If you’re a driver in Ontario, you certainly don’t need anyone to tell you that auto insurance rates are high.

In 2014, the average Ontario driver paid a premium of $1,500, putting Ontario’s insurance rates well above any other province.

On average, just under a quarter of a million accidents occur annually on Ontario roads. Drivers pay auto insurance because if they get injured in those accidents, their insurance companies will cover the cost of medical treatments or lost income.

And while in recent years the rate of collisions and the number of people injured in those collisions have gone down, the cost of claims and billings for accident benefits have gone up. This discrepancy is something insurance providers say is a result of flagrant fraud within the industry.

“For some time we’ve known that fraud and exaggeration of a claim has been a problem,” said Greg Somerville, the president and CEO of Aviva Canada, a large insurance company.

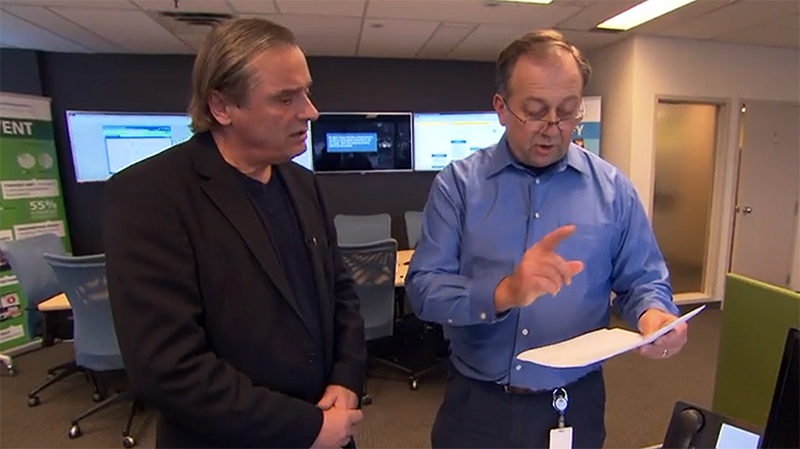

Aviva has a team of fraud investigators who look into claims and try to verify if the claims are legitimate. Gord Rasbach is a Vice President of Aviva and leads Aviva’s investigative unit.

“We get about 70,000 injury claims every year,” said Rasbach. “And a proportion of those, albeit a small one, are not legitimate.”

It’s a problem Aviva is well aware of, but until now has had a hard time proving. Unless someone involved comes forward and reports fraud, it’s difficult for insurance companies to prove which claims aren’t legitimate.

But in November 2014, Aviva saw an opening to do just that. Doug Dunstan works as an investigator with Aviva’s anti-fraud department. Dunstan’s interest was piqued when the Wellness Centres of Ontario, a Toronto chiropractic clinic in the north end of the city, sent Aviva a bill for $2,200 worth of treatments on a claim that had been dropped months before.

Dunstan followed up with their client who’d dropped the claim to see what was going on. He learned that after getting into a minor collision, their client had been told by a friend to go to this clinic and tell them he’d been in an accident, he wasn’t hurt, but he needed some money. The friend told him he could get money from the clinic.

According to Dunstan, the client went along with the plan at first, but then decided against it and cancelled the claim. He never went for any of those treatments that Aviva was billed for.

“My partner and I discussed it and thought, this is a good opportunity for us to do a concealed validation,” said Dunstan. In other words, an undercover operation.

Aviva sent two undercover investigators to the Wellness Centres of Ontario. Over the course of seven months, Aviva’s undercover investigators pretended they were in accidents and weren’t injured, but were looking to make money off the accident somehow.

“I want you to go in and say, ‘I’m not injured and I want money.’ That was the premise by which they entered into it,” said Rasbach.

Hidden camera footage shows both investigators meeting separately with chiropractor Edward Hayes, who tells them what to say to their insurance company in order to get income replacement benefits. “I have not gone back to work because of the severity of the injury to my neck and low back,” he writes for one of them.

