OTTAWA – The Liberal party has released its costed 2019 platform, and it includes promises of billions in new spending for students, families, and the environment, continuing their so-called economic approach of “investing in Canadians,” while targeting corporations and the wealthiest Canadians to help pay for these proposals.

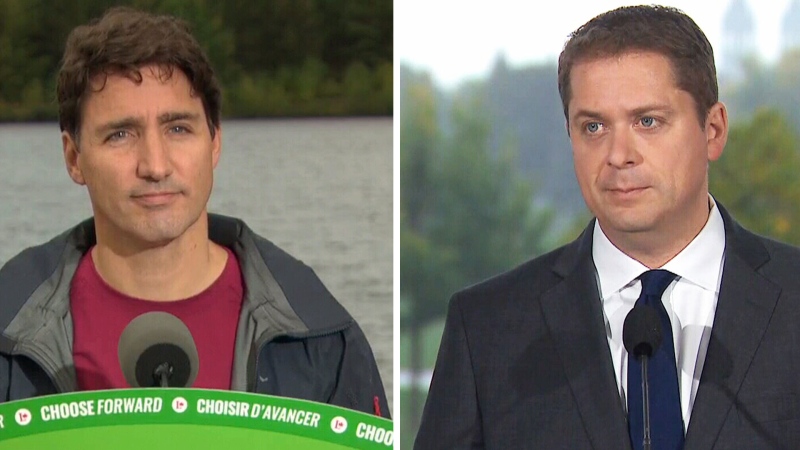

The platform titled “Forward a real plan for the middle class” spans 85 pages and includes chapters on the middle class and jobs, the environment, social and cultural programs, Indigenous commitments, parliamentary reforms, as well as pledges focused on international and domestic trade, justice, and security. Sprinkled throughout are photos of Liberal Leader Justin Trudeau and his candidates.

The document is a mix of already-announced campaign promises, and new ideas that they’d yet to announce, alongside a costing analysis done by the Parliamentary Budget Officer (PBO) of 22 key pieces.

Central to what the Liberals are promising to deliver should they be re-elected on Oct. 21 is a boost to the Canada Child Benefit, relief for student debtors, new taxes on the rich, and new regulations for multinational tech giants.

In total, the Liberals estimate that the new commitments they’re making would cost $9.3 billion in 2020-21 and rise each year following, but would also bring in just over $5.2 billion in new revenue in 2020-21 also rising over time. This would leave Canadians with an additional $4.1 billion added on to the deficit in the first year, which the Liberals project would be at $27.4 billion in 2020-21, with no time frame for getting back to balance. Based on today’s platform, a re-elected Liberal government would run another four years of deficits, but the party points to the continued decrease of Canada’s debt-to-GDP ratio as a more favorable figure.

“Our economy is driven by people. So we will keep investing in Canadians, and doing the things that make it better for the middle class,” said Liberal incumbent candidate and co-chair of the national platform committee Ralph Goodale during a press conference with reporters who received the platform under embargo in Ottawa. “Over the last four years we've seen what happens when you put people first,” he said.

Conservative incumbent candidate Pierre Poilievre reacted to the announcement in Ottawa, immediately pouncing on the higher debt levels as a result of the billions in new promises.

“And he expects you to believe that no one will have to pay for any of it,” he said. “He is frivolously spraying money in all directions uncontrollably in all directions and he will stick Canadians with the bill after the election.”

Speaking from British Columbia, NDP Leader Jagmeet Singh said the Liberal platform will do the opposite of what the Liberal say it will, accusing Trudeau of turning his back on families and students by pushing the costs down the road with these measures.

“What Mr. Trudeau and the Liberals are doing, they’re trying to scare people into settling for less,” Singh said. Similar to Trudeau, Singh has not committed to balanced books, saying only that the New Democrats would take “a very serious approach,” to the budget.

Relief for the middle class

The first chapter of the platform is focused on the middle class, and measures the Liberals say will make life more affordable for those within that income range.

Early days in this campaign the Liberals promised to increase their Canada Child Benefit program by 15 per cent for children under one; exempting parental and maternity leave employment insurance benefits from tax; and extending those benefits to adoptive parents.

According to the PBO, this suite of measures would cost $777 million in 2020-21, rising to just under $1.2 billion by 2023-24.

The Liberals have also promised to make the first $15,000 of income tax-free for Canadians earning $147,000 a year or less, which the Liberals say will help lift another 40,000 people out of poverty. Billed as helping more people keep what they earn, it’s projected to cost $2.9 billion in 2020-21.

A promise to increase Old Age Security by 10 per cent for seniors once they turn 75 would cost $1.6 billion in 2020-21, rising to $2.6 billion in 2023-24. The Liberals would also increase the CPP survivors benefit by 25 per cent.

And for families who qualify for the Canada Child Disability Benefit, it would double from $2,832 to $5,664 for each child, estimated to cost $391 million in 2020-21.

