TRENTON, N.J. -- The global pharmaceutical industry is pouring billions of dollars into developing treatments for rare diseases, which once drew little interest from major drugmakers but now point the way toward a new era of innovative therapies and big profits.

The investments come as researchers harness recent scientific advances, including the mapping of the human genome, sophisticated and affordable genetic tests and laboratory robots that can screen thousands of compounds per hour in search of the most potent ones.

"It's a very, very promising time," said Jimmy Lin, a National Institutes of Health cancer researcher who co-founded the Rare Genomics Institute.

By definition, a rare disease is one that strikes fewer than 200,000 Americans, sometimes only a few dozen. But with 7,000 rare diseases known to doctors, and more emerging all the time, nearly 1 in 10 Americans has a rare disease. For most, there is no treatment, let alone a cure. Just getting an accurate diagnosis often requires a medical odyssey, and 30 per cent of children with a rare disease die before age 5.

For decades, drugmakers were reluctant to invest in rare-disease treatments, preferring to focus on mass-market drugs for cholesterol, heart trouble and other common problems. Then, starting a decade ago, patents on some of the industry's most lucrative medicines began to expire, and cheap generic drugs started wiping out tens of billions of dollars in annual revenue.

So many companies shifted money to rare-disease drugs, knowing that those medicines cost less to develop and will face limited competition. Some already sell for $100,000 or more for a year of treatment, although drugmakers usually give financial aid to patients and big discounts to insurers and government health programs.

"They're recreating the blockbuster," said analyst Steve Brozak of WBB Securities. "There's more money, fewer patients and it's 10 times easier to defend high prices to payers."

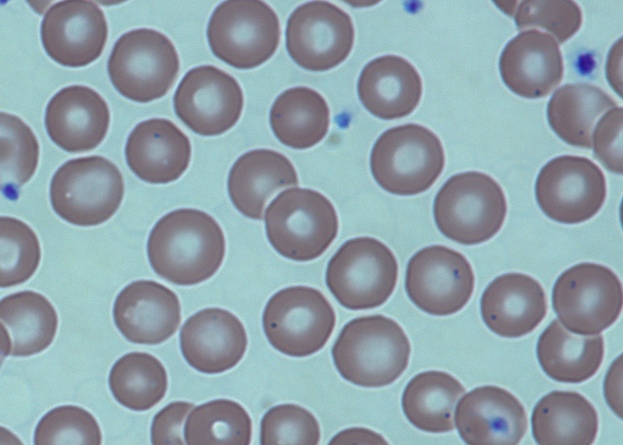

Last year, the Food and Drug Administration approved a record 17 medicines for rare diseases. More than 450 others are in development to treat a wide variety of ailments -- rare cancers, sickle-cell disease, the hormonal disorder Cushing's disease and a bleeding ailment called thrombocytopenic purpura, as well as hemophilia, Hodgkin's lymphoma and pulmonary fibrosis.

Patient-advocacy groups are getting better at raising money for research and building registries of patients that could be used to recruit participants for drug studies, a process that otherwise can take years.

In the 1970s, only a handful of rare-disease drugs got approved. Then the 1983 Orphan Drug Act helped rouse interest by providing expedited drug reviews, tax credits and other benefits for drug companies.

Since then, about 220 medicines have been approved -- 93 in the last decade.

For diabetes, heart and other common medications, drugmakers must test treatments on thousands of patients, usually through three rounds of studies lasting roughly seven years total. Counting initial cell and animal studies, and regulatory review at the end, the process easily takes a decade and more than $1 billion.

But for rare diseases, the drugs are tested on much smaller groups, sometimes just a few hundred or few dozen. And patient testing can wrap up a couple of years sooner. That, plus government financial incentives, can cut development costs by one-third to one-half, and approval is nearly assured.

Big drugmakers do not disclose how much they invest in rare diseases. The returns can be huge, though.

Pfizer Inc. made $3.53 billion last year selling rare-disease treatments, not counting its 10 cancer drugs for patients with specific genetic mutations. By 2019, 34 rare-disease drugs could have annual sales exceeding $1 billion each, according to a forecast by research firm GlobalData.

Other companies leading in the rare-disease field include Baxter International Inc., Bayer Corp., Bristol-Myers Squibb Co., Celgene Corp., Novartis AG and Novo Nordisk A/S.

