TORONTO -- Travellers are being advised to confirm their insurance details before flying abroad as airlines around the world halt travel to China amid the coronavirus outbreak.

The Public Health Agency of Canada -- along with other agencies around the world -- has issued a notice to avoid all non-essential travel to China, with another notice to avoid all travel to Hubei Province, the epicentre of the outbreak.

As efforts to contain the outbreak have the potential to further impact commercial travel, Anne Marie Thomas, an insurance expert at InsuranceHotline.com, suggests travel insurance can help cover some of the additional costs if a planned trip has to be cancelled at the last-minute.

“If you’re not obtaining a refund through the airline or the tour company, you might have some coverage through your travel insurance,” she told CTVNews.ca in a recent phone interview.

According to the insurance provider Ontario Blue Cross, travel insurance coverage that includes trip cancellation or trip interruption will reimburse policyholders for their expenses as long as it was purchased before the Canadian government issued an advisory to “avoid all travel” or “avoid all non-essential travel.”

“We recommend purchasing trip cancellation or interruption insurance as soon as you plan a vacation abroad,” the insurer states on its website. “That way if an advisory against all travel or non-essential travel is issued after you purchase your plan and you decide to cancel or return from your trip earlier, you can be reimbursed for all prepaid non-refundable travel expenses covered under your plan.”

Will McAleer, the executive director at the Travel Health Insurance Association of Canada, also stressed that the travel advisory needs to be in effect during your date of travel for a policyholder to use that as a reason to claim reimbursement.

“Let’s say you’ve got a trip planned to China right now, but it’s not for another six months, you’re going to need to wait until you get much closer to that before you’d be able to claim on something like that for travel insurance,” he told CTVNews.ca on Friday.

As an added precaution, Thomas said travellers can purchase an optional Cancel for Any Reason (CFAR) add-on to their coverage, which allows them to cancel their trip, regardless of the situation. The caveat, of course, is that CFAR adds to premium costs and also comes with additional terms and conditions.

However, now that the travel advisories to China are in place, McAleer said customers should check with their insurance providers before upgrading to a CFAR to confirm it will cover coronavirus concerns. He also said that while most CFAR policies would cover such a scenario, it’s important to keep in mind that they typically don’t reimburse the full amount.

“In a case like this, I would hope that anybody had purchased Cancel for Any Reason travel insurance,” Thomas said.

Because all travel insurance plans are not the same, Thomas adds that if you plan on relying on your travel insurance through work or a credit card, it’s important to look through the details of each plan to make sure you’re properly covered.

“Maybe it just protects the cardholder and not the travel companion, so make sure you have the coverage that you think you have,” she said.

Thomas said travel insurance is available for purchase up to the moment you leave, but it might not be available for upcoming trips to China as providers typically don’t offer insurance for trips to countries that are under travel advisories.

On Wednesday, Air Canada suspended each of its 33 weekly direct flights to Beijing and Shanghai. The airline said it would work with passengers to provide travel on other airlines or offer a full refund for passengers and waive rebooking fees for flights on a partner airline that are destined for Wuhan, China.

Several other airlines, including British Airways, United Airlines, Air France, Air Asia, EgyptAir, Air India and Finnair have all similarly suspended service to China and offered refunds to those heading there.

Thomas also suggests travellers print out their travel insurance documents before a trip, because there might not be internet access available when you need it.

McAleer added that anyone who is concerned about what their policy covers should reach out to their insurance provider for clarification before they depart.

“If you do have questions, contact your insurer,” he said. “There are toll-free numbers on all those policies to determine what would happen if things change once I was there.”

What to do if you're sick abroad

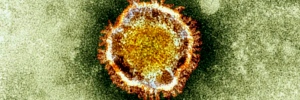

On Thursday, the World Health Organization declared the outbreak a global emergency. To date, China has reported more than 7,800 cases of the infection, including 170 deaths. The virus has also spread to 18 countries.

If you contract a virus in a foreign country, Thomas advises Canadians to immediately contact their insurance company to avoid some of the potentially nasty fees that come with medical care abroad.

“Your travel insurance company will provide you with a list of recommended clinics or doctors in the area where you are,” she said. “If you are concerned about getting back home, check with the Canadian Embassy for direction and next steps.”

Travellers should also be aware that if they are showing signs of sickness or they have a pre-existing condition before they depart, it could void their insurance coverage.

“If you develop symptoms associated with a coronavirus before your vacation, it may be wiser to avoid travelling altogether,” insurer Blue Cross said on its website.

The Canadian government is evacuating 196 Canadians who are stuck in China. The U.S., Japan, Germany and Italy have either already completed an evacuation or are planning to do so.

For those who cannot avoid travel to China, the U.S. Centers for Disease Control and Prevention suggests avoiding contact with people who are sick, to avoid animal markets and to wash your hands with soap frequently for at least 20 seconds.

The agency also suggests older adults and those with prior conditions may be at a higher risk of contracting the virus.

With files from CTVNews.ca's Jackie Dunham