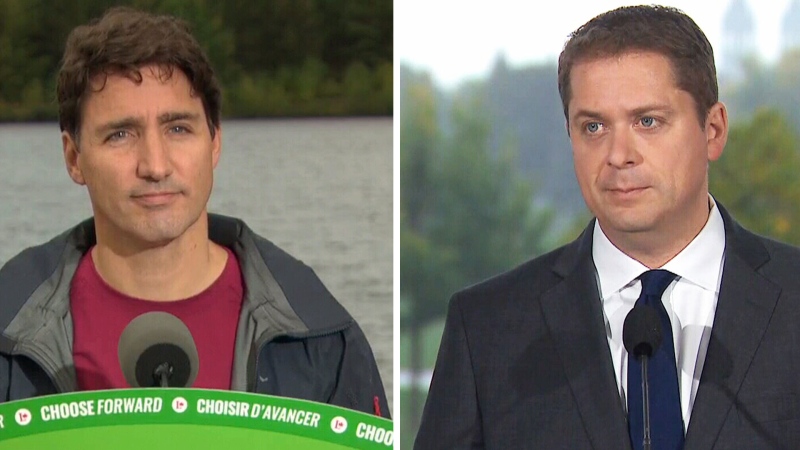

TORONTO -- During Monday’s election debate the Conservative Party joined other parties in live-tweeting the debate in real time on Twitter.

But those tweets weren’t always reliable.

About 30 minutes into the debate, the Conservatives tweeted that it had been “confirmed by the media that Justin Trudeau lowered taxes for millionaires.” The tweet then linked to a Canadian Press story from September.

The problem: the story says no such thing.

The CP article is based on a Statistics Canada report that shed light on income growth in 2017. The report, which can be found here, showed that incomes among Canada’s highest earners grew more than the rest of the country that year.

At the same time, the richest Canadians saw their total taxes drop.

But it’s not true to suggest that the Liberals “lowered taxes for millionaires.” As the CP article points out, the Liberals increased the tax rate on incomes in the highest bracket in 2016 by creating a fifth tax bracket. The move pushed federal taxes even higher for the richest Canadians, up to 18.8 per cent from 18.4 per cent.

“He actually increased the tax rate on high income people,” Moshe Lander, a professor of economics at Concordia University, told CTVNews.ca.

But despite the federal tax boost, the wealthiest Canadians still saw a decline in taxes due to tax reductions at the provincial level – particularly in Quebec.

In 2017, the richest Canadians’ overall tax rate was 30.9 per cent, down slightly from 31.3 per cent in 2016.

The reason for that drop, Lander said, has a lot to do with tax avoidance – a perfectly legal practice whereby the individuals find legitimate ways to lower their tax burden.

“It’s not because Trudeau lowered the tax on them. It’s because they became more skilled at avoiding it,” Lander said.

“When you’re trying to squeeze the rich, that encourages them to hire tax accountants and tax lawyers to avoid the tax.”

Last night, Green Party Leader Elizabeth May called for tighter tax rules on the wealthy. In her platform she has promised to put forward a reassessment of the Canadian tax system, close loopholes that benefit the wealthy and crack down on offshore tax dodging.

Lander said May’s theory is “right but unimplementable” because of how much it would cost to operate.

“She is inherently contradicting herself somewhere. If you want to stick with the current tax code, then to reduce tax avoidance you need to hire thousands of more CRA employees to chase it, which is going to cost money, which is going to create a bigger deficit, more debt, and less room for saving the environment or whatever other policy she wants,” Lander said.

According to the StatsCan report, Canada had 277,695 one-per-centers in 2017. Most of them lived in Ontario, Alberta, Quebec or B.C.

Contact us

See a story or post circulating on social media that you think may be disinformation or in need of fact-checking?

Let us know by sharing with us the link to the post or the source of the information.

Email us by clicking here or visit our Newsbreaker page.

Please include your full name, city and province.