The federal government's luxury goods tax came into effect on Sept. 1, targeting luxury cars, private jets and yachts.

Plans for a luxury goods tax were first introduced in last year's federal budget, but a bill to enact the tax wasn't introduced until April 2022. The Select Luxury Items Tax Act received royal assent in June 2022.

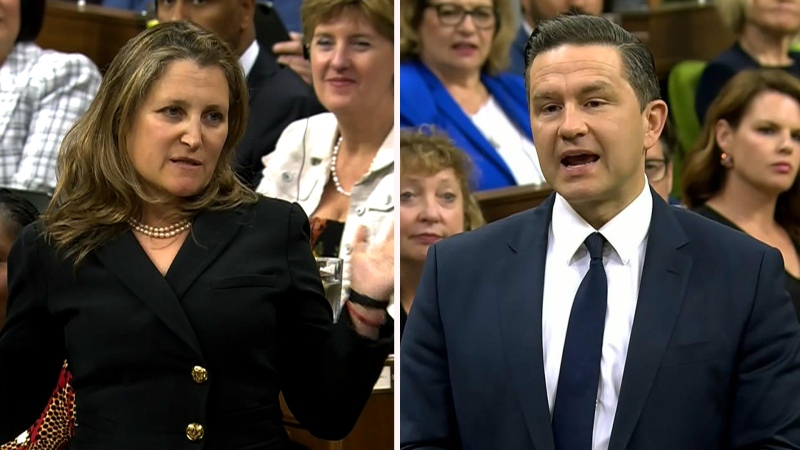

Finance Minister and Deputy Prime Minister Chrystia Freeland has said the tax will help ensure that the wealthiest Canadians are paying their fair share in taxes. But the move has also been met with criticism from aircraft and boat manufacturers, who say the tax could kill jobs in their industries.

Here's what you need to know about the tax and how it's being implemented:

WHAT'S BEING TAXED?

The new federal tax covers new vehicles, aircraft and vessels manufactured after 2018 and exceeding certain price thresholds.

For vehicles and aircraft, the luxury tax applies to goods priced above $100,000, while vessels over $250,000 are affected by the tax.

Only vehicles typically used as personal vehicles, such as sedans, sports cars, minivans and SUVs, will be taxed under the Select Luxury Items Tax Act. The vehicle must have a weight of 3,856 kilograms or less and have seating for 10 or fewer passengers. Motorcycles, ATVs, snowmobiles, motor homes, ambulances, police cars, firetrucks and military vehicles are exempt from the tax.

There are no exemptions for electric vehicles, and critics have warned that the tax could hit vehicles meant to help the environment, as the prices for some EVs can exceed $100,000.

For aircraft, the products that fall under the Act include planes, helicopters and gliders with seating for fewer than 40 people. Commercial aircraft, such as airliners or cargo planes, are exempt.

Subject vessels under the Act include yachts, sailboats, deck boats, waterskiing boats and houseboats. Floating homes, fishing boats, ferries and cruise ships are not subject to the tax.

HOW IS THE TAX CALCULATED?

The tax is calculated as the lesser of:

- 10 per cent of the price of the item, or

- 20 per cent of the price of the item subtracted by the threshold (either $100,000 or $250,000)

For example, a luxury car priced at $110,000 would be subject to a $2,000 tax, given that 20 per cent of $10,000 is smaller than 10 per cent of $110,000. However, a $560,000 yacht would be subject to a $56,000 tax, as 10 per cent of $560,000 is smaller than 20 per cent of $310,000.

The taxable amount excludes the PST, GST, HST and QST, but includes any customs fees and tariffs the item may be subject to.

WHO HAS TO PAY THE TAX?

The tax has to be paid by manufacturers, wholesalers, retailers and importers of the affected luxury items. Sales of these items to manufacturers, wholesalers and retailers are exempt from the tax, so the items won't be taxed twice.

Manufacturers, wholesalers, retailers and importers will have to file with the CRA as a registered vendor under the Act.

WHAT HAVE MANUFACTURERS SAID ABOUT THE TAX?

The luxury goods tax has drawn widespread criticism from leaders in the aerospace and marine manufacturing sectors, who have called the tax "job killing."

In December 2021, the National Marine Manufacturers Association Canada published a paper detailing how the tax could result in a minimum of $90 million in decreased revenues for boat dealers, as well as a loss of 900 full-time jobs.

“Unfortunately, the government has failed to recognize that a luxury tax won’t target the rich. Instead, it will punish the dealers, manufacturers and middle-class workers who will become collateral damage,” said association president Sara Anghel in a press release at the time.

Organizations representing the aviation industry also sent a letter to Freeland and Prime Minister Justin Trudeau in May 2022, saying the tax could result in $1 billion in lost revenue and over 1,000 job losses.

"The trickle-down effect of the implementation of this proposed luxury tax on private aircraft will have long-term detrimental effects on the average working-class Canadian family," the letter said.

Industry groups also pointed to a report from the Parliamentary Budget Officer, which found the tax could result in $2.8 billion in lost sales in the next five years.

When asked about such concerns, Freeland told reporters during a media availability on Wednesday it was "entirely reasonable" to ask someone who can afford a luxury car, plane or boat to pay an additional tax.

"I think it is great for Canadians to be successful. It is great for Canadians to be prosperous. I also think that people who are doing really, really well should feel comfortable supporting everybody else," she said. "And, I bet if you ask the truckers and mechanics who are here, do they think it's fair for someone who is spending $250,000 on a boat to pay a 10 per cent luxury tax so that we can afford the things we need as a country? I bet they'd say 'Yeah, that makes a lot of sense.’"

With files from CTV News' Rachel Aiello