There are also new or expanded measures for first-time home buyers; initiatives and measures for entrepreneurs and small business owners; more accessible and affordable childcare; strengthening public health care; increasing EI sickness benefits from 15 to 26 weeks at a cost of $306 million in 2020-21; and implementing a new EI career insurance benefit.

The Liberals are also promising a variety of other middle-class targeted initiatives, but not all were costed by the PBO. What the party did pass along to the independent office to scrutinize helped the Liberals make “realistic” commitments, Goodale said in thanking the PBO for its work.

Throughout the platform the Liberals stack up their commitments to those by the Conservatives, noting the differences between what each party is offering.

Trudeau spoke about the costed platform at the University of Toronto’s Mississauga campus, and then took questions during a town hall with students.

“Under a Conservative government, a person making $400,000 a year would benefit more than a person making $40,000 with their tax cuts,” said Trudeau on Sunday.

Help for student debt

As CTV News reported Saturday, the platform also includes measures aimed at students and Canadians who still have student debt. All these commitments are promised to come into effect in 2020-2021, and apply to new graduates and people already paying off student loans.

These measures include:

- Allowing new parents to put their student loans on hold by giving them an interest-free break from paying off their loans until their youngest child turns five years old.

- Extending the grace period on payments after graduation from six months to two years, and even after that time only will people have to make payments once they are earning at least $35,000 per year after graduation.

- Increasing student grants under the Canada Students Loans and Grants program by $1,200, to reach $4,200 per year.

According to the PBO’s assessment of the post-secondary measures, it would cost $172 million in the first year, rising to just over $1 billion by 2023-24. The Liberals estimate up to 470,000 students could benefit.

In Ontario, Progressive Conservative Premier Doug Ford has reversed previous student assistance measures and it appears the Liberals are looking to make a direct appeal to those impacted by that and other provincial cuts.

“Conservative provincial governments are trying to balance the budget on the backs of families and students, all while the cost of tuition keeps going up,” said Trudeau.

“Cuts to education. To healthcare. To environmental protection. We can’t afford to double down on the Conservatives, not here in Mississauga, not across Ontario, not anywhere in Canada,” he said.

Corporate and tech crackdown, luxury tax

In an effort to help generate new revenue and crack down on corporate tax evasion, the Liberals would introduce new tax measures that’ll hit wealthy Canadians and are promising regulations for multinational tech companies.

The Liberals would impose a 10 per cent luxury goods sales tax applied at point of sale, for purchases of personal cars, boats, and aircraft that are valued at $100,000 or more. This, according to the PBO, will bring in $585 million in 2020-21, rising to $622 million in 2023-24.

And, changes would come to corporate taxation under a re-elected Liberal government. They would review current policies to ensure the wealthy aren’t benefitting unfairly, and target tax avoidance and corporate tax loopholes. The PBO has estimated that the corporate tax crackdown could bring in $459 million in the current 2019-20 fiscal year, and would raise $1.7 billion in 2020-21.

The Liberals had already said they’d impose a one per cent tax on properties owned in Canada, by non-Canadians and non-residents, to limit housing speculation. The PBO estimates this would bring in $217 million in revenue in 2020-21, rising to $256 million by 2023-24.

Another major aspect of this is a new effort the Liberals are billing as “making multinational tech giants pay their fair share.” What this entails is a new three per cent tax on the income of businesses in the digital economy sector. It would come into effect on April 1, 2020 and target advertising and digital companies like Netflix, Apple, Google or Amazon, with worldwide revenues of at least $1 billion and Canadian revenues of more than $40 million.

The Liberals estimate this would bring in $540 million in 2020-21, rising to $730 million by 2023-32.

As well the Liberals are promising to impose new privacy measures on large digital companies like Facebook, because they hold massive troves of Canadians’ personal data. The Liberals would install a new set of online rights for people to be able to erase their data from platforms, know who has access to it and how it’s being used, standards for reporting and compensation when data breaches occur, and force companies to report to a national advertising registry. All of this they say, would be part of the job for a new Data Commissioner.

Some climate measures costed

The platform document lays out the Liberals promised next steps to tackle climate change, including the promise to achieve net-zero emissions by 2050. This broad commitment doesn’t have a price tag attached but would include five-year goals decided on with help from experts, and new supports for those who will be impacted by the transition.

The carbon tax regime would remain, but no new information on the price per tonne it would reach in coming years.

The environmental measures that the PBO costed include the promise of interest-free loans for environmental retrofits, and grants for zero-emission homes, which the PBO pegs at costing $300 million in 2020-21, up to $411 million by 2023-24.

As well, the promise to cut the tax rate for companies that produce zero emission technology like electric cars or batteries in half would cost $14 million in 2020-21, according to the Liberal platform.

And, the Liberals estimate that once fully completed—something they say is still three years away— the Trans Mountain pipeline expansion would generate $500 million in revenue, which the Liberals would put back into clean energy projects and climate change solutions.

