Statistics Canada has begun tracking used vehicle inflation, thanks to pandemic-driven changes in consumer behaviour.

As of June, the agency now includes used vehicle prices in the consumer price index (CPI), which it uses to calculate inflation. Previously, Statistics Canada used new vehicle prices as a proxy for used vehicle prices when calculating the private transportation portion of the CPI.

Taylor Mitchell, Statistics Canada's senior CPI analyst, explained the agency used this method because, while new vehicles tend to be more expensive than used, price changes in both categories typically mirror one another, rising and falling at approximately the same rate.

Since the CPI doesn't measure the actual cost of things, but rather the rate of price change, this method worked as long as price changes in new and used cars were aligned.

"There's a whole universe of consumer prices and it's just not feasible for us to price everything,” Mitchell said, “so what we do is we pick products that can represent the movement for other things that are in the same type of product class.”

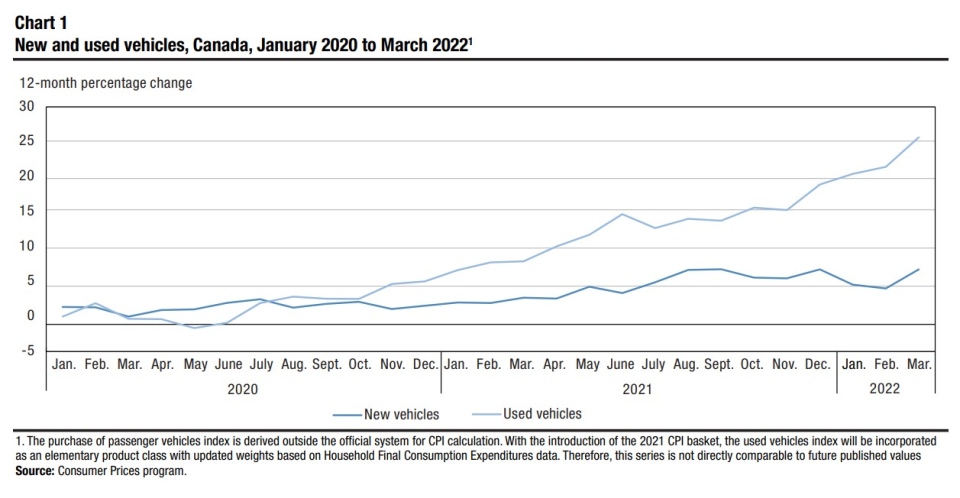

However, Mitchell said used vehicle prices began to diverge from those of new vehicles in the fall of 2020 amid the COVID-19 pandemic.

“We started to see prices for used cars outpacing price growth for new cars and there's a few reasons for that,” she said.

Mitchell said the pandemic led to production constraints for new vehicles, including plant closures due to COVID-19 outbreaks and a slowdown in the production of semiconductor chips, a vital component in modern cars. With fewer new vehicles on the market, consumers turned to the used vehicle market. As consumers filled their demand for new vehicles with used vehicles, demand outpaced supply and led the cost of used vehicles to rise at a higher rate than those of new vehicles.

"So that really made adding used car prices to the CPI that much more of a priority," Mitchell said.

Mitchell's team used the new CPI basket to calculate May's inflation rate, and found the all-item CPI number was the same with or without used vehicle prices. However, Mitchell said it's too soon to tell what effect used car prices will have on overall inflation going forward.

"As time goes on we'll have more information about how it's affecting the all-item CPI and really that'll depend on how used prices move going forward compared with new cars,” Mitchell said.

Moshe Lander, an economist with Montreal's Concordia University, believes Statistics Canada made the right choice in updating the CPI, based on how the pandemic has affected consumer behaviour.

"If the typical Canadian consumer starts changing what they buy, the basket no longer reflects reality," Lander said. "So the inclusion of used cars now is merely a reflection that the typical Canadian consumer is not behaving in a way they were a couple years ago."

The CPI basket change is permanent, meaning Statistics Canada now has a mechanism for measuring used car price increases separately from new car increases, should new and used car price changes diverge again in the future. In the meantime, Lander believes the current gap between new and used vehicle inflation will start to correct itself eventually.

"I think that while it is inflationary and it is affecting consumers' pockets, it's the type of thing that, when things get back to normal, whenever that might be, this type of pressure should probably go away," Lander said.

OUTLOOK ON USED CAR PRICES

Baris Akyurek, has been tracking used vehicle prices closely throughout the pandemic. As director of marketing intelligence at AutoTrader.ca, a Canadian online marketplace for new and used cars, Akyurek has access to large amounts of data on used vehicle sales.

Based on the way used vehicle prices have risen since 2021, as well as signs of cooling in some regional markets, he believes used car prices in Canada could be approaching their peak.

Akyurek said used vehicle prices are typically high in January, and then gradually decline throughout the year. However, 2021 and 2022 have bucked that trend.

"On a month over month basis, [prices] have been going up non-stop since the beginning of 2021,” he said. At the beginning of 2020, the average price of a used vehicle in Canada was $27,029, according to AutoTrader’s data. By early 2022, that price had risen to $36,562. As of last month, the average price of a used vehicle in Canada is $38,097 — a 34.5 per cent increase year-over-year.

"So looking at the prices over all…it seems like we're probably at the peak or getting close to the peak at the national average level,” Akyurek said. “But if you look at pockets of the country, we are seeing some softening."

Akyurek said Manitoba and Saskatchewan both saw a slight decline in month-to-month used vehicle prices in May, while British Columbia, Manitoba and Saskatchewan saw declines again in June. Akyurek attributes these declines to a few key factors, including recovering new car production levels and an increase in used car inventory.

“There's more cars on [AutoTrader.ca], and going back to the supply and demand mismatch, it seems like prices have started to come down slightly,” Akyurek. “We are expecting some sort of normalization in the near future."