor Don Drummond told CTVNews.ca.

“We may need welders and plumbers today, but what if we don’t tomorrow?” he said of the push to churn out more skilled workers.

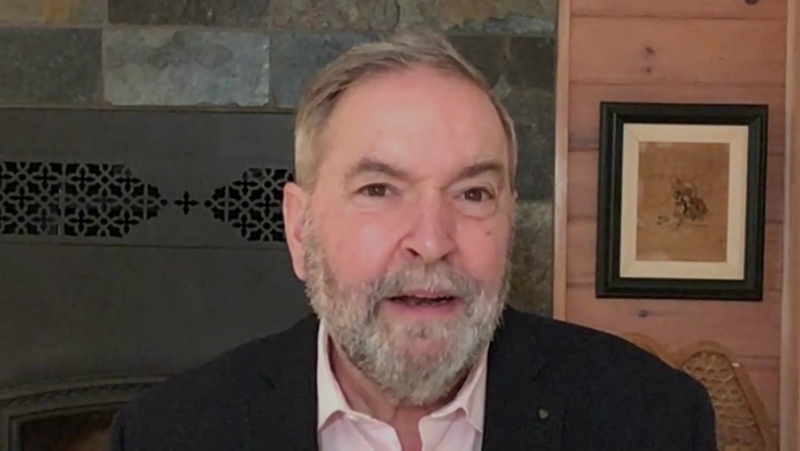

Federal Opposition Leader Thomas Mulcair didn't pull any punches in criticizing Flaherty's budget. It's all "too little, too late," he said, adding that the budget fails the hundreds of thousands of young Canadians looking for jobs. "We've hollowed out the manufacturing sector since the Conservatives came to power. They're starting to try to patch that up and kiss and make up," Mulcair told CTV's Power Play.

Liberal Leader Bob Rae, meanwhile, slammed what he described as a "minimalist" budget.

"It further confirms that we're going to have the smallest, least imaginative government ... doing as little as possible to address the issues and challenges that face Canadians," he said.

Modest budget

The Canada Job Grant is the centrepiece of a modest budget that includes very little new spending with the goal of erasing the deficit and posting an $800-million surplus by 2015 -- just in time for the next federal election.

The federal deficit currently stands at $25.9 billion.

But Flaherty said Canada is doing well compared to other G7 nations and on track to eliminate the deficit, despite a sluggish economy and competition from emerging markets in Asia and elsewhere.

In case of another financial crisis, “I want our country to be in a very solid fiscal position,” Flaherty told reporters in the budget information lockup.

He said this year’s budget could have included more goodies, but they weren’t necessary. There are no new taxes and no major cuts, either.

“We do not need to slash and burn. We can be sensible over time,” Flaherty said.

The biggest spending in the restrained budget is on infrastructure projects – $47 billion in new funding over 10 years. That includes $14 billion for a new Building Canada Fund for major projects of “national, regional and local significance.”

The Federation of Canadian Municipalities had asked for $5.75 billion per year in federal funding for long-term infrastructure projects. It also recommended that the Gas Tax Fund, a source of revenue for municipalities, be indexed – a move recommended in this year’s budget.

The 2013 budget also proposes a two-year extension of a program that will give manufacturing companies $1.4 billion in tax relief over four years when they invest in new machinery and equipment.

Drummond said the government’s fiscal plan is based on lowering projections of “virtually every expenditure item” and keeping transfers to provinces and individuals low thanks to lower inflation.

“The adjustments they made in the expenditure forecast almost exactly offset the revenue so they’re staying on track through luck rather than anything else,” he said.

Public sector cutbacks

In last year’s budget, Flaherty announced that federal public service will be slashed by more than 19,000 jobs over three years.

The 2013 budget notes that 16,220 positions have been eliminated since Dec. 31, 2012. Nearly 9,400 of those jobs were lost through attrition.

The Conservatives also plan to cut back on travel costs by using high-tech video-conferencing that will project life-size images and videos in conference rooms across the country. The move will save nearly $43 million a year, but will require a one-time $20-million investment in the new technology.

Among the highlights of the 2013 budget:

- The government hopes to raise $6.7 billion in additional revenue over six years by closing tax loopholes and enforcing tax compliance

- A “snitch line” for those who wish to report international tax evasion or avoidance of at least $100,000

- $76 million in annual tariff relief on baby clothing and sports equipment aimed at reducing the gap between Canadian and U.S. retail prices

- The Department of Foreign Affairs and Canadian International Development Agency will be amalgamated to improve efficiency

- Temporary “super credits” for those making their first charity donations, meant to encourage contributions from young Canadians

- A tax credit for adoptive parents to help alleviate some of the costs of child adoption

- $100 million over two years for housing construction in Nunavut. There is also some modest spending on First Nations communities and Aboriginal programs.