Gun control, victim supports

As part of the broad promise to make Canadian streets safer, the Liberals have already said they’d ban all military-style assault rifles, create a buy-back program for legally-purchased assault rifles and allow provinces and municipalities to beef up their bans or restrictions further if desired.

In the costed platform the Liberals are earmarking an additional $50 million a year to help cities crack down on gun and gang crime.

Other justice-related measures pledged that include costing are:

- Hiring and retaining 425 Crown prosecutors and 225 judges, the cost of which will be split between the federal government and provinces;

- Hiring and retaining an additional 100 RCMP officers; and

- Providing sexual assault and domestic violence survivors free legal representation for application hearings, another cost to be split with the provinces.

According to the PBO this trio of measures will cost $122 million in 2020-21

Relatedly the Liberals are also promising to make it mandatory that all judges in Canada take sexual assault law training, which was an initiative from former interim Conservative leader Rona Ambrose that was thwarted in the Senate. This chapter also has promises for drug treatments, elder abuse, and targeted at first responders.

Immigration, citizenship fees:

The 2015 federal election was largely centred on accepting refugees and contrasting the parties’ immigration policies, this time around the proposals from the Liberals are limited.

They include a promise to eliminate the processing and right of citizenship fees for new applicants. The PBO says this will have a limited cost, estimated at $75 million in 2020-21, rising to $110 million by 2023-24.

The Liberals say they will “move forward with modest and responsible increases to immigration,” focusing on welcoming highly skilled immigrants. And a re-elected Liberal government would also continue talks with the United States about updating the Safe Third Country agreement, which some believe has resulted in the influx of irregular border crossings into Canada from the U.S.

Continuing reconciliation efforts:

After making several big commitments to Indigenous voters in 2015, the 2019 platform is arguably much more measured. Largely it vows to keep chipping away at the changes already promised.

The Liberal platform restates past, and yet to be fully-met commitments to eliminate all long-term drinking water advisories by 2021, improve access to health services, and improving infrastructure in Indigenous communities.

As well, work would continue on implementing the recommendations stemming from the Truth and Reconciliation Commission and the National Inquiry into Missing and Murdered Indigenous Women and Girls.

A re-elected Liberal government says it would also ensure First Nations groups benefit from new resource projects, introduce a National Treaty Commissioner’s office, and implement the United Nations Declaration on the Rights of Indigenous peoples, within the first year of a new mandate, something the Liberals were unable to make much progress on in the last four.

Veteran, first responder support

The Liberals say they’d implement a “rapid response” mental health service staffed by social workers and inform all veterans about how to access it. They’re also pledging to automatically approve disability applications for conditions deemed highly likely to be service-related such as depression, PTSD, and arthritis. Though, this measure wouldn’t come into effect until 2021-22, with a PBO estimated cost of $194 million in that year.

And, the Liberals say they’d push the ball forward on the National Action Plan on post-traumatic stress injuries, and by the end of 2020 add correctional officers to be eligible for the $300,000 memorial grant for family members of first responders who have died as a result of their jobs.

Combatting drug addiction, drug costs

One of the biggest commitments left un-costed was the Liberal’s plan to move towards a universal pharmacare system. This pledge was wrapped into a $6-billion commitment for several public health initiatives, such as ensuring access to family doctors; setting standards for mental health services; and making home care and palliative care more available.

The Liberals would also spend $100 million in 2020-21 on drug treatment programs to combat opioid and meth addictions, in addition to making drug treatment court “the default option for first-time non-violent offenders charged exclusively with simple possession.”

Equality-focused commitments

- The plan also includes many social policy and equality-centered commitments that don’t have dollar signs attached, such as:

- Appointing another gender-balanced cabinet and improve federal diversity in appointments;

- Protecting abortion rights and improving how women are treated in the health care sector more broadly;

- Making it so people are “free from discrimination online, including bias and harassment”;

- Re-stating the not-met commitment to completely end the current 3-month blood donation ban for men who have sex with men;

- Amending the Criminal Code to ban the practice of conversion therapy that targets LGBTQ people;

- Study extremism like racism, anti-Semitism, and white supremacy and attempt to combat radicalization; and

- Establishing the Canadian Centre for Peace, Order, and Good Government, along with other supports for similar international institutions.

Parliamentary reform

While there is zero mention of reviving the now long-broken promise of electoral reform, the Liberals are looking to make a handful of tweaks to the parliamentary system, should they be re-elected. These include:

- More time for private members’ bills to be dealt with in the House of Commons;

- New technology to connect constituents with their MPs, without specifics;

- Eliminating whip and party lists to give the Speaker more freedom in picking who to let in on debates;

- More resources for parliamentary committees;

- Upholding the Independent Senate; and

- Implementing the Anne McLellan-issued recommendations around role and structure of the minister of justice position.