Flood waters have seeped into homes, while cars float where they were once parked after days of torrential rain hit British Columbia early in the week.

Experts say the damage from this storm will be costly.

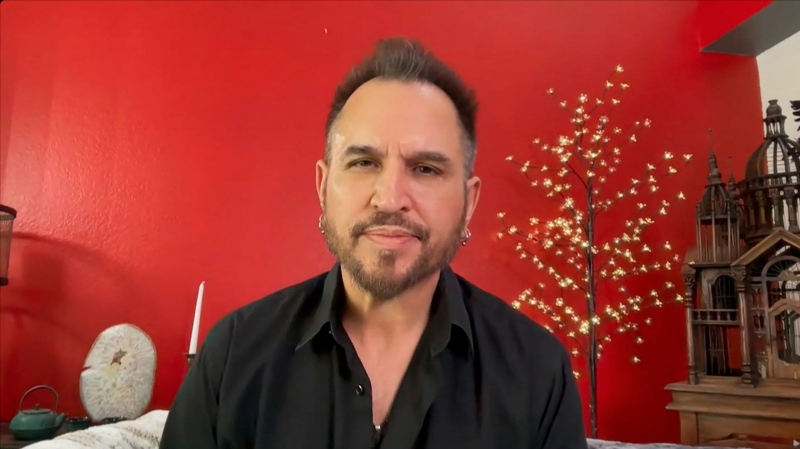

"We are considering this to be a catastrophic loss," Rob de Pruis, director of consumer and industry relations at the Insurance Bureau of Canada, told CTV National News.

Floods in both Toronto and Calgary in 2013 prompted the Canadian insurance industry to offer what it called "overland flood coverage" starting in 2015. The Insurance Bureau of Canada estimates about 50 per cent of B.C. property owners have purchased it.

"We do know and we have received reports of overland flood damage, sewer backups, even wind damage," de Pruis told CTV News Vancouver. "If you have been evacuated and you do have the overland flood coverage, you also have coverage for your additional living expenses."

The flooding in Toronto cost insurers nearly a billion dollars, and later that year in Calgary the tally was $1.7 billion.

"There is no estimate of what the total cost might be," B.C. Deputy Premier Mike Farnworth told reporters Friday.

Meanwhile, the mayor of Abbotsford suggested the damage in his city alone could reach $1 billion.

"It’s a bit too early to tell how they will compare to some of these other flood events, but there will be very significant damages," de Pruis told CTV National News.

As for homeowners, Jason Thistlethwaite, a professor at the University of Waterloo in Ontario who studies the economic impacts of extreme weather and climate change, says getting insurance companies to cover the flood damages from the B.C. storm might be a difficult task.

He told CTV’s Your Morning that he’s concerned a lot of the flooding has occurred in areas deemed to be high-risk.

"Insurance is generally not available in those areas," he said.

"The first thing that I would do is I’d be going to take a look at the fine print of your insurance policy, just to take a look at what coverage is available for that overland part of flooding," Thistlethwaite added.

He said anyone who may be unsure of their coverage should contact their insurance company.

Thistlethwaite also said there are many areas in Canada considered high-risk.

"We have approximately 10 per cent of Canadians [who] live in these areas, and insurance is unlikely to be available for that type of flooding," he said. "So I’m a little concerned we’re going to have some issues over the next few weeks as people reach out to try and understand and are likely to find that they’re not covered for the type of damage that’s occurred."

With files from CTV News Vancouver's Ross McLaughlin and CTVNews.ca's Hannah Jackson