One financial model for rare diseases is the groundbreaking "venture philanthropy" pioneered by the Cystic Fibrosis Foundation, which funded early research on four key medicines for the genetic disease. Those drugs and better care raised average life expectancy from 10 years in the 1960s to 41 today.

Over the years, the foundation raised millions through walkathons, gala dinners, golf tournaments and the like. With drug companies still not biting, it turned to paying for specific research projects.

Since 2000, the foundation has committed $150 million to Vertex Pharmaceuticals Inc., which spent 11 years screening 200,000 possibilities to find the best drug to test. The result was Kalydeco, approved in 2012 for 1,650 patients with a specific mutation.

Kalydeco is the first drug to target the cause, not just symptoms, of cystic fibrosis, which causes sticky mucus to clog the lungs, triggering frequent infections and other complications. Kalydeco slows the disease's progression and eases breathing. Its list price is $311,000 a year, but Vertex says most patients pay $50 per month.

In December, the foundation sold its royalty rights on Kalydeco and other treatments developed by Vertex for $3.3 billion to speed up new research by Vertex, Pfizer and others. A second drug awaits approval, and Vertex is developing others. The company hopes to have treatments for roughly 90 per cent of patients by around 2020.

Meanwhile, patients and their families are seeking help and money by telling their stories on social media. One of the best-known fundraising efforts was last year's Ice Bucket Challenge, in which people around the world doused themselves with ice water, raising $115 million for the ALS Association.

Glenn and Cara O'Neill started the Cure Sanfilippo Foundation to save daughter Eliza, now 5. The disease kills brain cells, causing hyperactivity and autistic-like behaviour, then seizures. Patients eventually lose the ability to walk, speak and eat and usually die by their teens.

The Columbia, South Carolina, couple tried charity events to fund research, but amassed only $250,000 in five months. They knew they needed millions.

So they got volunteers to make an emotional video of Eliza and started a GoFundMe campaign. The video, posted at www.CureSFF.org, went viral and raised $2.2 million in eight months.

Now the O'Neills are working with a children's hospital and a biotech firm to test a potential gene therapy, though manufacturing difficulties have delayed patient testing. The parents hope the therapy shows enough promise to attract a well-off drugmaker that can fund larger studies needed for approval.

"If it works in humans as well as it does in mice, it'll be incredible," O'Neill said. "It's Eliza's only chance, but we are nearly out of time."

Laurie Eallonardo of Torrance, California, faced similar fears when one of her twins, Jenna, started having hundreds of seizures daily at five months and stopped laughing, smiling and interacting with her.

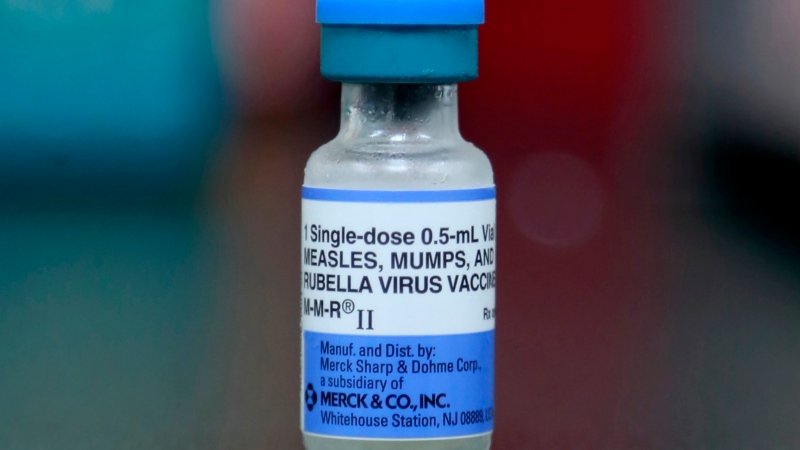

A doctor misdiagnosed Jenna's condition, wasting months on an ineffective treatment. Then Children's Hospital of Los Angeles doctors diagnosed infantile spasms, which often cause autism and mental disabilities.

Jenna got the only approved treatment, adrenocorticotropic hormone costing $125,000 over 2 1/2 months. The cost was partly covered by the National Organization for Rare Disorders.

"We knew within five days it worked," Eallonardo recalls.

Jenna did not talk until she was 2 1/2, but with years of medication and therapy, overcame developmental delays. She's now an outgoing first-grader starring in her school play.

"She's ahead in spelling and reading," beams her mother. "I'm in tears when I see her play or speak."