More than 11 million leaked documents from a Panama-based law firm are offering a glimpse into how the world’s rich and powerful obscure their wealth through the use of shell companies that conceal the identities of their real owners.

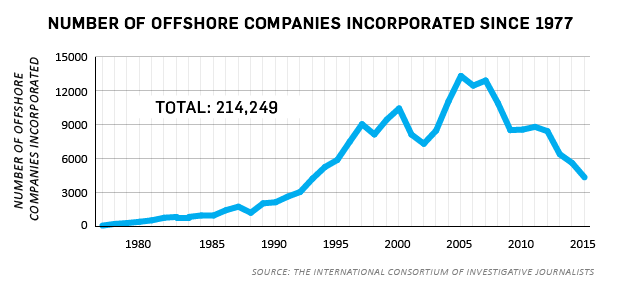

Reports show that since 1977, law firm Mossack Fonseca has incorporated more than 214,000 offshore companies. Though not illegal, these types of companies generally serve no purpose other than to hide funds from tax and law enforcement authorities.

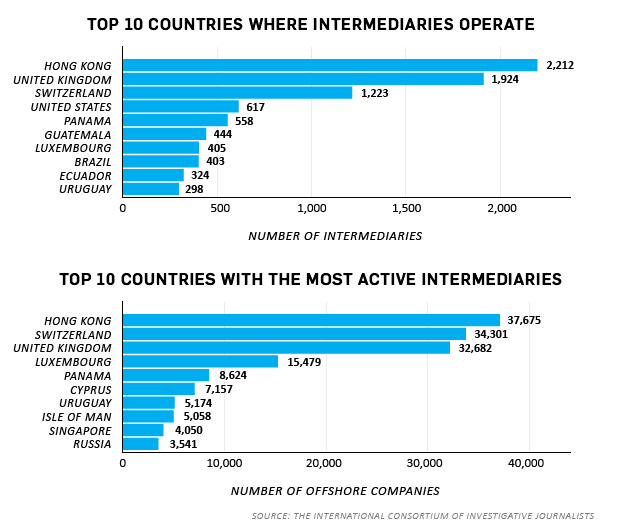

According to one of the firm’s co-founders, many of the people identified in the documents are intermediaries – someone acting as a middleman on behalf of a client. Documents show that most of the firm’s intermediaries come from Hong Kong, the United Kingdom and Switzerland.

Intermediaries from those three countries also set up by far the most offshore companies.

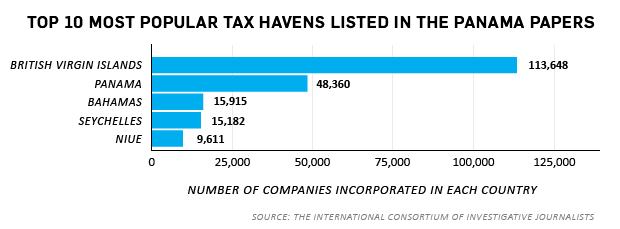

Documents also revealed that the British Virgin Islands is by far the most popular tax haven, housing 50 per cent of all companies in Mossack Fonseca’s files. Panama, where the firm is headquartered, is a clear second.