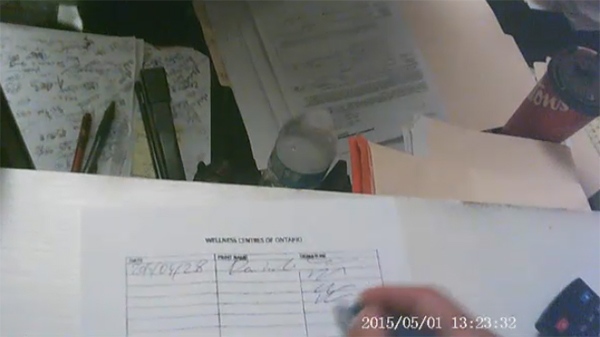

The undercover footage also shows the clinic’s receptionist, Doina Osacenco, who goes by “Michelle” getting both undercover investigators to sign attendance logs for treatment sessions, even though both of them are clear they won’t be coming back for further treatment.

“Give me 20 signatures – I’ll put in the names and dates,” she tells one of the undercover investigators in the video. At one point, she is seen telling one of the investigators to switch pens to change the ink colours.

Months later, the clinic billed Aviva for those phantom treatments. “Our undercover operator never did go for any treatments. But in July, we get our invoice for $2,200 for 15 treatments,” said Dunstan.

After seeing the chiropractor, the undercover investigators were sent down the hall to meet a paralegal named Anna Kovtanuka, whose office is next to the Wellness Centres of Ontario clinic. The hidden-camera footage shows Kovtanuka telling the undercovers investigators what they need to do to get income replacement benefits and an eventual cash settlement from their insurance companies.

“I need you to tell your family physician you suffer from tremendous headache. Headache it’s something you cannot check.”

Kovtanuka is seen in the hidden camera footage telling the undercover investigator that her fee is 20 per cent of any income replacement benefits he might get, and 30 per cent of any final settlement down the road. “I’m working with you and you have to work with me…the more money you get the better cheque I get,” she says.

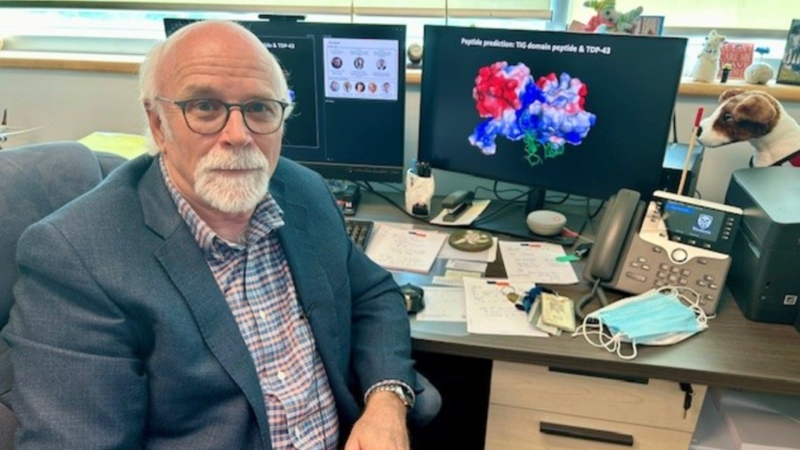

“We have a professional chiropractor who’s licensed in Ontario,” said Dunstan. “We have a paralegal that’s gone through training and is licensed as well. These are people that are professionals and you expect better of people like that.”

Aviva handed over their footage to the Toronto police, and on February 5, 2016, chiropractor Edward Hayes and his assistant Doina Osacenco were charged with three counts of fraud. Paralegal Anna Kovtanuka was charged with two counts of fraud and possession of property obtained by crime. The charges have not been tested or proven in court.

But for the investigators at Aviva, they claim this case is just scratching the surface of what they consider a much bigger problem.

“I believe there are other clinics and other paralegals and maybe other lawyers, for all I know, that are doing the exact same thing. It’s an easy way to get money. They don’t have to do anything and all they have to do is file paper and they get money,” said Dunstan.