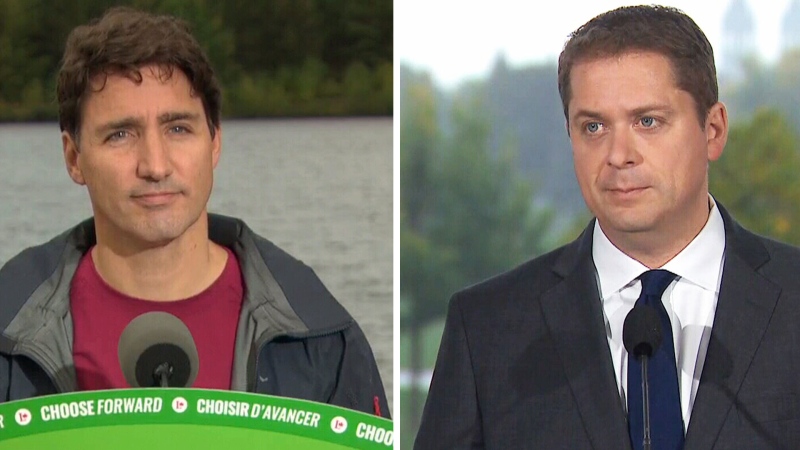

TORONTO -- The housing industry welcomed Conservative Leader Andrew Scheer’s proposal to fix Canada’s mortgage stress test to make home ownership more accessible, but Canada’s housing agency and bank regulator have previously defended the stress test as necessary measures to ensure economic and financial stability.

In a four-point plan to make home ownership more affordable, Scheer said his government would fix the stress test to ensure easier mortgage access for first-time homebuyers and also work with the Office of the Superintendent of Financial Institutions (OSFI) to remove the stress test from mortgage renewals.

"Many experts agree that the stress test has gone too far and has many unintended consequences, pricing many would-be homeowners out of the market," Scheer told his supporters during a campaign appearance on Monday in Vaughan, just north of Toronto.

The move was lauded by the Canadian Real Estate Association (CREA), the Mortgage Professionals Canada, and the Canadian Home Builders’ Association (CHBA), and in line with key measures the organizations have previously recommended.

The Canadian Mortgage and Housing Corporation (CMHC) declined to comment on Scheer’s announcement, but when asked about comments made by chief executive Evan Siddall regarding the stress test, a spokesperson said statements previously made in the public sphere remain unchanged. Siddall posted on Twitter after the election was officially called that it was inappropriate for him to offer comments on policy during an election campaign.

"The mortgage stress test is exactly the kind of policy we need to protect our economy,” Siddall wrote in a letter to the Standing Committee on Finance in May.

The stress test, which took effect at the beginning of 2018, would require new mortgage applicants to qualify for a loan at the Bank of Canada’s 5-year benchmark rate, or at 2 per cent higher than the rate being offered by the applicants’ bank. Applicants would be exempt from the test if they were renewing their mortgage with their existing bank.

But critics have said the move shuts out first time buyers from homeownership, resulting in higher rent rates due to greater demand for rental housing, and parents depleting their own savings to help adult children.

Siddall said in his letter that high home prices were the primary reason home ownership was out of reach for many Canadians, and that the stress test helped slow the rise in housing prices and also helped limit household debt.

CREA reported last week that home sales were up across most of the largest markets in Canada, and predicted that housing prices would rise 0.5 per cent in Canada this year, reversing its June forecast of a 0.6 per cent decline.

Meanwhile household-debt-to-income ratio stood at 177.1 per cent in the second quarter, according to the most recent data from Statistics Canada. This means Canadians owe $1.77 for every dollar in disposable annual income, levels that far exceed acceptable thresholds, according to some studies, and negatively impact consumer spending and GDP growth.

"My job is to advise you against this reckless myopia and protect our economy from potentially tragic consequences," Siddall wrote at the time.

The Liberal Party criticized Scheer’s plan on Monday, arguing that it would increase Canadian household debt and create further risk and instability in the housing market.

"Scheer is removing protections (former finance minister) Jim Flaherty introduced following the subprime mortgage crisis," Eglinton-Lawrence Liberal candidate Marco Mendicino said in a statement. "Andrew Scheer’s only plan is a reckless recipe to increase the debt of Canadian households – and to hurt families by taking money out of their pockets and cancelling the Liberal First-Time Home Buyer Incentive."

The Liberals said they would expand the First-Time Home Buyer Incentive program.

Scheer also said that more Canadians were also seeking out unregulated private lenders and that choosing this route often meant paying higher interest rates.

A CIBC report from April noted that the market share of alternative lenders has increased since the mortgage stress test was introduced.

"Alternative lending is an integral part of any normally functioning market. But a fast-growing alternative lending market is not," wrote author Benjamin Tal, who declined to comment further during the politically sensitive election period.

"Behind the scenes, there is a transfer of risk from the regulated to the less regulated segment of the market—from where there is light to where it’s dark," he said in the report.

While the stress test "was probably necessary", Tal also questioned the 200 basis point benchmark, and suggested regulators revisit the stress test given the higher interest rate environment since the rules were introduced and a five-year mortgage rate that has also climbed higher.

In February, OSFI Assistant Superintendent Carolyn Rogers said in a speech that while interest rates have climbed, they remained at historically low levels, while personal debt stood at historically high levels.

"A margin of safety in these conditions is prudent," she said at the time, adding that OSFI continuously monitors the financial environment and would make adjustments as necessary. OSFI said on Monday it did not have any information to add.

Rogers also said at the time that renewals with a new lender should not be exempted from the stress test to mitigate certain risks, and that OFSI has a tracking system to guard against concerns that a bank would have less incentive to offer its most competitive rate to an existing borrower who failed the stress test.

The cost of homeownership is a challenging problem, Rogers said, but the answer "cannot be more debt. Particularly, it cannot be more consumer debt, fuelled by lower underwriting standards."